Question

Please I need help on my accounting problem. Opening Balance Sheet REQUIRED TASK (USE ONLY EXCEL) Opening balance sheet- this is given above Sales budget

Please I need help on my accounting problem.

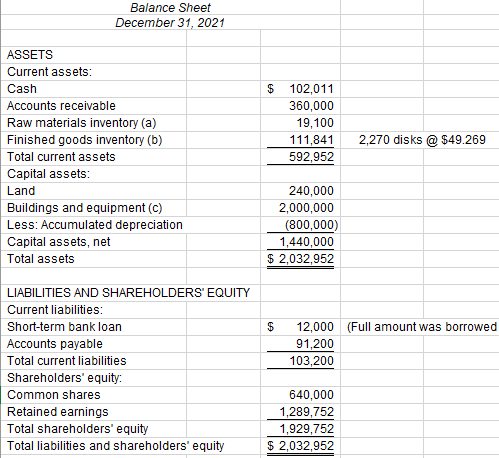

Opening Balance Sheet

REQUIRED TASK (USE ONLY EXCEL)

- Opening balance sheet- this is given above

- Sales budget

- Schedule of cash collection

- Production Budget

- Direct Material Budget

- Schedule of Cash payments

- Direct Labour Budget

- Manufacturing Overhead Budget

- Ending Finished Goods inventory

- Selling and administrative budget

- Cash budget

- Cost of good manufactured budget

- Budgeted income statement (with detailed COGS calculation)

- Budgeted Statement of retained earnings

- Budgeted balance sheet

PREPARE A MASTER BUDGET

Sales Budget and Cash Collection

- Forecast Sales (unit) January 10,000,February 35,000, March 15,000, April 10,000, May 25,000

- Selling Price: $75.00 per seat cover

- Sales Collected in the following pattern: Same month 60%, 1 month later 30%, 2 months later 10%

- All accounts receivable at the end of December will be collected in January

Inventory Production and raw Materials Details

*Direct Material per unit (needed) not given JUST ASSUME it is 1 (one)

- Desired ending inventory of seat cover is 20% of next months sales

- Inventory on December 31 was 2,270 seat cover

- The fabric required for each seat cover cost $16.00

- The fabric required to be in the ending inventory at the end of each month is 10% of next months requirement

- All A/P on December 31 will be paid in January

- 40% of the cost of fabric is paid in the month of purchase, 60% the next month.

Direct Labour and Manufacturing Overhead Details

- It takes 0.75 hours to make each bed sheet

- We pay our production employees $25 per hour

- The direct labour payments are made in the same moth the employees earned the wages.

- Fixed overhead is $160,000 per month (including $34,000 of depreciation)

- Variable overhead is $8.00 per direct labour hour

- You will need to calculate the predetermined overhead rate

Administrative and Selling Expense Details

- Variable administrative and selling expense are $5.00 per unit sold

- Fixed administrative and selling expense are:

Advertising $65,000

Admin salaries $130,000

Insurance $28,000

Office Depreciation $41,000

- Other cash payments:

February equipment purchase $123,000

February dividends paid $55,000

Cash Management Details

- We have an unlimited capacity short-term demand loan which automatically covers any cash deficiency (short-term bank loan on the B/S)

- Amounts are borrowed at the start of the month, repaid at the end of the month

- Interest is paid based on the amount of the principal repaid

- We require a minimum cash balance of $45,000

- Interest is charged at 10% per year

| CHECK FIGURES | ||||

| Figure | Schedule | |||

| Total cash collections for the quarter | 4,147,500 | Expected cash collections | ||

| Total required production for the quarter (units) | 59,730 | Production | ||

| Raw materials to be purchased for the quarter | 957,380 | Direct materials | ||

| March 31st, 2022 Ending cash balance | 316,123 | Cash budget | ||

| Total cost of goods manufactured for the quarter | 2,913,998 | Schedule of COGM | ||

| Total assets for the quarter ended March 31 | 2,484,995 | Balance sheet | ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started