Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need a correct answerr, this is the second time that I am posting the question. BAHT APPRECIATED 11.8 Bangkok Instruments, Ltd. (A). Bangkok

please I need a correct answerr, this is the second time that I am posting the question.

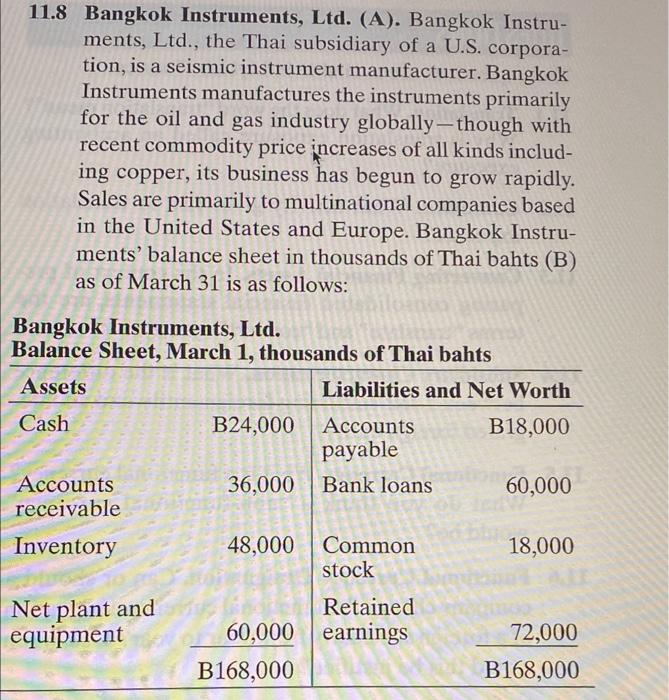

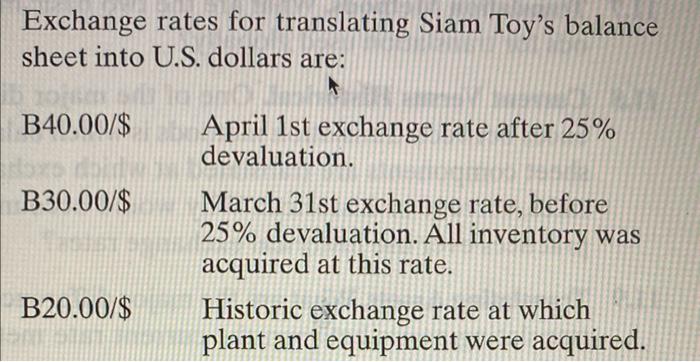

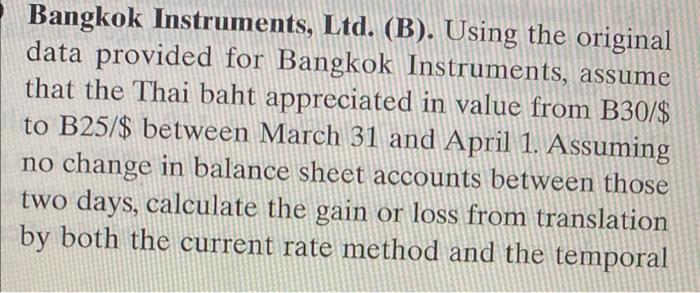

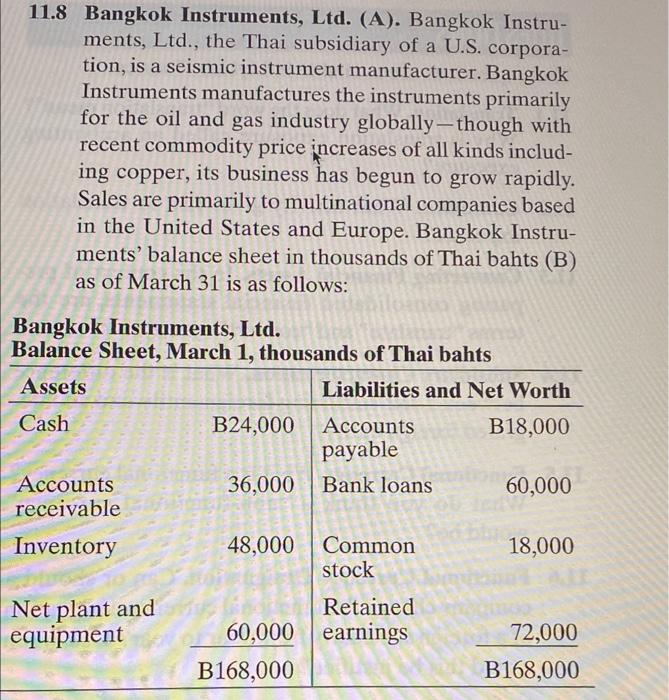

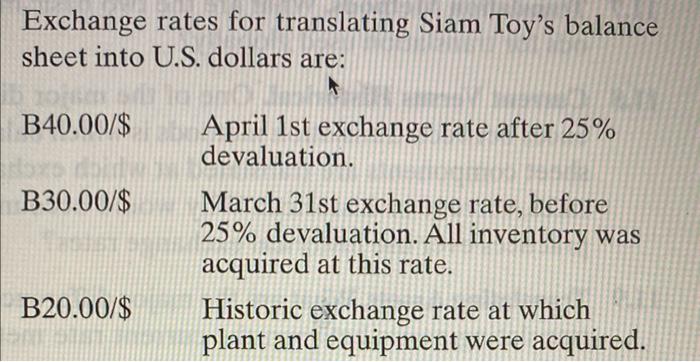

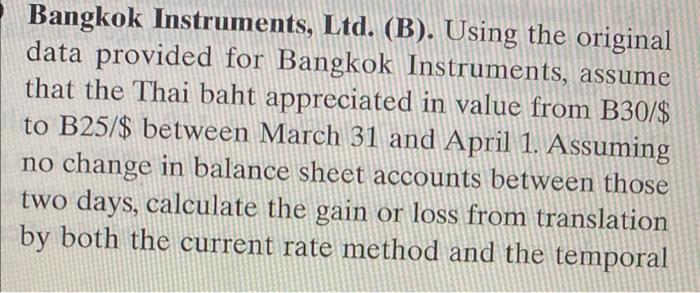

11.8 Bangkok Instruments, Ltd. (A). Bangkok Instruments, Ltd., the Thai subsidiary of a U.S. corporation, is a seismic instrument manufacturer. Bangkok Instruments manufactures the instruments primarily for the oil and gas industry globally - though with recent commodity price increases of all kinds including copper, its business has begun to grow rapidly. Sales are primarily to multinational companies based in the United States and Europe. Bangkok Instruments' balance sheet in thousands of Thai bahts (B) as of March 31 is as follows: Bangkok Instruments, Ltd. Balance Sheet, March 1, thousands of Thai bahts Exchange rates for translating Siam Toy's balance sheet into U.S. dollars are: B40.00/\$ April 1st exchange rate after 25% devaluation. B30.00/\$ March 31st exchange rate, before 25% devaluation. All inventory was acquired at this rate. B20.00/\$ Historic exchange rate at which plant and equipment were acquired. Bangkok Instruments, Ltd. (B). Using the original data provided for Bangkok Instruments, assume that the Thai baht appreciated in value from B30/\$ to B25/$ between March 31 and April 1. Assuming no change in balance sheet accounts between those two days, calculate the gain or loss from translation by both the current rate method and the temporal BAHT APPRECIATED

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started