Answered step by step

Verified Expert Solution

Question

1 Approved Answer

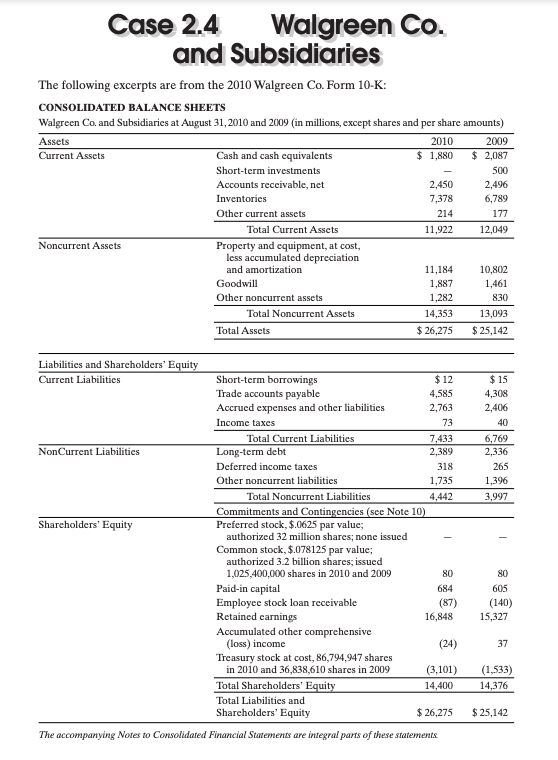

Please I need clear answers Case 2.4 Walgreen Co. and Subsidiaries The following excerpts are from the 2010 Walgreen Co. Form 10-K: Inventories Inventories are

Please I need clear answers

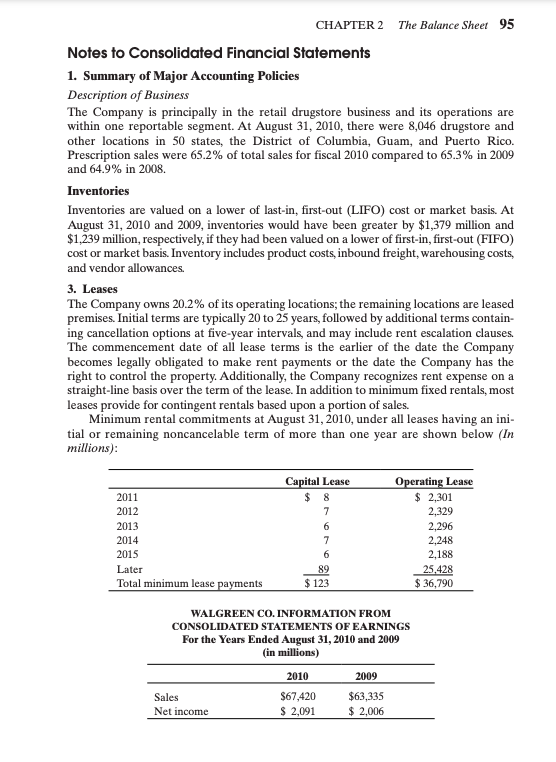

Case 2.4 Walgreen Co. and Subsidiaries The following excerpts are from the 2010 Walgreen Co. Form 10-K: Inventories Inventories are valued on a lower of last-in, first-out (LIFO) cost or market basis. At August 31, 2010 and 2009 , inventories would have been greater by $1,379 million and $1,239 million, respectively, if they had been valued on a lower of first-in, first-out (FIFO) cost or market basis. Inventory includes product costs, inbound freight, warehousing costs, and vendor allowances. 3. Leases The Company owns 20.2% of its operating locations; the remaining locations are leased premises. Initial terms are typically 20 to 25 years, followed by additional terms containing cancellation options at five-year intervals, and may include rent escalation clauses. The commencement date of all lease terms is the earlier of the date the Company becomes legally obligated to make rent payments or the date the Company has the right to control the property. Additionally, the Company recognizes rent expense on a straight-line basis over the term of the lease. In addition to minimum fixed rentals, most leases provide for contingent rentals based upon a portion of sales. Minimum rental commitments at August 31,2010, under all leases having an initial or remaining noncancelable term of more than one year are shown below (In millions): WALGREEN CO. INFORMATION FROM CONSOLIDATED STATEMENTS OF EARNINGS For the Years Ended August 31, 2010 and 2009 (in millions) 1. Using the Consolidated Balance Sheets for Walgreen Co. for August 31, 2010 and 2009, prepare a common-size balance sheet. 2. Which current asset is the most significant? Which noncurrent asset is the most significant? Are the relative proportions of current and noncurrent assets what you would expect for a drug store? 3. What inventory method is used to value inventories? Has Walgreen experienced inflation or deflation? Explain your answer. 4. Assess the level of debt and risk that Walgreen has by looking only at the balance sheet. 5. Estimate the dollar amount of dividends Walgreen paid in 2010. 6. Does Walgreen use off-balance sheet financing? Explain your answer. 7. Evaluate the creditworthiness of Walgreen based on the balance sheet and the excerpts from the notesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started