Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i need help in this multiple choice questions, thank you so much Drops Corp., which began business at the start of the current year,

please i need help in this multiple choice questions, thank you so much

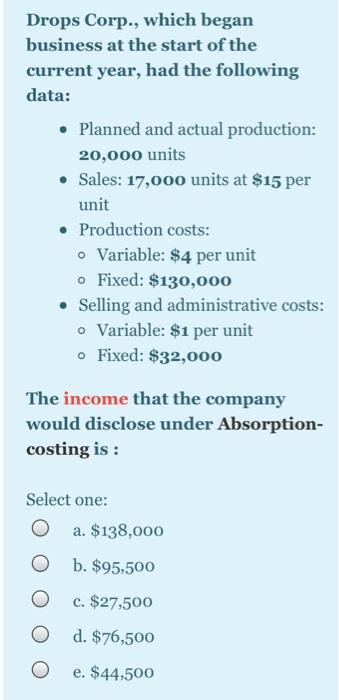

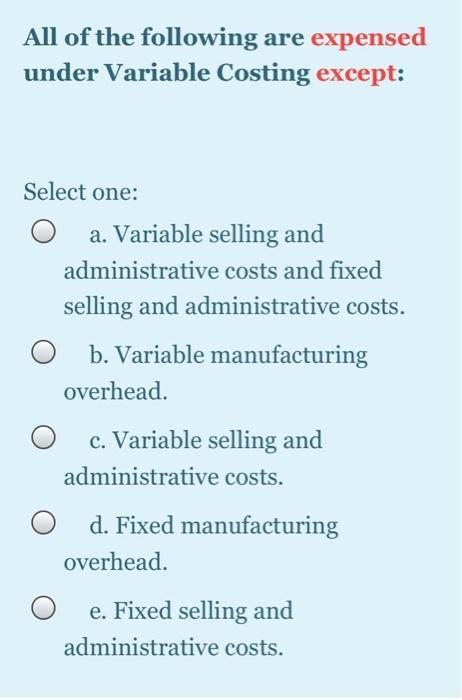

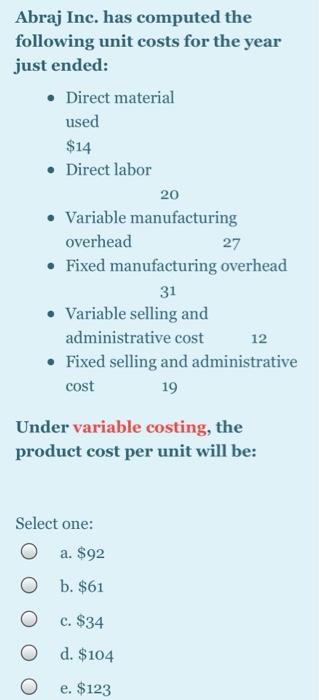

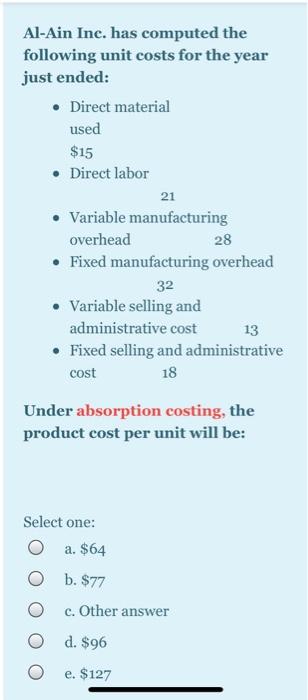

Drops Corp., which began business at the start of the current year, had the following data: Planned and actual production: 20,000 units Sales: 17,000 units at $15 per unit Production costs: o Variable: $4 per unit o Fixed: $130,000 . Selling and administrative costs: o Variable: $1 per unit . Fixed: $32,000 The income that the company would disclose under Absorption- costing is : Select one: a. $138,000 b. $95,500 c. $27,500 O d. $76,500 O e. $44,500 All of the following are expensed under Variable Costing except: Select one: a. Variable selling and administrative costs and fixed selling and administrative costs. b. Variable manufacturing overhead. c. Variable selling and administrative costs. d. Fixed manufacturing overhead. e. Fixed selling and administrative costs. Abraj Inc. has computed the following unit costs for the year just ended: Direct material used $14 Direct labor 20 Variable manufacturing overhead Fixed manufacturing overhead 31 Variable selling and administrative cost Fixed selling and administrative cost 19 27 12 Under variable costing, the product cost per unit will be: Select one: a. $92 b. $61 O c. $34 O d. $104 O e. $123 Al-Ain Inc. has computed the following unit costs for the year just ended: Direct material used $15 Direct labor 21 Variable manufacturing overhead 28 Fixed manufacturing overhead 32 Variable selling and administrative cost 13 Fixed selling and administrative cost 18 Under absorption costing, the product cost per unit will be: Select one: a. $64 O b. $77 c. Other answer O d. $96 O e. $127 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started