Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please I need an answer. The question is correct. QUESTION ONE The treasurer of Kakeldadi's Club has presented the following Information to you on 31

Please I need an answer. The question is correct.

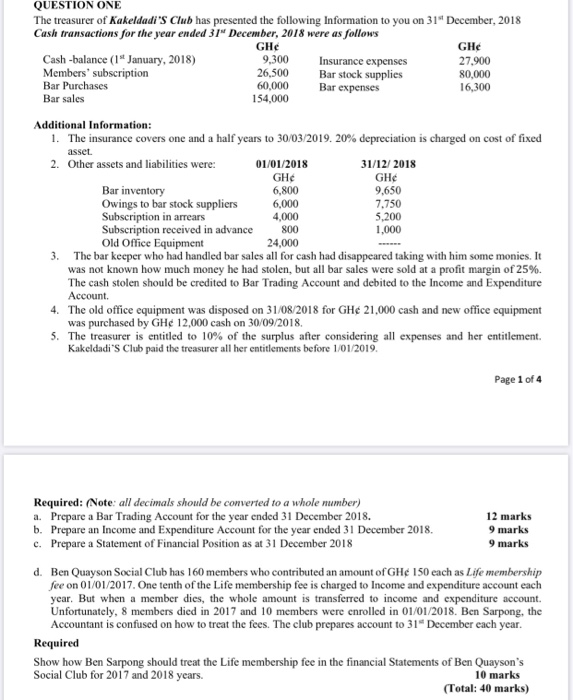

QUESTION ONE The treasurer of Kakeldadi's Club has presented the following Information to you on 31" December, 2018 Cash transactions for the year ended 31 December, 2018 were as follows GH GHE Cash -balance (1" January, 2018) 9,300 Insurance expenses 27.900 Members' subscription 26,500 Bar stock supplies 80,000 Bar Purchases 60,000 Bar expenses 16,300 Bar sales 154,000 Additional Information: 1. The insurance covers one and a half years to 30/03/2019. 20% depreciation is charged on cost of fixed asset 2. Other assets and liabilities were: 01/01/2018 31/12/2018 GH GH Bar inventory 6,800 9,650 Owings to bar stock suppliers 6,000 7.750 Subscription in arrears 4,000 5,200 Subscription received in advance 800 1,000 Old Office Equipment 24,000 3. The bar keeper who had handled bar sales all for cash had disappeared taking with him some monies. It was not known how much money he had stolen, but all bar sales were sold at a profit margin of 25%. The cash stolen should be credited to Bar Trading Account and debited to the Income and Expenditure Account 4. The old office equipment was disposed on 31/08/2018 for GH 21,000 cash and new office equipment was purchased by GH 12,000 cash on 30/09/2018 5. The treasurer is entitled to 10% of the surplus after considering all expenses and her entitlement. Kakeldadi's Club paid the treasurer all her entitlements before 1/01/2019. Page 1 of 4 Required: (Note: all decimals should be converted to a whole number) a. Prepare a Bar Trading Account for the year ended 31 December 2018. 12 marks b. Prepare an Income and Expenditure Account for the year ended 31 December 2018. 9 marks c. Prepare a Statement of Financial Position as at 31 December 2018 9 marks d. Ben Quayson Social Club has 160 members who contributed an amount of GH 150 each as Life membership fee on 01/01/2017. One tenth of the Life membership fee is charged to Income and expenditure account each year. But when a member dies, the whole amount is transferred to income and expenditure account. Unfortunately, 8 members died in 2017 and 10 members were enrolled in 01/01/2018. Ben Sarpong, the Accountant is confused on how to treat the fees. The club prepares account to 31" December each year. Required Show how Ben Sarpong should treat the Life membership fee in the financial Statements of Ben Quayson's Social Club for 2017 and 2018 years. 10 marks (Total: 40 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started