Answered step by step

Verified Expert Solution

Question

1 Approved Answer

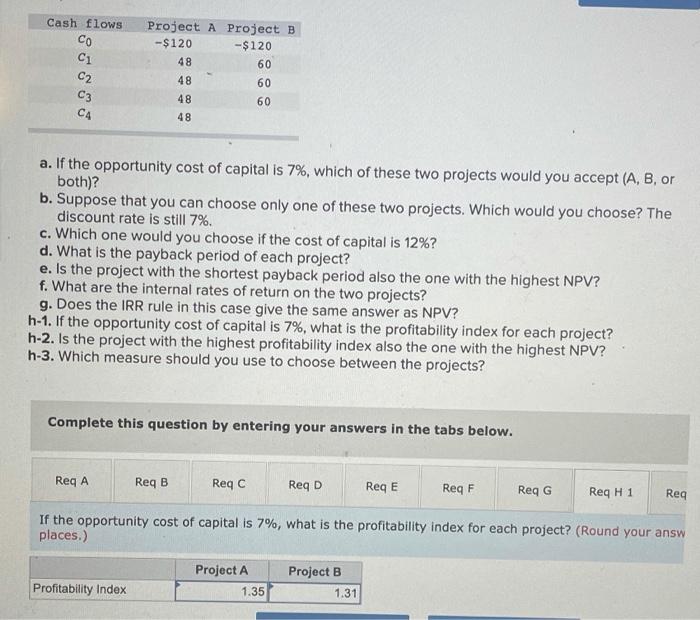

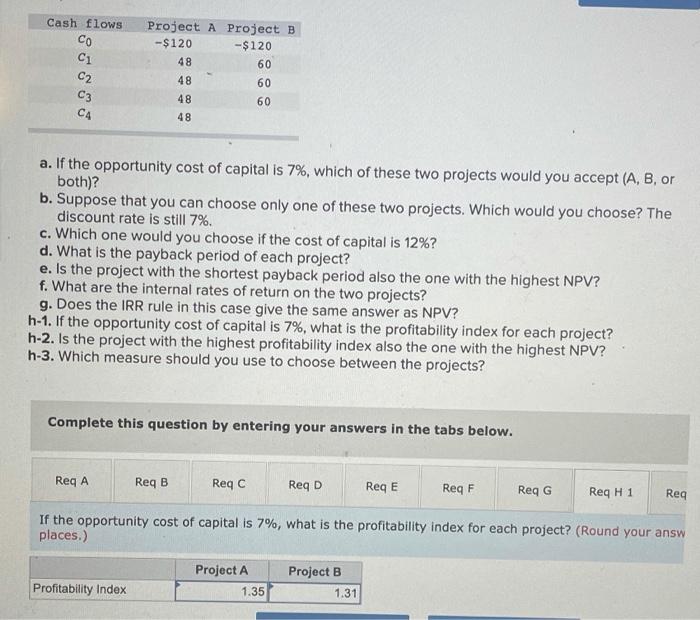

Please I need answer to Req H 1. 1.35 and 1.31 are wrong. Cash flows Co Ci C2 C3 CA Project A Project B -$120

Please I need answer to Req H 1. 1.35 and 1.31 are wrong.

Cash flows Co Ci C2 C3 CA Project A Project B -$120 -$120 48 60 48 60 48 60 48 a. If the opportunity cost of capital is 7%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 7%. c. Which one would you choose if the cost of capital is 12%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h-1. If the opportunity cost of capital is 7%, what is the profitability index for each project? h-2. Is the project with the highest profitability index also the one with the highest NPV? h-3. Which measure should you use to choose between the projects? Complete this question by entering your answers in the tabs below. Req A Req B Reqc Reg D ReqE ReqF ReqG Req H1 Reg If the opportunity cost of capital is 7%, what is the profitability index for each project? (Round your answ places.) Project A 1.35 Profitability Index Project B 1.31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started