Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need solution to all the three questions. thanks answer all the three questions 3. If a bank manager was quite certain that interest

please I need solution to all the three questions. thanks

answer all the three questions

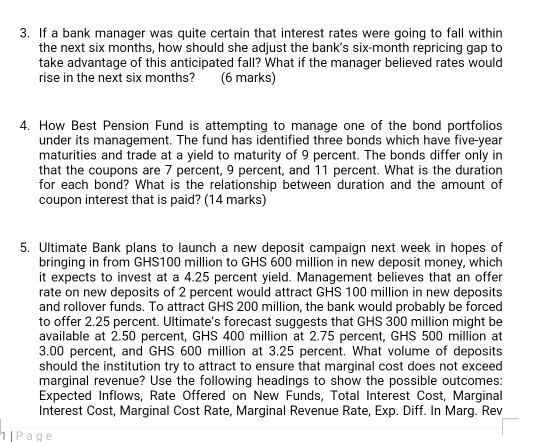

3. If a bank manager was quite certain that interest rates were going to fall within the next six months, how should she adjust the bank's six-month repricing gap to take advantage of this anticipated fall? What if the manager believed rates would rise in the next six months? (6 marks) How Best Pension Fund is attempting to manage one of the bond portfolios under its management. The fund has identified three bonds which have five-year maturities and trade at a yield to maturity of 9 percent. The bonds differ only in that the coupons are 7 percent, 9 percent, and 11 percent. What is the duration for each bond? What is the relationship between duration and the amount of coupon interest that is paid? (14 marks) 5. Ultimate Bank plans to launch a new deposit campaign next week in hopes of bringing in from GHS100 million to GHS 600 million in new deposit money, which it expects to invest at a 4.25 percent yield. Management believes that an offer rate on new deposits of 2 percent would attract GHS 100 million in new deposits and rollover funds. To attract GHS 200 million, the bank would probably be forced to offer 2.25 percent. Ultimate's forecast suggests that GHS 300 million might be available at 2.50 percent, GHS 400 million at 2.75 percent, GHS 500 million at 3.00 percent, and GHS 600 million at 3.25 percent. What volume of deposits should the institution try to attract to ensure that marginal cost does not exceed marginal revenue? Use the following headings to show the possible outcomes: Expected Inflows, Rate Offered on New Funds, Total Interest Cost, Marginal Interest Cost, Marginal Cost Rate, Marginal Revenue Rate, Exp. Diff. In Marg. Rev 1 Page 3. If a bank manager was quite certain that interest rates were going to fall within the next six months, how should she adjust the bank's six-month repricing gap to take advantage of this anticipated fall? What if the manager believed rates would rise in the next six months? (6 marks) How Best Pension Fund is attempting to manage one of the bond portfolios under its management. The fund has identified three bonds which have five-year maturities and trade at a yield to maturity of 9 percent. The bonds differ only in that the coupons are 7 percent, 9 percent, and 11 percent. What is the duration for each bond? What is the relationship between duration and the amount of coupon interest that is paid? (14 marks) 5. Ultimate Bank plans to launch a new deposit campaign next week in hopes of bringing in from GHS100 million to GHS 600 million in new deposit money, which it expects to invest at a 4.25 percent yield. Management believes that an offer rate on new deposits of 2 percent would attract GHS 100 million in new deposits and rollover funds. To attract GHS 200 million, the bank would probably be forced to offer 2.25 percent. Ultimate's forecast suggests that GHS 300 million might be available at 2.50 percent, GHS 400 million at 2.75 percent, GHS 500 million at 3.00 percent, and GHS 600 million at 3.25 percent. What volume of deposits should the institution try to attract to ensure that marginal cost does not exceed marginal revenue? Use the following headings to show the possible outcomes: Expected Inflows, Rate Offered on New Funds, Total Interest Cost, Marginal Interest Cost, Marginal Cost Rate, Marginal Revenue Rate, Exp. Diff. In Marg. Rev 1 PageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started