Question

Please I need help with these questions to get me started. First, what would be your own suggestions to improve the company in the future

Please I need help with these questions to get me started.

Please I need help with these questions to get me started.

First, what would be your own suggestions to improve the company in the future based on a trend analysis of the printing industry and product mixes that are being sold now and possibly in the future along with the demographics of people living in the region (U.S. Census census.gov) along with the types of businesses in the area (TriCity Development Council - https://www.tridec.org/ ), in addition to types of groups (schools, local sports teams, YMCA/YWCA, etc.): o Is the industry growing in the market; o Is the company selling their products at prices that are competitive in their chosen market and, if not, have they differentiated themselves enough to sell at a higher price and how; o Is the company selling their products using the right avenue (site location, online, both, etc.); o Are the cost of the goods percentage in line with what a similar company might pay for those goods (check an annual income statement for a publically traded company's COGS % to Net Sales using Yahoo Finance-UPS Store might be a good publically traded company ); o Do the operating expenses seemto be in line with that same company from above (do a % of that company's operating expenses to Net Sales to see if similar to this company; o Do the volume of sales seems to be ok, too much, too little for the customer base and market they are selling into; o Do you think with this budget the company will be able to succeed (just come up with your best opinion on this. How to increase sales; How to decrease expenses; o What new products could the company add to its sales mix, what new customer base they should also be targeting, any new equipment may be needed and the cost of that equipment. Also, state why you think these would be beneficial to the company based on the demographics of people and types of businesses/groups in the areas who might need these services.

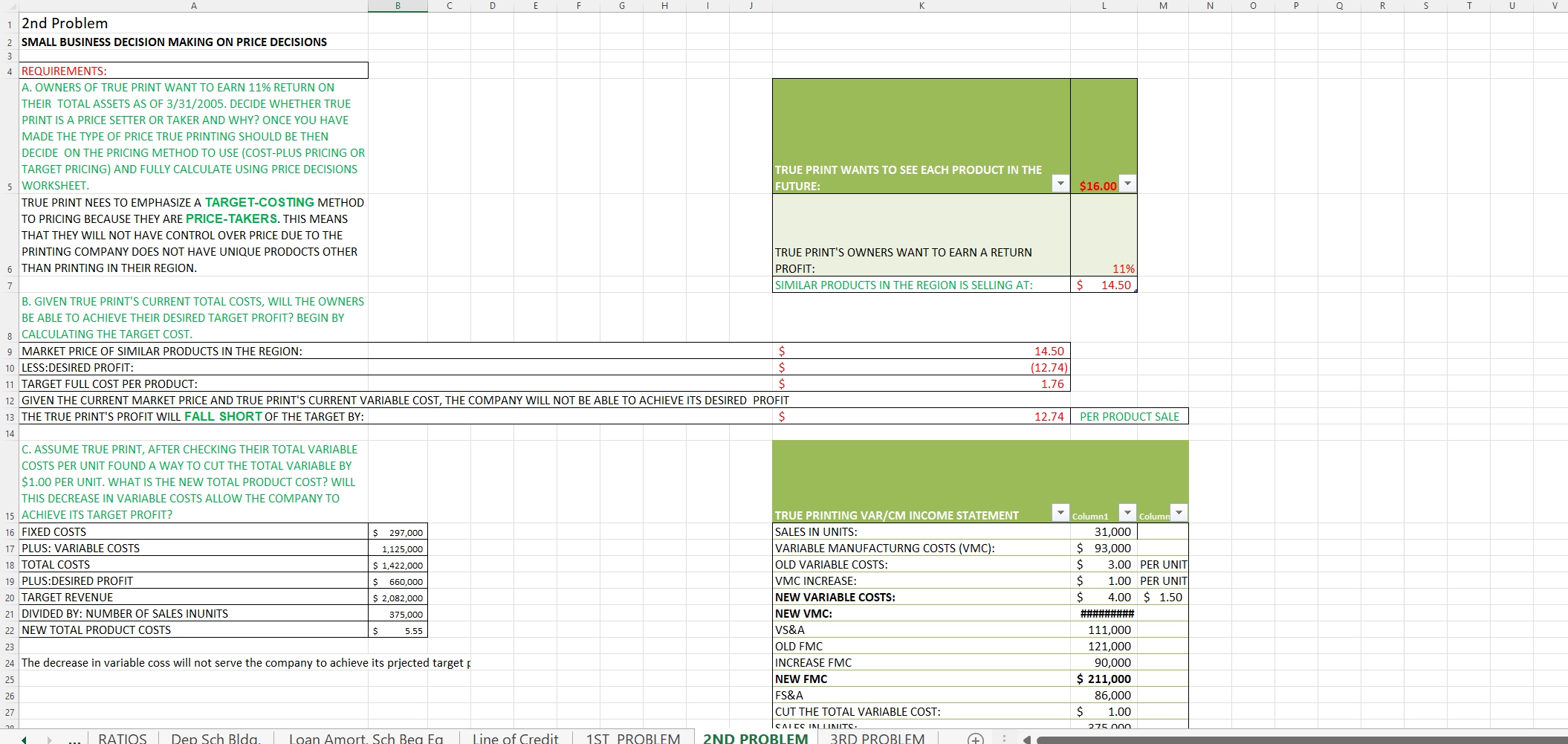

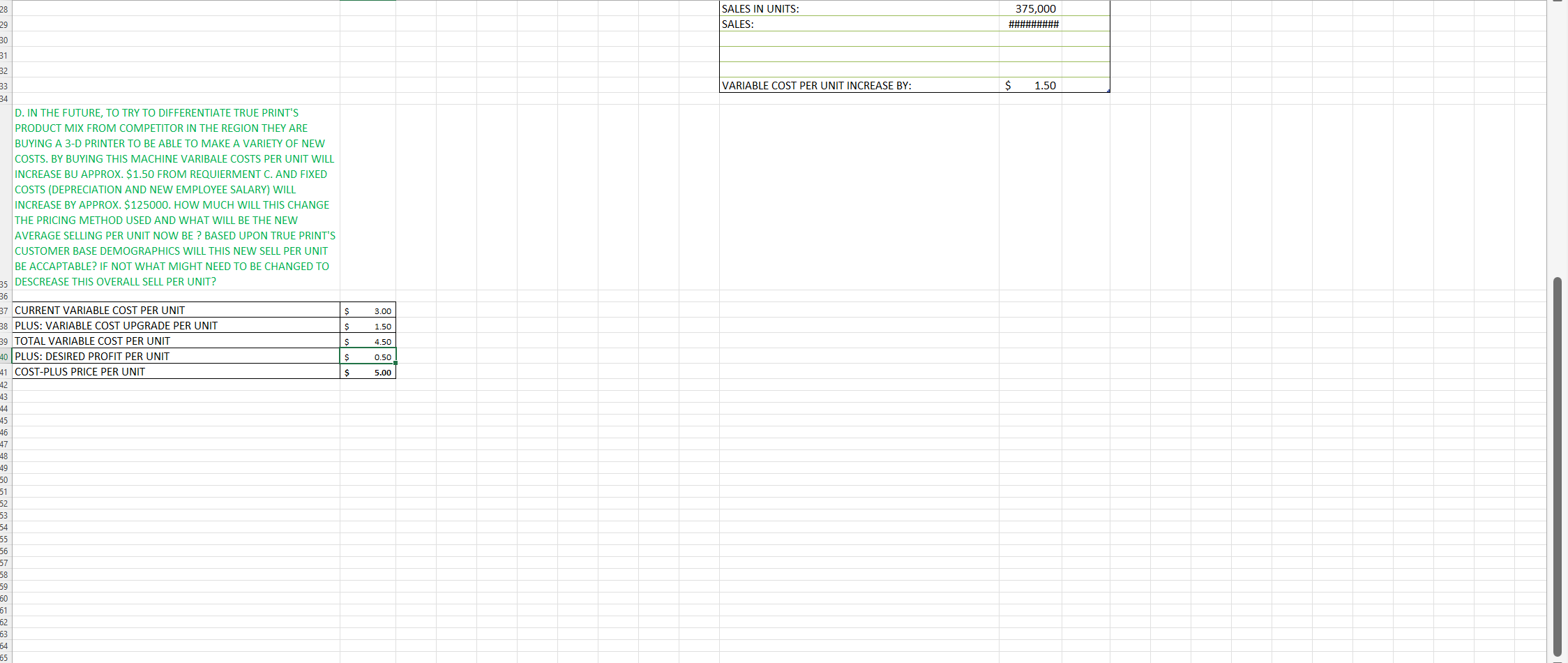

L M N o Q R S U V $16.00 B D E F G H K 1 2nd Problem 2 SMALL BUSINESS DECISION MAKING ON PRICE DECISIONS 3 4 REQUIREMENTS: A. OWNERS OF TRUE PRINT WANT TO EARN 11% RETURN ON THEIR TOTAL ASSETS AS OF 3/31/2005. DECIDE WHETHER TRUE PRINT IS A PRICE SETTER OR TAKER AND WHY? ONCE YOU HAVE MADE THE TYPE OF PRICE TRUE PRINTING SHOULD BE THEN DECIDE ON THE PRICING METHOD TO USE (COST-PLUS PRICING OR TARGET PRICING) AND FULLY CALCULATE USING PRICE DECISIONS TRUE PRINT WANTS TO SEE EACH PRODUCT IN THE 5 WORKSHEET. FUTURE: TRUE PRINT NEES TO EMPHASIZE A TARGET-COSTING METHOD TO PRICING BECAUSE THEY ARE PRICE-TAKERS. THIS MEANS THAT THEY WILL NOT HAVE CONTROL OVER PRICE DUE TO THE PRINTING COMPANY DOES NOT HAVE UNIQUE PRODOCTS OTHER TRUE PRINT'S OWNERS WANT TO EARN A RETURN 6 THAN PRINTING IN THEIR REGION. PROFIT: 7 SIMILAR PRODUCTS IN THE REGION IS SELLING AT: B. GIVEN TRUE PRINT'S CURRENT TOTAL COSTS, WILL THE OWNERS BE ABLE TO ACHIEVE THEIR DESIRED TARGET PROFIT? BEGIN BY 8 CALCULATING THE TARGET COST. 9 MARKET PRICE OF SIMILAR PRODUCTS IN THE REGION: S 14.50 10 LESS:DESIRED PROFIT: $ (12.74) 11 TARGET FULL COST PER PRODUCT: $ 1.76 12 GIVEN THE CURRENT MARKET PRICE AND TRUE PRINT'S CURRENT VARIABLE COST, THE COMPANY WILL NOT BE ABLE TO ACHIEVE ITS DESIRED PROFIT 13 THE TRUE PRINT'S PROFIT WILL FALL SHORT OF THE TARGET BY: $ 12.74 11% 14.50 $ PER PRODUCT SALE 14 C. ASSUME TRUE PRINT, AFTER CHECKING THEIR TOTAL VARIABLE COSTS PER UNIT FOUND A WAY TO CUT THE TOTAL VARIABLE BY $1.00 PER UNIT. WHAT IS THE NEW TOTAL PRODUCT COST? WILL THIS DECREASE IN VARIABLE COSTS ALLOW THE COMPANY TO 15 ACHIEVE ITS TARGET PROFIT? 16 FIXED COSTS 17 PLUS: VARIABLE COSTS 18 TOTAL COSTS 19 PLUS:DESIRED PROFIT 20 TARGET REVENUE 21 DIVIDED BY: NUMBER OF SALES INUNITS 22 NEW TOTAL PRODUCT COSTS $ 297,000 1,125,000 $ 1,422,000 $ 660,000 $ 2,082,000 375,000 Columni Column 31,000 93,000 $ 3.00 PER UNIT $ 1.00 PER UNIT $ 4.00 $ 1.50 TRUE PRINTING VAR/CM INCOME STATEMENT SALES IN UNITS: VARIABLE MANUFACTURNG COSTS (VMC): OLD VARIABLE COSTS: VMC INCREASE: NEW VARIABLE COSTS: NEW VMC: VS&A OLD FMC INCREASE FMC NEW EMC FS&A CUT THE TOTAL VARIABLE COST: CAICC IML LINUITS. 2ND PROBLEM 3RD PROBLEM $ 5.55 23 24 The decrease in variable coss will not serve the company to achieve its prjected target 25 111,000 121,000 90,000 $ 211,000 86,000 $ 1.00 275 non 26 27 20 RATIOS Dep Sch Blda. Loan Amort Sch Bea Ea Line of Credit 1ST PROBLEM 28 SALES IN UNITS: SALES: 375,000 ######### 29 30 31 32 VARIABLE COST PER UNIT INCREASE BY: $ 1.50 $ 3.00 $ 1.50 33 34 D. IN THE FUTURE, TO TRY TO DIFFERENTIATE TRUE PRINT'S PRODUCT MIX FROM COMPETITOR IN THE REGION THEY ARE BUYING A 3-D PRINTER TO BE ABLE TO MAKE A VARIETY OF NEW COSTS. BY BUYING THIS MACHINE VARIBALE COSTS PER UNIT WILL INCREASE BU APPROX. $1.50 FROM REQUIERMENT C. AND FIXED COSTS (DEPRECIATION AND NEW EMPLOYEE SALARY) WILL INCREASE BY APPROX. $125000. HOW MUCH WILL THIS CHANGE THE PRICING METHOD USED AND WHAT WILL BE THE NEW AVERAGE SELLING PER UNIT NOW BE ? BASED UPON TRUE PRINT'S CUSTOMER BASE DEMOGRAPHICS WILL THIS NEW SELL PER UNIT BE ACCAPTABLE? IF NOT WHAT MIGHT NEED TO BE CHANGED TO 35 DESCREASE THIS OVERALL SELL PER UNIT? 36 37 CURRENT VARIABLE COST PER UNIT 38 PLUS: VARIABLE COST UPGRADE PER UNIT 39 TOTAL VARIABLE COST PER UNIT 40 PLUS: DESIRED PROFIT PER UNIT 41 COST-PLUS PRICE PER UNIT 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 $ 4.50 $ 0.50 5.00 $ 62 63 64 65 L M N o Q R S U V $16.00 B D E F G H K 1 2nd Problem 2 SMALL BUSINESS DECISION MAKING ON PRICE DECISIONS 3 4 REQUIREMENTS: A. OWNERS OF TRUE PRINT WANT TO EARN 11% RETURN ON THEIR TOTAL ASSETS AS OF 3/31/2005. DECIDE WHETHER TRUE PRINT IS A PRICE SETTER OR TAKER AND WHY? ONCE YOU HAVE MADE THE TYPE OF PRICE TRUE PRINTING SHOULD BE THEN DECIDE ON THE PRICING METHOD TO USE (COST-PLUS PRICING OR TARGET PRICING) AND FULLY CALCULATE USING PRICE DECISIONS TRUE PRINT WANTS TO SEE EACH PRODUCT IN THE 5 WORKSHEET. FUTURE: TRUE PRINT NEES TO EMPHASIZE A TARGET-COSTING METHOD TO PRICING BECAUSE THEY ARE PRICE-TAKERS. THIS MEANS THAT THEY WILL NOT HAVE CONTROL OVER PRICE DUE TO THE PRINTING COMPANY DOES NOT HAVE UNIQUE PRODOCTS OTHER TRUE PRINT'S OWNERS WANT TO EARN A RETURN 6 THAN PRINTING IN THEIR REGION. PROFIT: 7 SIMILAR PRODUCTS IN THE REGION IS SELLING AT: B. GIVEN TRUE PRINT'S CURRENT TOTAL COSTS, WILL THE OWNERS BE ABLE TO ACHIEVE THEIR DESIRED TARGET PROFIT? BEGIN BY 8 CALCULATING THE TARGET COST. 9 MARKET PRICE OF SIMILAR PRODUCTS IN THE REGION: S 14.50 10 LESS:DESIRED PROFIT: $ (12.74) 11 TARGET FULL COST PER PRODUCT: $ 1.76 12 GIVEN THE CURRENT MARKET PRICE AND TRUE PRINT'S CURRENT VARIABLE COST, THE COMPANY WILL NOT BE ABLE TO ACHIEVE ITS DESIRED PROFIT 13 THE TRUE PRINT'S PROFIT WILL FALL SHORT OF THE TARGET BY: $ 12.74 11% 14.50 $ PER PRODUCT SALE 14 C. ASSUME TRUE PRINT, AFTER CHECKING THEIR TOTAL VARIABLE COSTS PER UNIT FOUND A WAY TO CUT THE TOTAL VARIABLE BY $1.00 PER UNIT. WHAT IS THE NEW TOTAL PRODUCT COST? WILL THIS DECREASE IN VARIABLE COSTS ALLOW THE COMPANY TO 15 ACHIEVE ITS TARGET PROFIT? 16 FIXED COSTS 17 PLUS: VARIABLE COSTS 18 TOTAL COSTS 19 PLUS:DESIRED PROFIT 20 TARGET REVENUE 21 DIVIDED BY: NUMBER OF SALES INUNITS 22 NEW TOTAL PRODUCT COSTS $ 297,000 1,125,000 $ 1,422,000 $ 660,000 $ 2,082,000 375,000 Columni Column 31,000 93,000 $ 3.00 PER UNIT $ 1.00 PER UNIT $ 4.00 $ 1.50 TRUE PRINTING VAR/CM INCOME STATEMENT SALES IN UNITS: VARIABLE MANUFACTURNG COSTS (VMC): OLD VARIABLE COSTS: VMC INCREASE: NEW VARIABLE COSTS: NEW VMC: VS&A OLD FMC INCREASE FMC NEW EMC FS&A CUT THE TOTAL VARIABLE COST: CAICC IML LINUITS. 2ND PROBLEM 3RD PROBLEM $ 5.55 23 24 The decrease in variable coss will not serve the company to achieve its prjected target 25 111,000 121,000 90,000 $ 211,000 86,000 $ 1.00 275 non 26 27 20 RATIOS Dep Sch Blda. Loan Amort Sch Bea Ea Line of Credit 1ST PROBLEM 28 SALES IN UNITS: SALES: 375,000 ######### 29 30 31 32 VARIABLE COST PER UNIT INCREASE BY: $ 1.50 $ 3.00 $ 1.50 33 34 D. IN THE FUTURE, TO TRY TO DIFFERENTIATE TRUE PRINT'S PRODUCT MIX FROM COMPETITOR IN THE REGION THEY ARE BUYING A 3-D PRINTER TO BE ABLE TO MAKE A VARIETY OF NEW COSTS. BY BUYING THIS MACHINE VARIBALE COSTS PER UNIT WILL INCREASE BU APPROX. $1.50 FROM REQUIERMENT C. AND FIXED COSTS (DEPRECIATION AND NEW EMPLOYEE SALARY) WILL INCREASE BY APPROX. $125000. HOW MUCH WILL THIS CHANGE THE PRICING METHOD USED AND WHAT WILL BE THE NEW AVERAGE SELLING PER UNIT NOW BE ? BASED UPON TRUE PRINT'S CUSTOMER BASE DEMOGRAPHICS WILL THIS NEW SELL PER UNIT BE ACCAPTABLE? IF NOT WHAT MIGHT NEED TO BE CHANGED TO 35 DESCREASE THIS OVERALL SELL PER UNIT? 36 37 CURRENT VARIABLE COST PER UNIT 38 PLUS: VARIABLE COST UPGRADE PER UNIT 39 TOTAL VARIABLE COST PER UNIT 40 PLUS: DESIRED PROFIT PER UNIT 41 COST-PLUS PRICE PER UNIT 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 $ 4.50 $ 0.50 5.00 $ 62 63 64 65Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started