please i need help how to record any adjustments required to complete the year end on general journal.

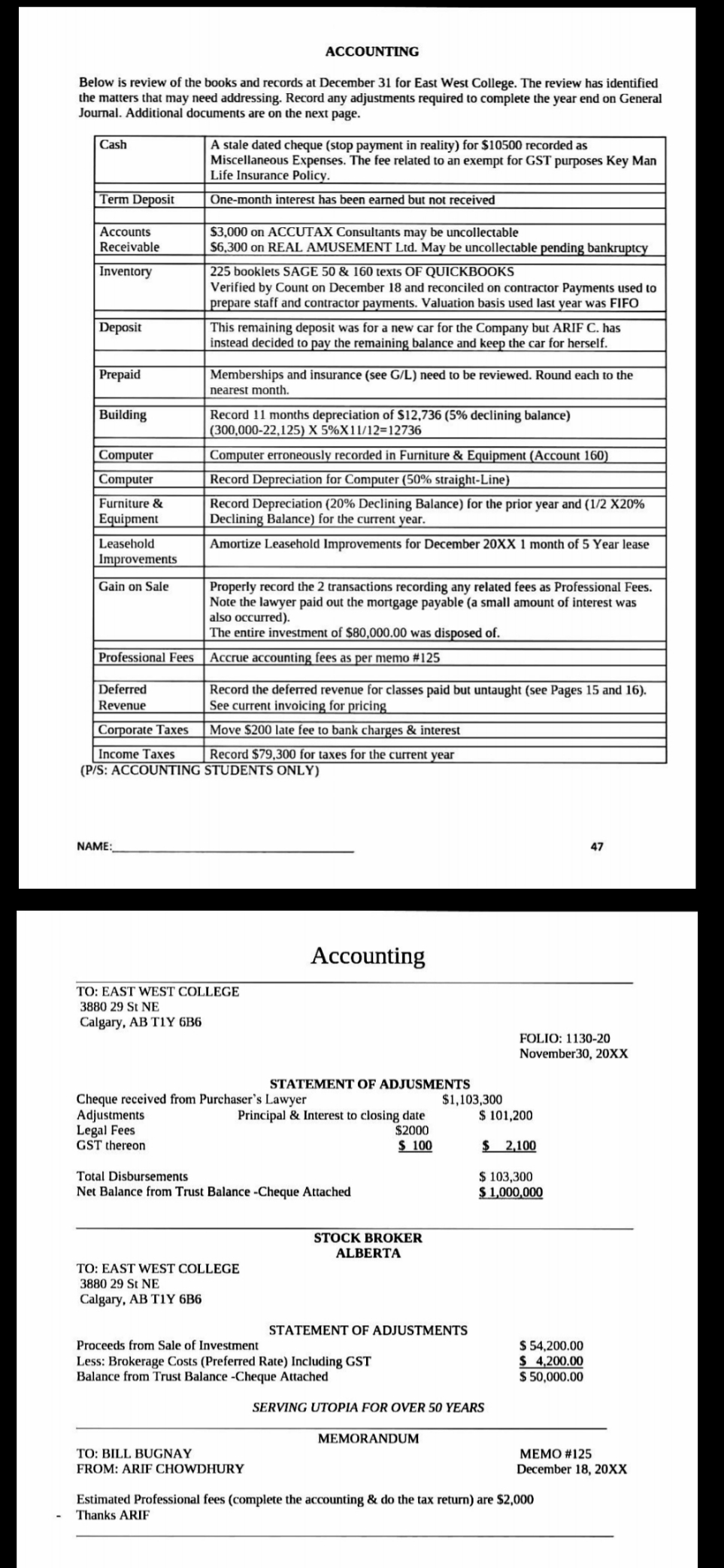

ACCOUNTING Below is review of the books and records at December 31 for East West College. The review has identified the matters that may need addressing. Record any adjustments required to complete the year end on General Journal. Additional documents are on the next page. Cash A stale dated cheque (stop payment in reality) for $10500 recorded as Miscellaneous Expenses. The fee related to an exempt for GST purposes Key Man Life Insurance Policy. Term Deposit One-month interest has been earned but not received Accounts $3,000 on ACCUTAX Consultants may be uncollectable Receivable $6,300 on REAL AMUSEMENT Lid. May be uncollectable pending bankruptcy Inventory 225 booklets SAGE 50 & 160 texts OF QUICKBOOKS Verified by Count on December 18 and reconciled on contractor Payments used to prepare staff and contractor payments. Valuation basis used last year was FIFO Deposit This remaining deposit was for a new car for the Company but ARIF C. has instead decided to pay the remaining balance and keep the car for herself. Prepaid Memberships and insurance (see G/L) need to be reviewed. Round each to the nearest month. Building Record 11 months depreciation of $12,736 (5% declining balance) (300,000-22,125) X 5%X 11/12=12736 Computer Computer erroneously recorded in Furniture & Equipment (Account 160) Computer Record Depreciation for Computer (50% straight-Line) Furniture & Record Depreciation (20% Declining Balance) for the prior year and (1/2 X20% Equipment Declining Balance) for the current year. Leasehold Amortize Leasehold Improvements for December 20XX 1 month of 5 Year lease Improvements Gain on Sale Properly record the 2 transactions recording any related fees as Professional Fees. Note the lawyer paid out the mortgage payable (a small amount of interest was also occurred). The entire investment of $80,000.00 was disposed of. Professional Fees Accrue accounting fees as per memo #125 Deferred Record the deferred revenue for classes paid but untaught (see Pages 15 and 16). Revenue See current invoicing for pricing Corporate Taxes Move $200 late fee to bank charges & interest Income Taxes Record $79,300 for taxes for the current year (P/S: ACCOUNTING STUDENTS ONLY) NAME: 47 Accounting TO: EAST WEST COLLEGE 3880 29 St NE Calgary, AB TLY 686 FOLIO: 1130-20 November30, 20XX STATEMENT OF ADJUSMENTS Cheque received from Purchaser's Lawyer $1,103,300 Adjustments Principal & Interest to closing date $ 101,200 Legal Fees $2000 GST thereon $ 100 $ 2,100 Total Disbursements $ 103,300 Net Balance from Trust Balance -Cheque Attached $ 1,000,000 STOCK BROKER ALBERTA TO: EAST WEST COLLEGE 3880 29 St NE Calgary, AB TIY 686 STATEMENT OF ADJUSTMENTS Proceeds from Sale of Investment $ 54,200.00 Less: Brokerage Costs (Preferred Rate) Including GST $ 4,200.00 Balance from Trust Balance -Cheque Attached $ 50,000.00 SERVING UTOPIA FOR OVER 50 YEARS MEMORANDUM TO: BILL BUGNAY MEMO #125 FROM: ARIF CHOWDHURY December 18, 20XX Estimated Professional fees (complete the accounting & do the tax return) are $2,000 Thanks ARIF