Answered step by step

Verified Expert Solution

Question

1 Approved Answer

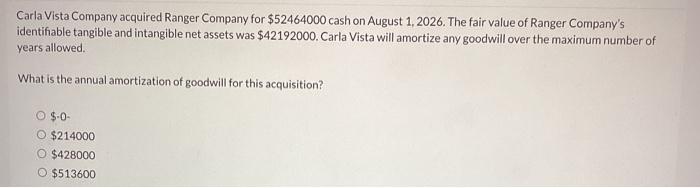

please I appreciate your help Carla Vista Company acquired Ranger Company for $52464000 cash on August 1, 2026. The fair value of Ranger Company's identifiable

please I appreciate your help

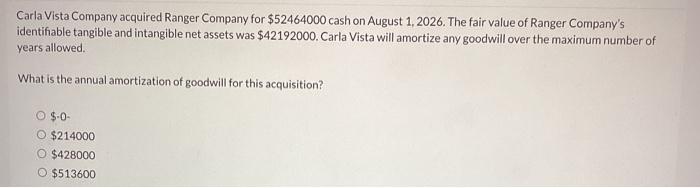

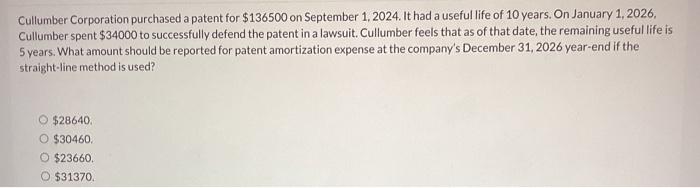

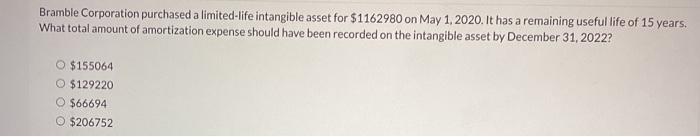

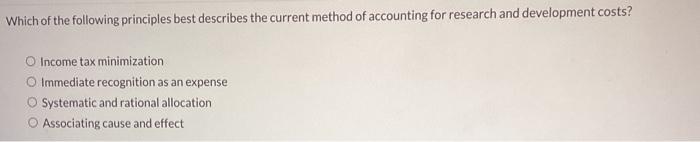

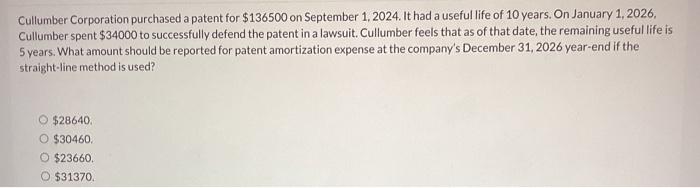

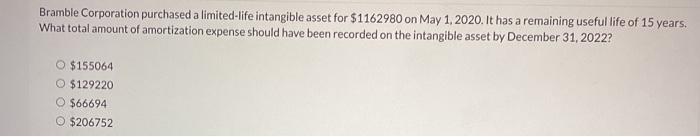

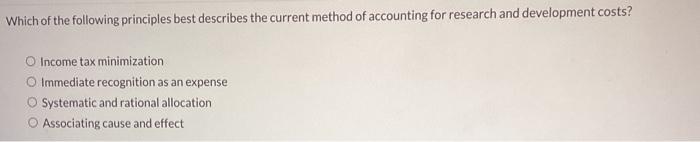

Carla Vista Company acquired Ranger Company for $52464000 cash on August 1, 2026. The fair value of Ranger Company's identifiable tangible and intangible net assets was $42192000. Carla Vista will amortize any goodwill over the maximum number of years allowed. What is the annual amortization of goodwill for this acquisition? \$.0- $214000 $428000 $513600 Cullumber Corporation purchased a patent for $136500 on September 1, 2024. It had a useful life of 10 years. On January 1,2026 , Cullumber spent $34000 to successfully defend the patent in a lawsuit. Cullumber feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense at the company's December 31,2026 year-end if the straight-line method is used? $28640$30460$23660$31370 Bramble Corporation purchased a limited-life intangible asset for $1162980 on May 1, 2020. It has a remaining useful life of 15 years. What total amount of amortization expense should have been recorded on the intangible asset by December 31,2022 ? $155064$129220$66694$206752 Which of the following principles best describes the current method of accounting for research and development costs? Income tax minimization Immediate recognition as an expense Systematic and rational allocation Associating cause and effect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started