Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need all three parts ...thanks -0. A project will cost Rs 40,000. Its stream of earnings before depreciation, interest and taxes (EBDIT) during

please I need all three parts ...thanks

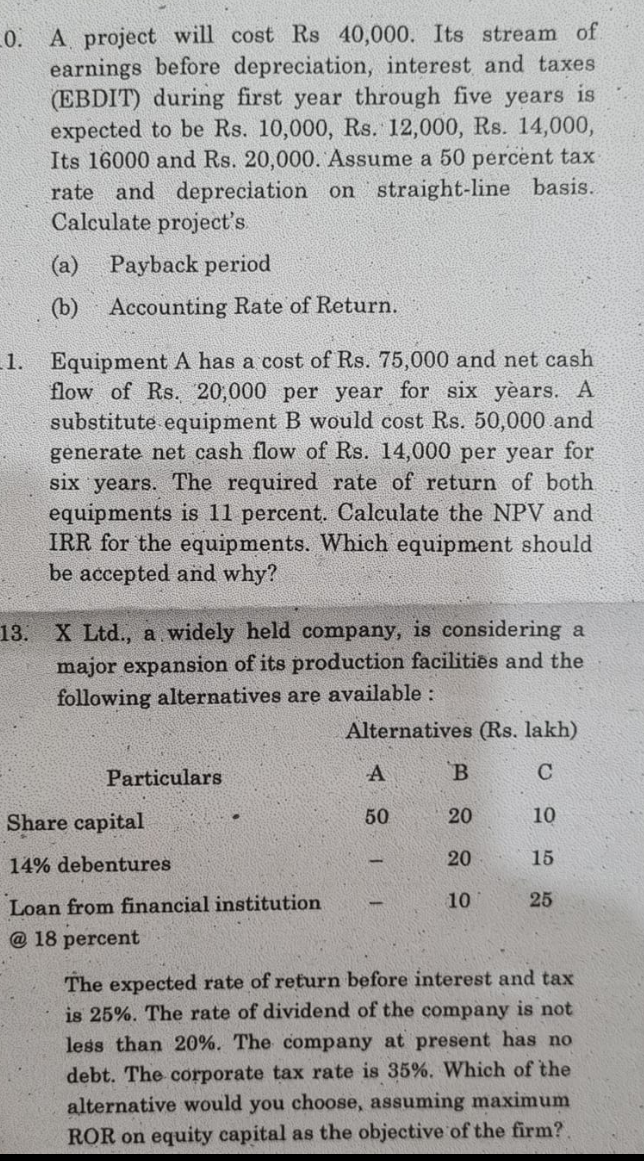

-0. A project will cost Rs 40,000. Its stream of earnings before depreciation, interest and taxes (EBDIT) during first year through five years is expected to be Rs. 10,000, Rs. 12,000, Rs. 14,000, Its 16000 and Rs. 20,000. Assume a 50 percent tax rate and depreciation on straight-line basis. Calculate project's (a) Payback period (b) Accounting Rate of Return. 1. Equipment A has a cost of Rs. 75,000 and net cash flow of Rs. 20,000 per year for six years. A substitute equipment B would cost Rs. 50,000 and generate net cash flow of Rs. 14,000 per year for six years. The required rate of return of both equipments is 11 percent. Calculate the NPV and IRR for the equipments. Which equipment should be accepted and why? 13. X Ltd., a widely held company, is considering a major expansion of its production facilities and the following alternatives are available : Alternatives (Rs. lakh) Particulars A B Share capital 50 20 10 14% debentures 20 15 10 25 Loan from financial institution @ 18 percent The expected rate of return before interest and tax is 25%. The rate of dividend of the company is not less than 20%. The company at present has no debt. The corporate tax rate is 35%. Which of the alternative would you choose, assuming maximum ROR on equity capital as the objective of the firmStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started