Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need just the answers. no need to show working 2. Which type of risk is faced by holders of corporate bonds that can

please I need just the answers. no need to show working

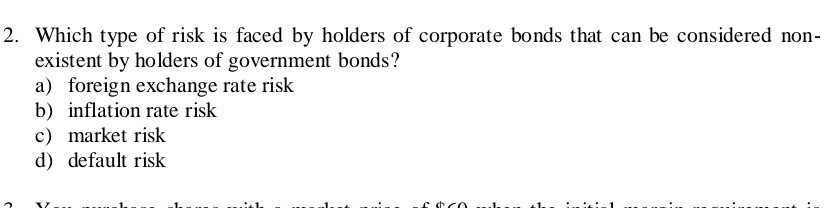

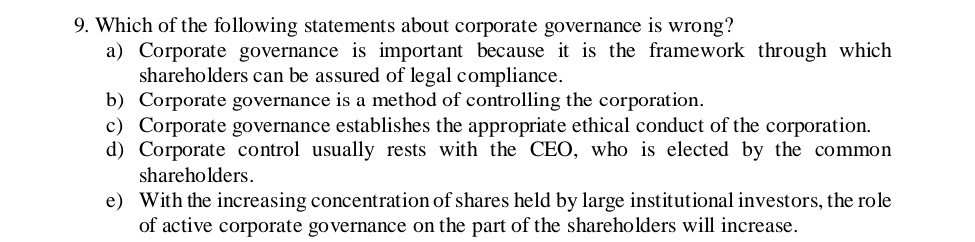

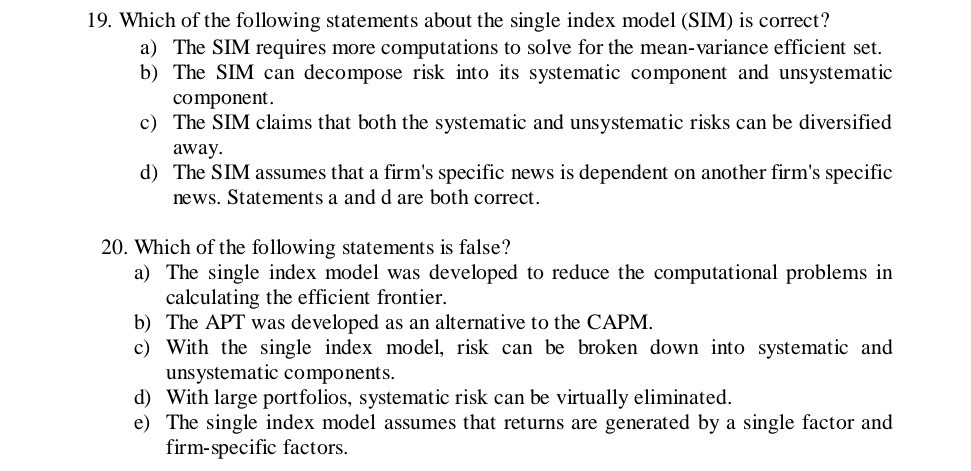

2. Which type of risk is faced by holders of corporate bonds that can be considered non- existent by holders of government bonds? a) foreign exchange rate risk b) inflation rate risk c) market risk d) default risk can 9. Which of the following statements about corporate governance is wrong? a) Corporate governance is important because it is the framework through which shareholders can be assured of legal compliance. b) Corporate governance is a method of controlling the corporation. c) Corporate governance establishes the appropriate ethical conduct of the corporation. d) Corporate control usually rests with the CEO, who is elected by the common shareholders. e) With the increasing concentration of shares held by large institutional investors, the role of active corporate governance on the part of the shareholders will increase. 19. Which of the following statements about the single index model (SIM) is correct? a) The SIM requires more computations to solve for the mean-variance efficient set. b) The SIM can decompose risk into its systematic component and unsystematic component. c) The SIM claims that both the systematic and unsystematic risks can be diversified away. d) The SIM assumes that a firm's specific news is dependent on another firm's specific news. Statements a and d are both correct. 20. Which of the following statements is false? a) The single index model was developed to reduce the computational problems in calculating the efficient frontier. b) The APT was developed as an alternative to the CAPM. c) With the single index model, risk can be broken down into systematic and unsystematic components. d) With large portfolios, systematic risk can be virtually eliminated. e) The single index model assumes that returns are generated by a single factor and firm-specific factors. 28. Which of the following is not a problem encountered when implementing DDMs? a) Using DDMs to identify undervalued stocks is useful only if the mispricing of stocks is corrected in the market. b) DDMs assume that the discount rate is constant over time. c) Theoretical DDMs relate future cash flows to price, but future cash flows are unknown today. d) DDMs have little practical value because they value stocks assuming infinite cash flows and investors' investment horizons are always finite. 28. Which of the following is not a problem encountered when implementing DDMs? a) Using DDMs to identify undervalued stocks is useful only if the mispricing of stocks is corrected in the market. b) DDMs assume that the discount rate is constant over time. c) Theoretical DDMs relate future cash flows to price, but future cash flows are unknown today. d) DDMs have little practical value because they value stocks assuming infinite cash flows and investors' investment horizons are always finite. 34. Which of the following statements about technical analysis is false? a) Technical analysts believe that financial prices reflect investors' attitudes, which at times may not be entirely rational. b) Technical analysis assumes that security prices react quickly to new information. c) Technical analysis contradicts the weak form of the EMT. d) Technical analysts believe that by studying historical market data, clues will be found regarding the future direction of security prices. e) Technical analysts believe that their analysis enables them to beat the market consistentlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started