Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please i need solution in 40 minutes thanks Question 1: Rebecca Isbell Optical Corporation is trying to determine an appropriate capital structure. It knows that,

Please i need solution in 40 minutes thanks

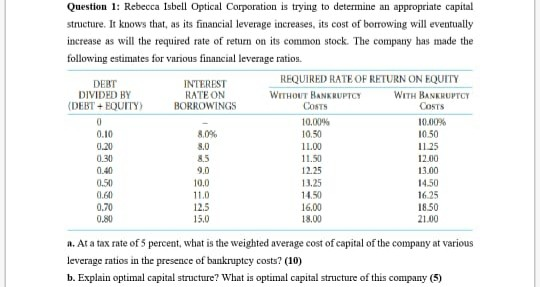

Question 1: Rebecca Isbell Optical Corporation is trying to determine an appropriate capital structure. It knows that, as its financial leverage increases, its cost of borrowing will eventually increase as will the required rate of return on its common stock. The company has made the following estimates for various financial leverage ratios. DEBT INTEREST REQUIRED RATE OF RETURN ON EQUITY DIVIDED BY RATE ON WITHOUT BANKRUPTCY WITH BANKRUPTCY (DEBT + EQUITY) BORROWINGS COSTS COSTS 0 10.00% 10.00% 0.10 8.0% 10.50 10.50 0.20 3.0 11.00 11.25 0.30 8.5 11.50 12.00 0.40 9.0 12.25 13.00 0.50 10,0 13.25 14.50 0.60 110 14.50 16.25 0.70 12.5 16,00 18.50 0.80 15.0 18.00 21.00 a. At a tax rate of 5 percent, what is the weighted average cost of capital of the company at various leverage ratios in the presence of bankruptcy costs? (10) b. Explain optimal capital structure? What is optimal capital structure of this companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started