Question: please I need help as soon as possible for this assignment on Resource Allocation.Thank you very much. Resources provide value and resources incur costs. Firms

please I need help as soon as possible for this assignment on Resource Allocation.Thank you very much.

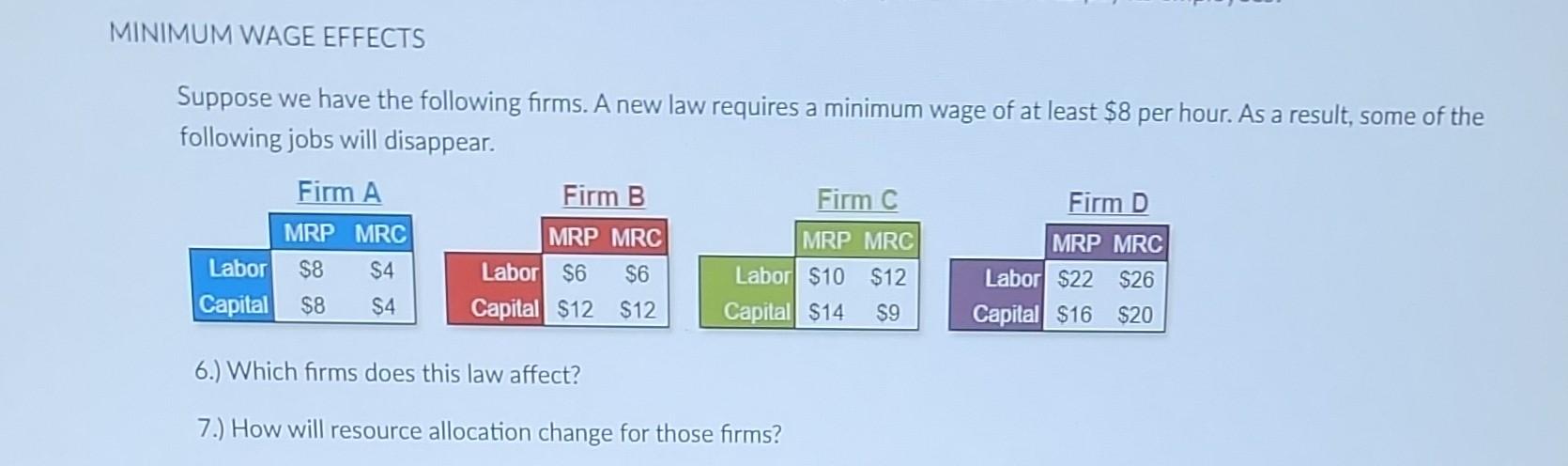

Resources provide value and resources incur costs. Firms have to choose how to use various factors of production to make products. To keep costs low, we have to be able to compare the productivity of different resources in making products. By making use of the most productive resources, firms can be efficient, responsible, and profitable. COSTS AND REVENUES The revenue a resource earns for a firm is the marginal revenue product or MRP. The cost to a firm for using that resource is the marginal resource cost or MRC. Based on relative costs and revenues, a firm will want to increase or decrease their use of the resource. This happens in a few different ways. In the following questions, we'll be looking at how firms use capital and labor. Example Question Give an example of a firm that should increase its use of capital and decrease its use of labor. Example Answer Labor: \$8MRP - \$15MRC Capital: \$8MRP - \$4MRC 1.) Give an example of a firm that should maintain its use of capital but increase its use of labor. 2.) Give an example of a firm that should has minimized costs but not maximized profits. 3.) Give an example of a firm that has maximized profits. 4.) Give an example of a firm that should decrease its use of both capital and labor. 5.) For your example in question 2 , what is the most the company would be able to pay its employees? Suppose we have the following firms. A new law requires a minimum wage of at least $8 per hour. As a result, some of the following jobs will disappear. 6.) Which firms does this law affect? 7.) How will resource allocation change for those firms? HE USE OF LABOR Machine learning techniques allow us to automate some computer programming with the use of capital. Suppose an influx of human coders has pushed down wages for workers in the tech industry. Assume all else is held equal. The marginal resource cost of labor has declined, so firms are evaluating their use of labor versus the use of automation (capital). Briefly explain what changes we expect to see in the quantities used of labor and of capital under the following scenarios. 7.) The substitution effect is stronger. 8.) The output effect is stronger. Suppose Peter Dinklage and Danny DeVito own a tree-trimming company. They're paid $19 for each tree trimmed. Business is good, so they are considering hiring another worker. A new employee will allow them to trim 6 more trees per day. 9.) What is the MRP of hiring this additional worker? 10.) If the new employee asks for a $120 daily wage, will they be hired? Resources provide value and resources incur costs. Firms have to choose how to use various factors of production to make products. To keep costs low, we have to be able to compare the productivity of different resources in making products. By making use of the most productive resources, firms can be efficient, responsible, and profitable. COSTS AND REVENUES The revenue a resource earns for a firm is the marginal revenue product or MRP. The cost to a firm for using that resource is the marginal resource cost or MRC. Based on relative costs and revenues, a firm will want to increase or decrease their use of the resource. This happens in a few different ways. In the following questions, we'll be looking at how firms use capital and labor. Example Question Give an example of a firm that should increase its use of capital and decrease its use of labor. Example Answer Labor: \$8MRP - \$15MRC Capital: \$8MRP - \$4MRC 1.) Give an example of a firm that should maintain its use of capital but increase its use of labor. 2.) Give an example of a firm that should has minimized costs but not maximized profits. 3.) Give an example of a firm that has maximized profits. 4.) Give an example of a firm that should decrease its use of both capital and labor. 5.) For your example in question 2 , what is the most the company would be able to pay its employees? Suppose we have the following firms. A new law requires a minimum wage of at least $8 per hour. As a result, some of the following jobs will disappear. 6.) Which firms does this law affect? 7.) How will resource allocation change for those firms? HE USE OF LABOR Machine learning techniques allow us to automate some computer programming with the use of capital. Suppose an influx of human coders has pushed down wages for workers in the tech industry. Assume all else is held equal. The marginal resource cost of labor has declined, so firms are evaluating their use of labor versus the use of automation (capital). Briefly explain what changes we expect to see in the quantities used of labor and of capital under the following scenarios. 7.) The substitution effect is stronger. 8.) The output effect is stronger. Suppose Peter Dinklage and Danny DeVito own a tree-trimming company. They're paid $19 for each tree trimmed. Business is good, so they are considering hiring another worker. A new employee will allow them to trim 6 more trees per day. 9.) What is the MRP of hiring this additional worker? 10.) If the new employee asks for a $120 daily wage, will they be hired

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts