please i need help with correct answer please , asap please

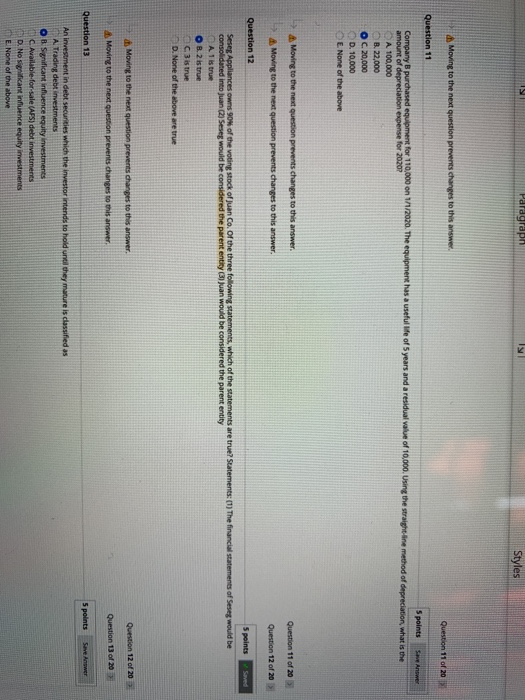

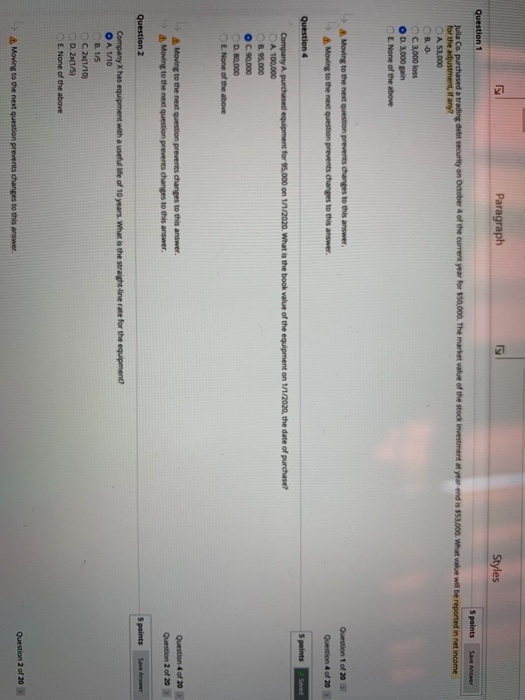

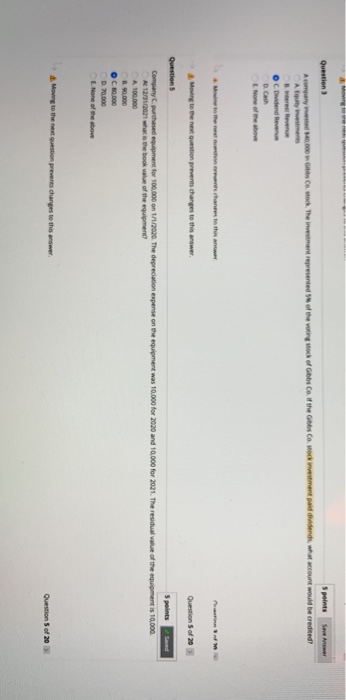

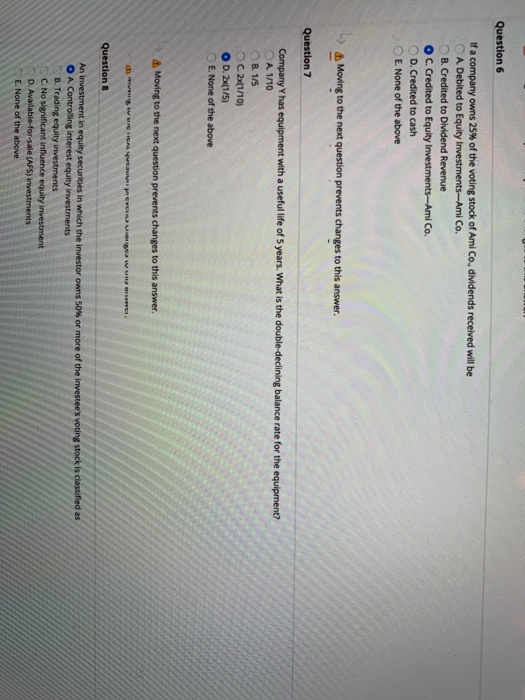

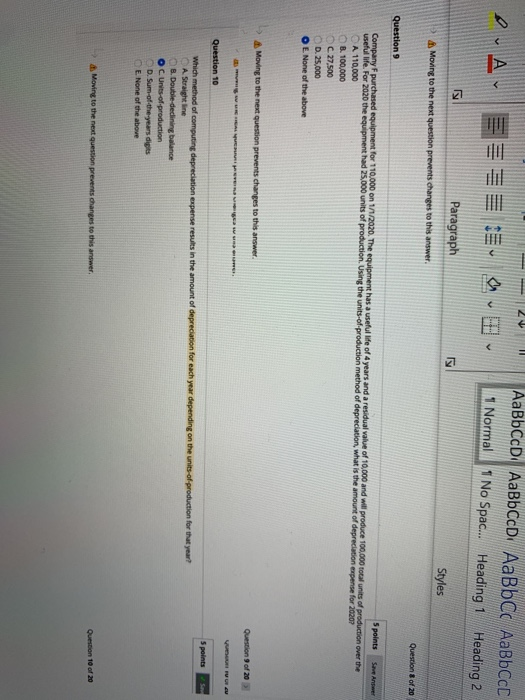

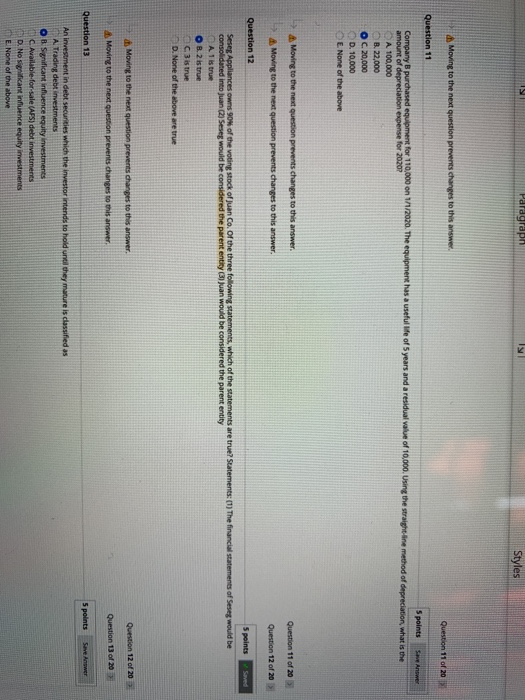

Paragraph Styles Question 1 5 points Save Answer Julia Co, purchased a trading debt security on October 4 of the current year for $50,000. The market value of the stock investment at year-endis 151,000. What value will be reported in net income for the adjustment, any? A 53,000 8.-0 3.000 loss OD 3,000 gain L. None of the above Moving to the next question prevents changes to this answer A Moving to the next question prevents changes to this answer Question 1 of 20 Question 4 of 20 Question 4 5 points saved Company A. purchased equipment for 95.000 on 1/1/2020. What is the book value of the equipment on 1/1/2020, the date of purchase A 100.000 B. 95.000 OC. 90.000 D. 80.000 E. None of the above Moving to the next question prevents changes to this answer. Moving to the next question prevents changes to this answer. Question 4 of 20 Question 2 of 20 Spaints Sevenswer Question 2 Company has equipment with a useful life of 10 years. What is the straight-line rate for the equipment? O A 1/10 B. 1/5 CC 2x{1/10) D. 2x{1/5) E. None of the above Question 2 of 20 > Moving to the next question prevents changes to this answer. Question 5 points Save Aler A company 140.000 The investment represented of the voting Mock of Gibbs Co. If the b o ok investment paid deadends. What count would be credited! o udend Revenue D. Cash None of the above Moving to the next question prevents changes to this answer Questions of 20 Questions Spoints Saved Company purchased equipment for 100,000 on 1/1/2020. The depreciation expense on the equipment was 10,000 for 2020 and 10.000 for 2021. The residual value of the equipment is 10,000 A1231201 w ith book value of the equipment A 100.000 0.70,000 L. None of the above Moving to the guestion prevents changes to this answer Question 5 of 20 Question 6 If a company owns 25% of the voting stock of Ami Co. dividends received will be A Debited to Equity Investments-Ami Co. B. Credited to Dividend Revenue O C. Credited to Equity Investments-Ami Co. D. Credited to cash E. None of the above & Moving to the next question prevents changes to this answer. Question 7 Company Y has equipment with a useful life of 5 years. What is the double-declining balance rate for the equipment? A 1/10 B. 1/5 C. 241/10) OD. 2x(1/5) E. None of the above A Moving to the next question prevents changes to this answer Question 8 An investment in equity securities in which the investor owns 50% or more of the investee's votin O A Controlling interest equity investments B. Trading equity investments C. No significant influence equity investment D. Available for sale (AFS) investments E. None of the above AaBbCcDi AaBbCcD. AaBbcc AaBbc 1 Normal 1 No Spac... Heading 1 Heading 2 = === Normal 1 No Sou n d Paragraph Styles 2 Moving to the next question prevents changes to this answer Question 8 of 20 Question 9 5 points Save Answer Company F purchased equipment for 110.000 on in 2020. The equipment has a useful life of 4 years and a residual value of 10,000 and will produce 100.000 total units of production over the useful life. For 2020 the equipment had 25,000 units of production. Using the units of production method of depreciation, what is the amount of depreciation expense for 20207 A 110,000 B. 100,000 C 27,500 OD. 25,000 O E. None of the above Moving to the next question prevents changes to this answer Question of 20 Question 10 s points Save Which method of computing depreciation expense results in the amount of depreciation for each year depending on the units of production for that year? A Straight line B. Double-declining balance OC Units of production D. Sum of the years digits E. None of the above Moving to the next question prevents changes to Question 10 of 20 Question 11 of 20 Question 11 5 points Save Answer Company purchased equipment for 110,000 on 1/1/2020. The equipment has a useful life of 5 years and a residual value of 10,000. Using the straight-line method of depreciation what is the amount of depreciation expense for 20201 A 100,000 B. 22.000 OC. 20,000 D. 10.000 E. None of the above A Moving to the next question prevents changes to this answer. Question 11 of 20 Question 12 of 20 Moving to the next question prevents changes to this answer. Saved Question 12 5 points Seseg Appliances owns 90% of the voting stock of Juan Co. of the three following statements, which of the statements are true? Statements: (1) The financial statements of Seseg would be consolidated into Juan (2) Seseg would be considered the parent entity (3) Juan would be considered the parent entity 1 is true O 8.2 is true 3 is true D. None of the above are true Moving to the next question prevents changes to the answer Question 12 of 20 Moving to the next question prevents changes to this answer Question 13 of 20 Question 13 5 points Save Answer An investment in debt securities which the investor intends to hold until they mature is classified as A Trading debt investments O B. Significant influence equity investments Available for sale (AFS) debt investments D. No significant influence equity investments E None of the above

please i need help with correct answer please , asap please

please i need help with correct answer please , asap please