Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE I NEED 1 0 0 SO ONLY ANSWER WHEN YOU ARE 1 0 0 % SURE OF YOUR ANSWER! If you have the same

PLEASE I NEED SO ONLY ANSWER WHEN YOU ARE SURE OF YOUR ANSWER! If you have the same answers as provided in the photo, then do not answer!

Maritime Corp. is a junior mining company listed on the TSX The common share price of Maritime fluctuates in value. Recent swings went from a high of $ to a low of $ Maritime issued stock options on September X to a consultant, in exchange for a project completed over the last year. The consultant estimated her time was worth $ but the company estimated that it could have had the necessary work done for about $ cash. The options specified that common shares could be bought for $ per share at any time over the next years. The market price of common shares was $ on the day the options were issued. At the same time options were issued to the consultant, identical options were issued to the company lawyer for work done to date. An option pricing model valued each set of stock options at $

Required:

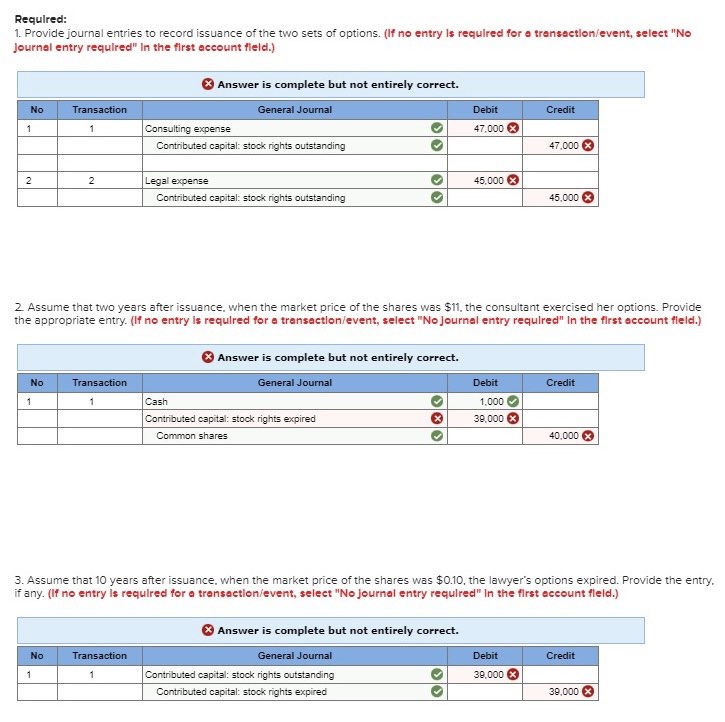

Provide journal entries to record issuance of the two sets of options.

Record the entry for granting stock rights towards Consulting expense.

Record the entry for granting stock rights towards legal expense.

Assume that two years after issuance, when the market price of the shares was $ the consultant exercised her options. Provide the appropriate entry.

Record the entry for exercising the stock rights.

Assume that years after issuance, when the market price of the shares was $ the lawyers options expired. Provide the entry.

Record the entry for the expiration of stock rights.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started