PLEASE I NEED C. AND D.

PLEASE I NEED C. AND D.

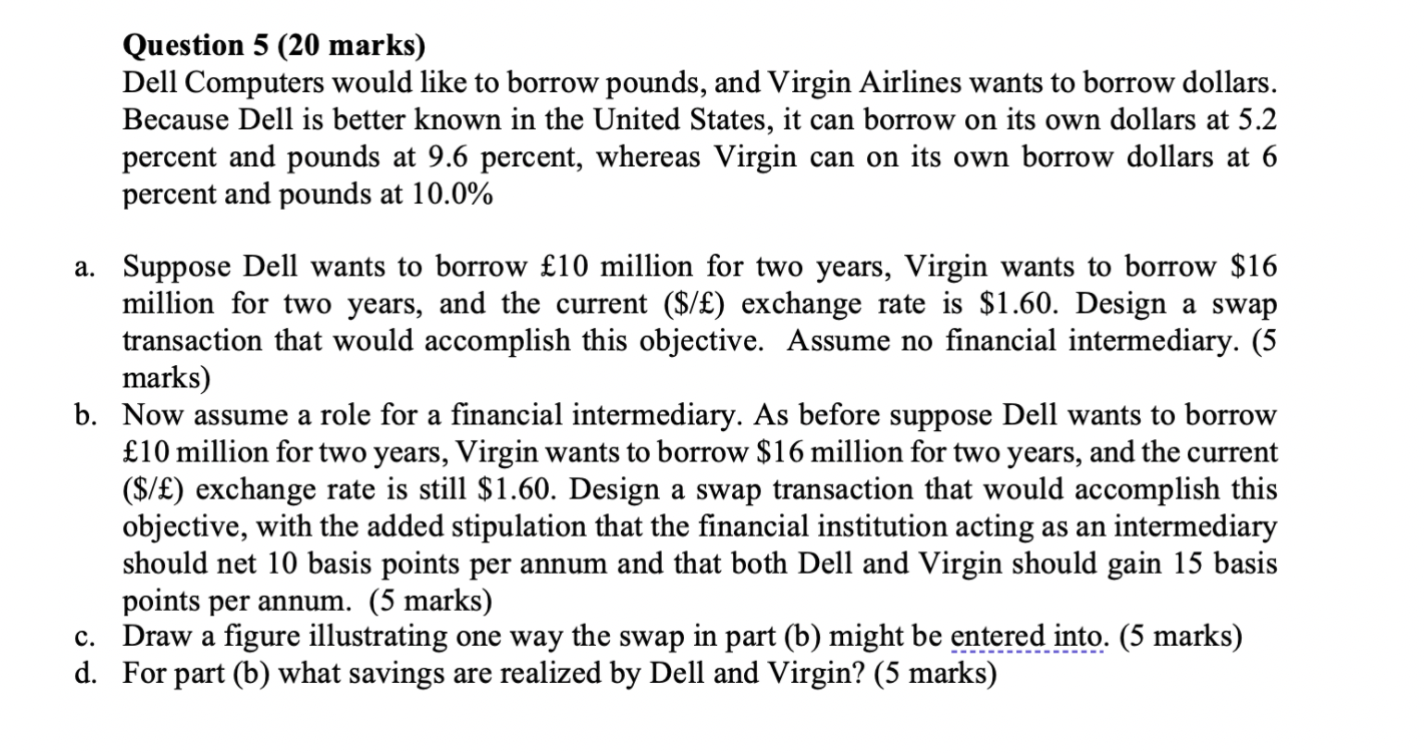

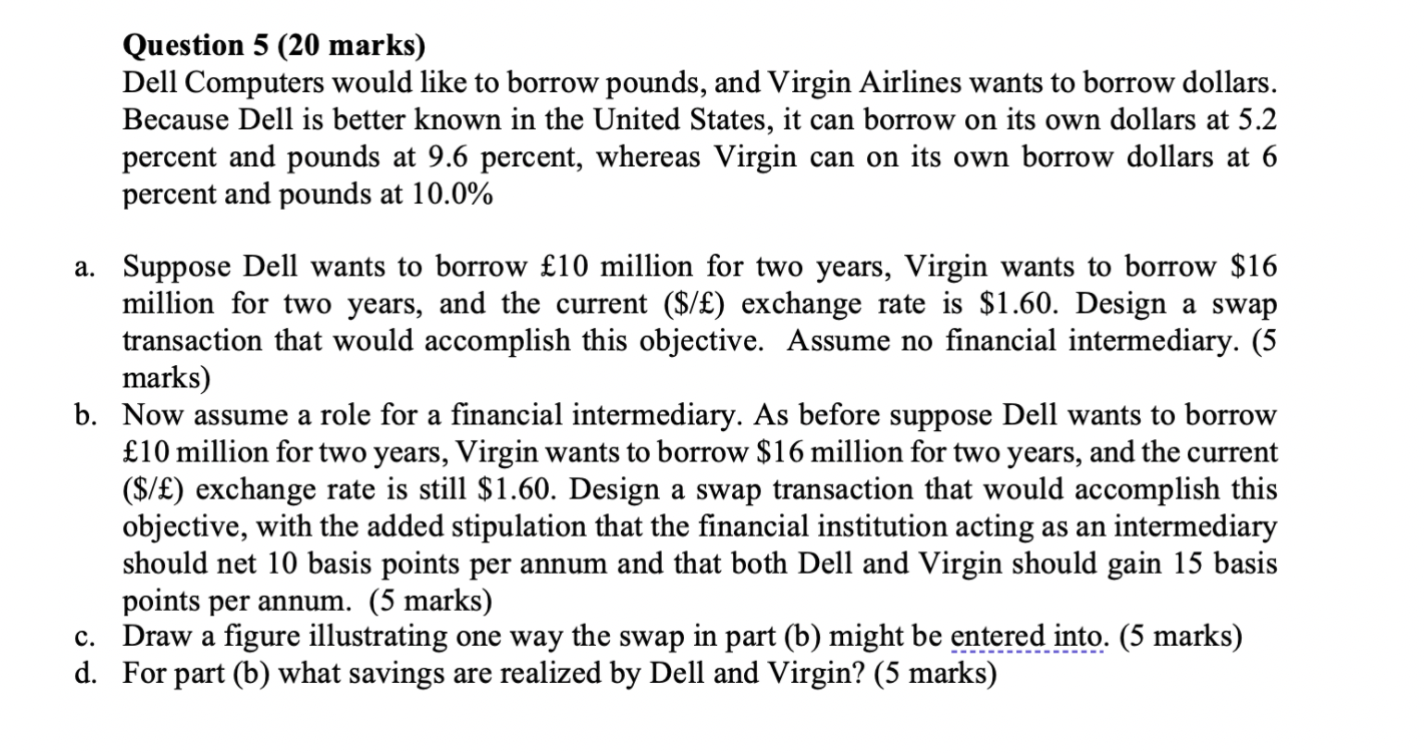

Question 5 (20 marks) Dell Computers would like to borrow pounds, and Virgin Airlines wants to borrow dollars. Because Dell is better known in the United States, it can borrow on its own dollars at 5.2 percent and pounds at 9.6 percent, whereas Virgin can on its own borrow dollars at 6 percent and pounds at 10.0% a. Suppose Dell wants to borrow 10 million for two years, Virgin wants to borrow $16 million for two years, and the current ($/) exchange rate is $1.60. Design a swap transaction that would accomplish this objective. Assume no financial intermediary. (5 marks) b. Now assume a role for a financial intermediary. As before suppose Dell wants to borrow 10 million for two years, Virgin wants to borrow $16 million for two years, and the current ($/) exchange rate is still $1.60. Design a swap transaction that would accomplish this objective, with the added stipulation that the financial institution acting as an intermediary should net 10 basis points per annum and that both Dell and Virgin should gain 15 basis points per annum. (5 marks) c. Draw a figure illustrating one way the swap in part (b) might be entered into. (5 marks) d. For part (b) what savings are realized by Dell and Virgin? (5 marks) Question 5 (20 marks) Dell Computers would like to borrow pounds, and Virgin Airlines wants to borrow dollars. Because Dell is better known in the United States, it can borrow on its own dollars at 5.2 percent and pounds at 9.6 percent, whereas Virgin can on its own borrow dollars at 6 percent and pounds at 10.0% a. Suppose Dell wants to borrow 10 million for two years, Virgin wants to borrow $16 million for two years, and the current ($/) exchange rate is $1.60. Design a swap transaction that would accomplish this objective. Assume no financial intermediary. (5 marks) b. Now assume a role for a financial intermediary. As before suppose Dell wants to borrow 10 million for two years, Virgin wants to borrow $16 million for two years, and the current ($/) exchange rate is still $1.60. Design a swap transaction that would accomplish this objective, with the added stipulation that the financial institution acting as an intermediary should net 10 basis points per annum and that both Dell and Virgin should gain 15 basis points per annum. (5 marks) c. Draw a figure illustrating one way the swap in part (b) might be entered into. (5 marks) d. For part (b) what savings are realized by Dell and Virgin

PLEASE I NEED C. AND D.

PLEASE I NEED C. AND D.