Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, I need the answer step by step, summarized, bullet points maybe thanks! ira Ltd. acquired and installed a new computerised grinding machine in its

Please, I need the answer step by step, summarized, bullet points maybe thanks!

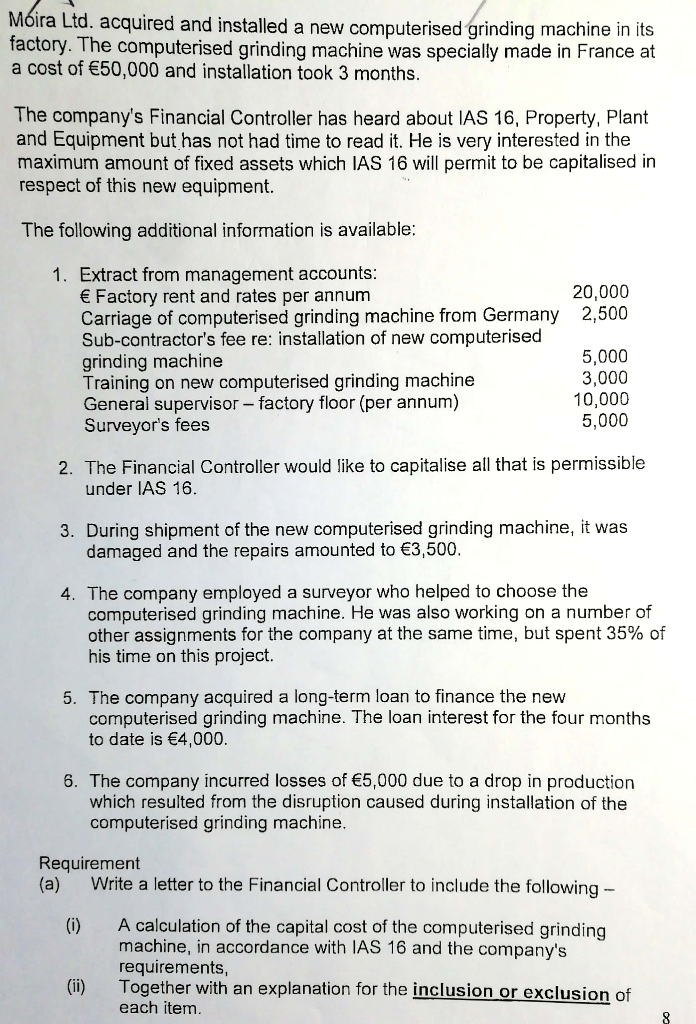

ira Ltd. acquired and installed a new computerised grinding machine in its factory. The computerised grinding machine was specially made in France af a cost of 50,000 and installation took 3 months The company's Financial Controller has heard about IAS 16, Property, Plant and Equipment but has not had time to read it. He is very interested in the maximum amount of fixed assets which IAS 16 will permit to be capitalised in respect of this new equipment. The following additional information is available: 1. Extract from management accounts: Factory rent and rates per annum Carriage of computerised grinding machine from Germany Sub-contractor's fee re: installation of new computerised grinding machine Training on new computerised grinding machine General supervisor - factory floor (per annum) Surveyor's fees 20,000 2,500 5,000 3,000 10,000 5,000 2. The Financial Controller would like to capitalise all that is permissible under IAS 16 3. During shipment of the new computerised grinding machine, it was damaged and the repairs amounted to 3,500 4. The company employed a surveyor who helped to choose the computerised grinding machine. He was also working on a number of other assignments for the company at the same time, but spent 35% of his time on this project. 5. The company acquired a long-term loan to finance the new computerised grinding machine. The loan interest for the four months to date is 4,000 6. The company incurred losses of 5,000 due to a drop in production which resulted from the disruption caused during installation of the computerised grinding machine. Requirement (a) Write a letter to the Financial Controller to include the following (i) A calculation of the capital cost of the computerised grinding machine, in accordance with IAS 16 and the company's requirements, (i) Together with an explanation for the inclusion or exclusion of each item ira Ltd. acquired and installed a new computerised grinding machine in its factory. The computerised grinding machine was specially made in France af a cost of 50,000 and installation took 3 months The company's Financial Controller has heard about IAS 16, Property, Plant and Equipment but has not had time to read it. He is very interested in the maximum amount of fixed assets which IAS 16 will permit to be capitalised in respect of this new equipment. The following additional information is available: 1. Extract from management accounts: Factory rent and rates per annum Carriage of computerised grinding machine from Germany Sub-contractor's fee re: installation of new computerised grinding machine Training on new computerised grinding machine General supervisor - factory floor (per annum) Surveyor's fees 20,000 2,500 5,000 3,000 10,000 5,000 2. The Financial Controller would like to capitalise all that is permissible under IAS 16 3. During shipment of the new computerised grinding machine, it was damaged and the repairs amounted to 3,500 4. The company employed a surveyor who helped to choose the computerised grinding machine. He was also working on a number of other assignments for the company at the same time, but spent 35% of his time on this project. 5. The company acquired a long-term loan to finance the new computerised grinding machine. The loan interest for the four months to date is 4,000 6. The company incurred losses of 5,000 due to a drop in production which resulted from the disruption caused during installation of the computerised grinding machine. Requirement (a) Write a letter to the Financial Controller to include the following (i) A calculation of the capital cost of the computerised grinding machine, in accordance with IAS 16 and the company's requirements, (i) Together with an explanation for the inclusion or exclusion of each itemStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started