Answered step by step

Verified Expert Solution

Question

1 Approved Answer

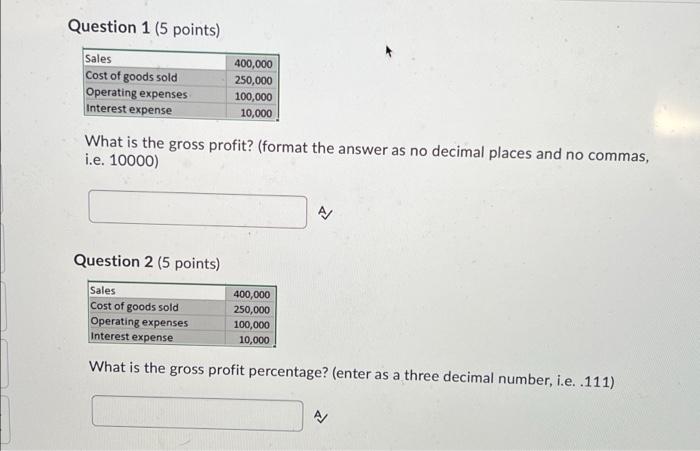

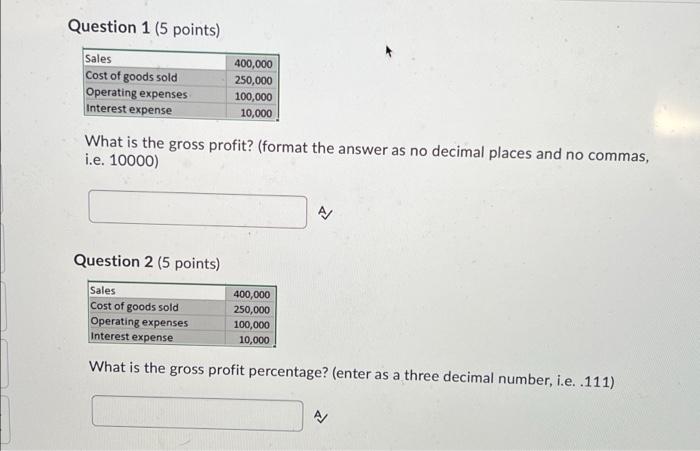

please i need the answers asap. thanks Question 1 (5 points) Sales 400,000 Cost of goods sold 250,000 Operating expenses 100,000 Interest expense 10,000 What

please i need the answers asap. thanks

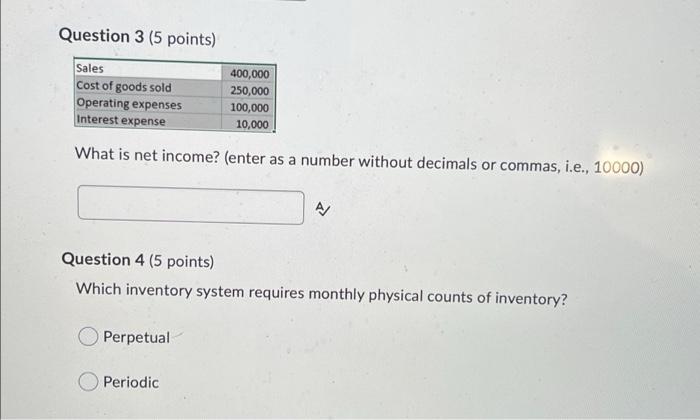

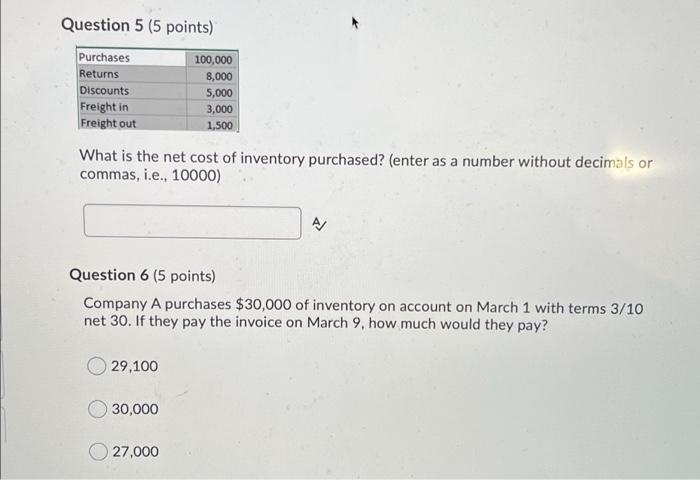

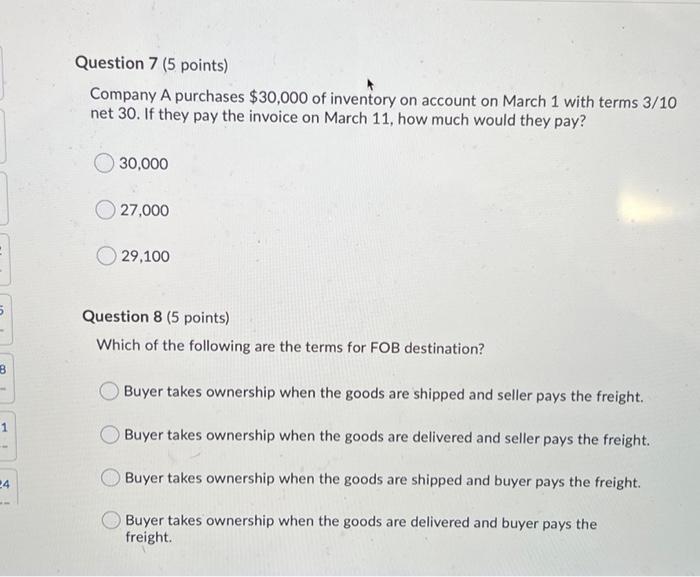

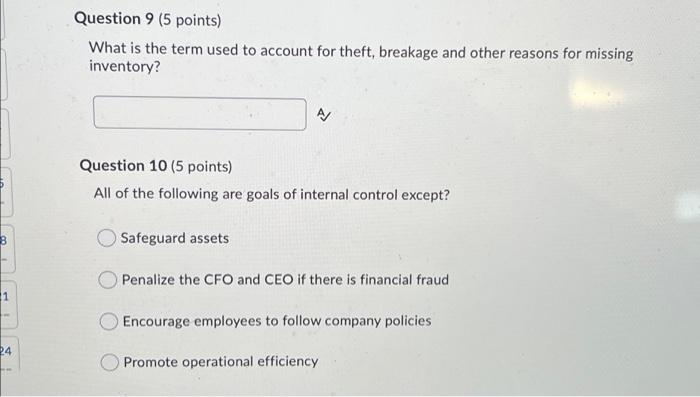

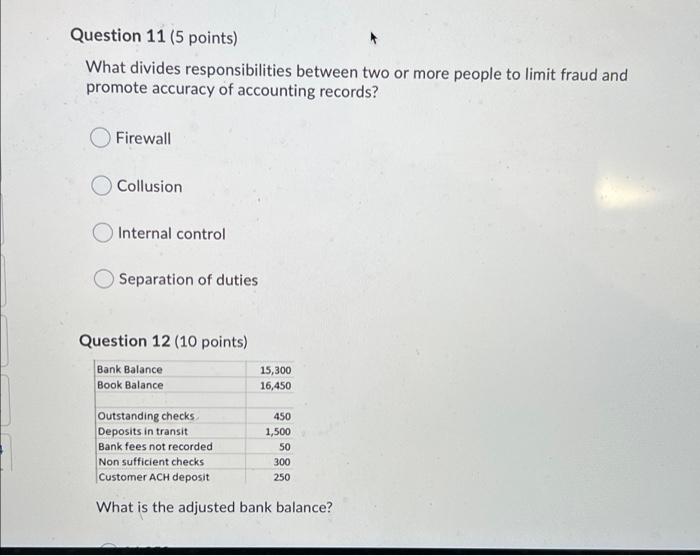

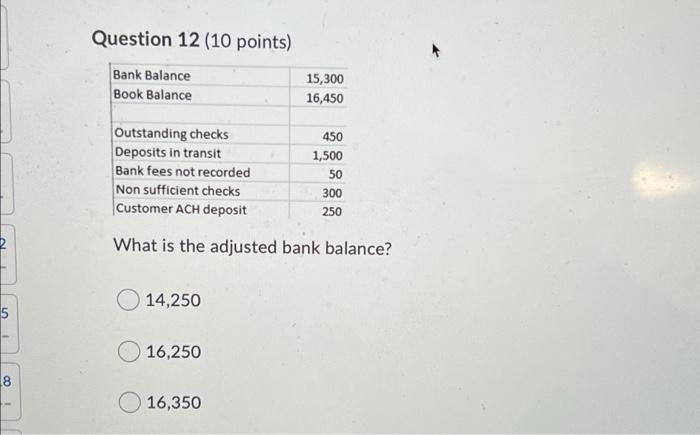

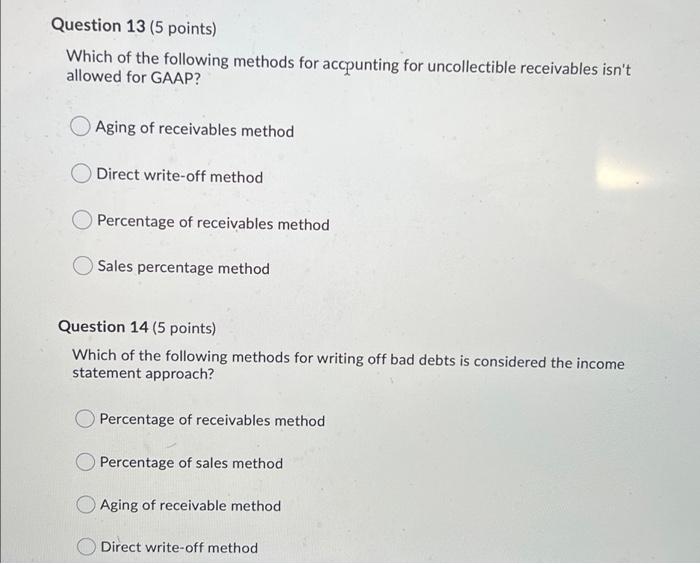

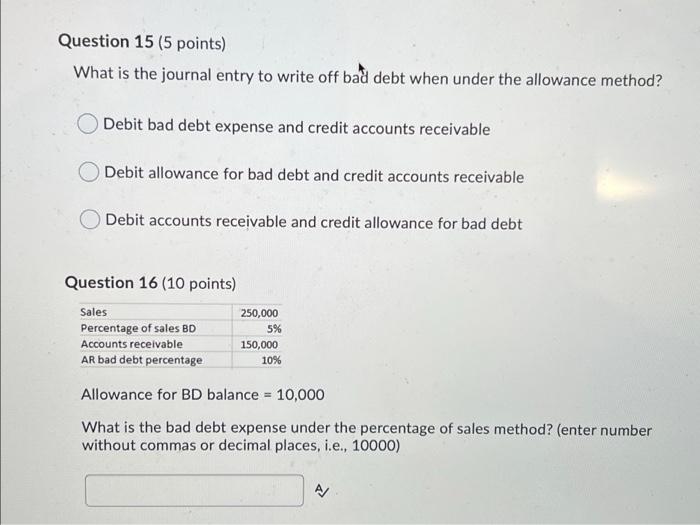

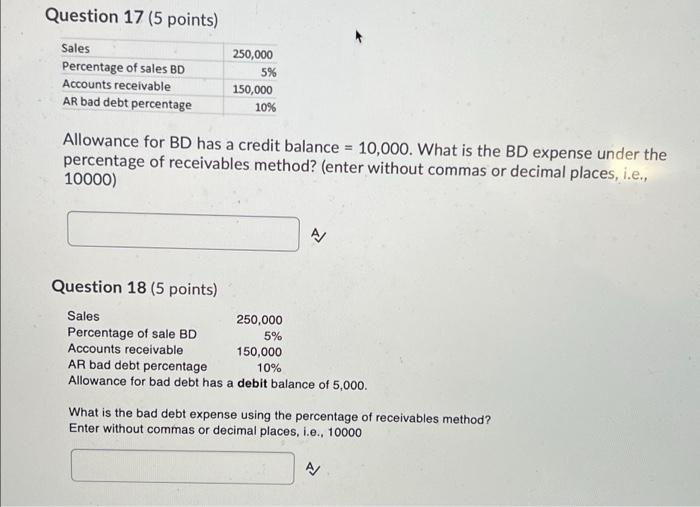

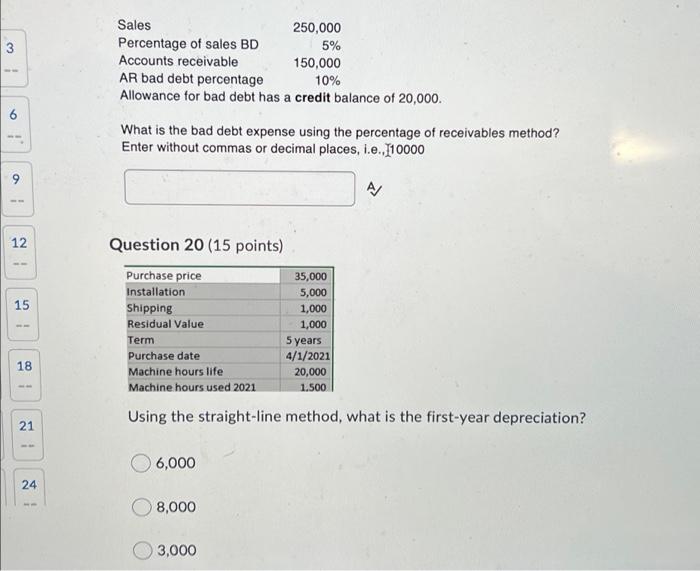

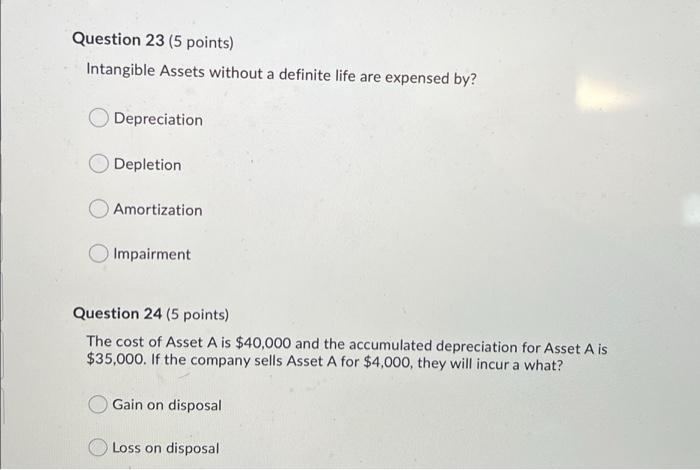

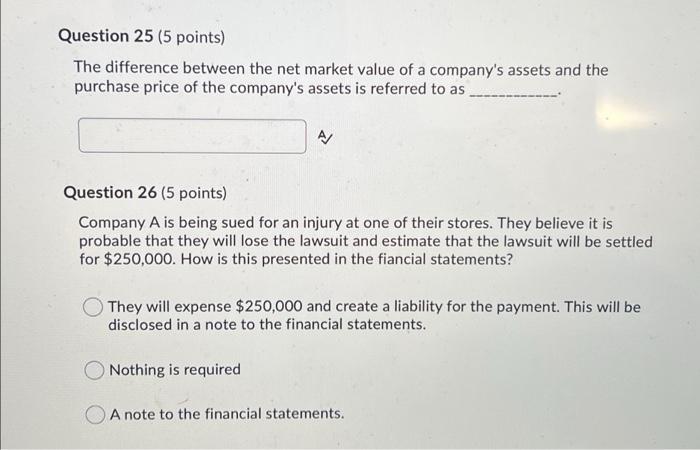

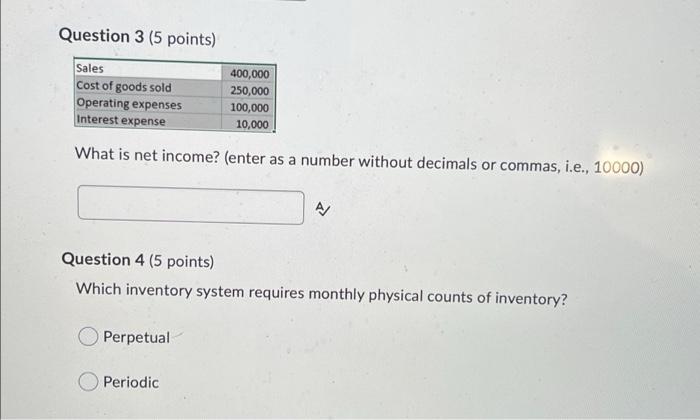

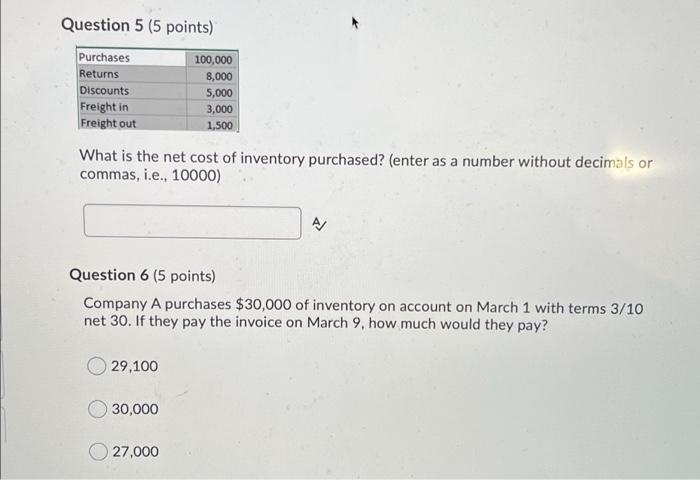

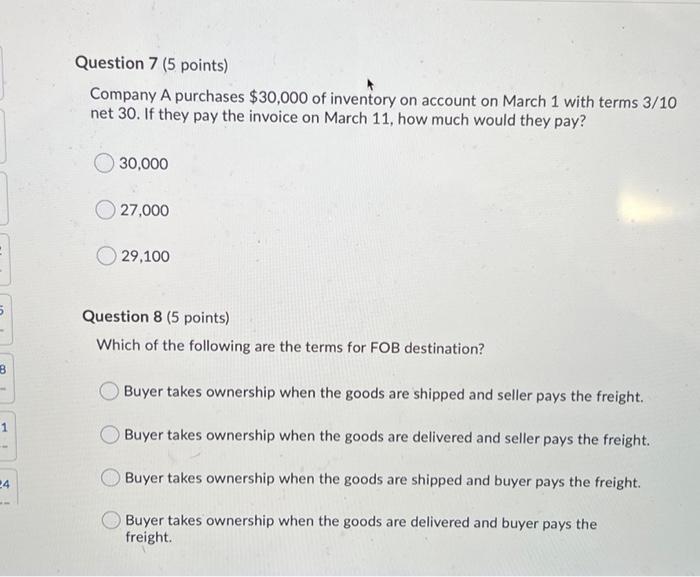

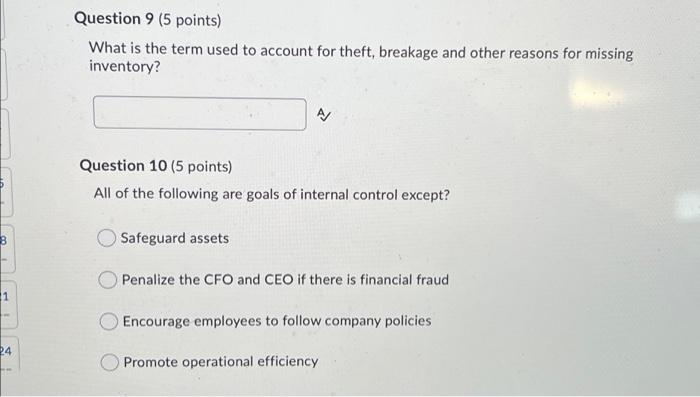

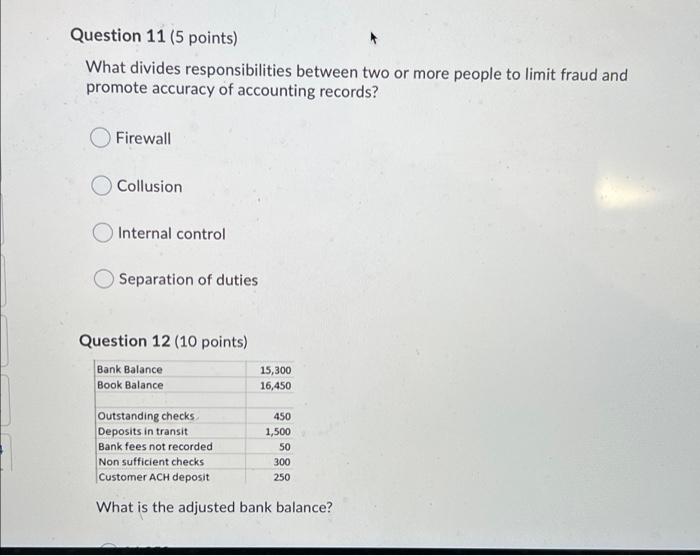

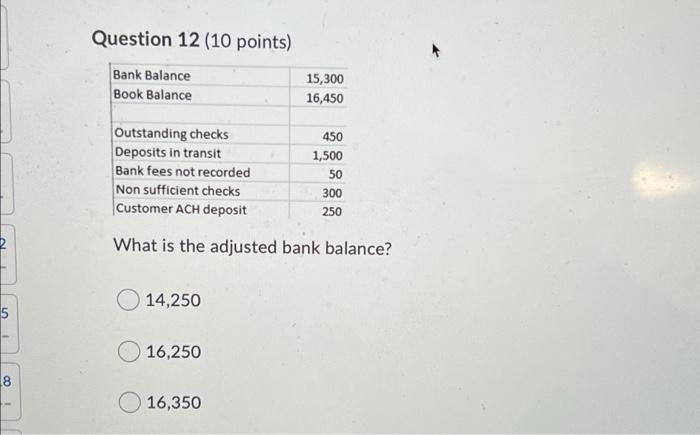

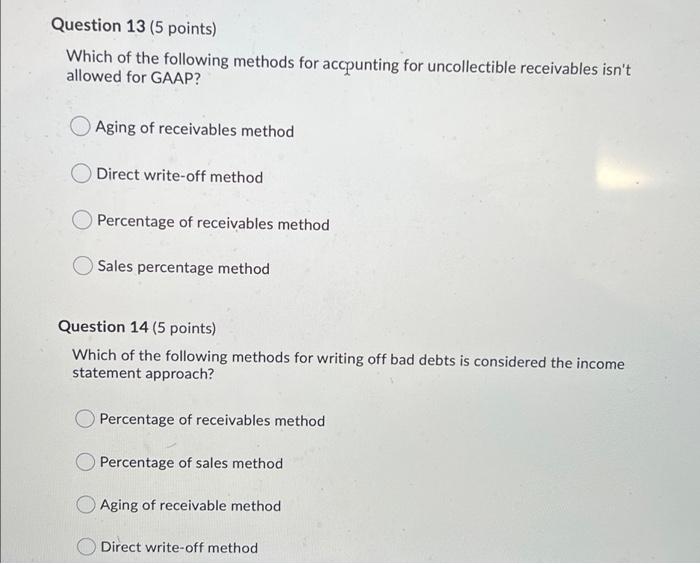

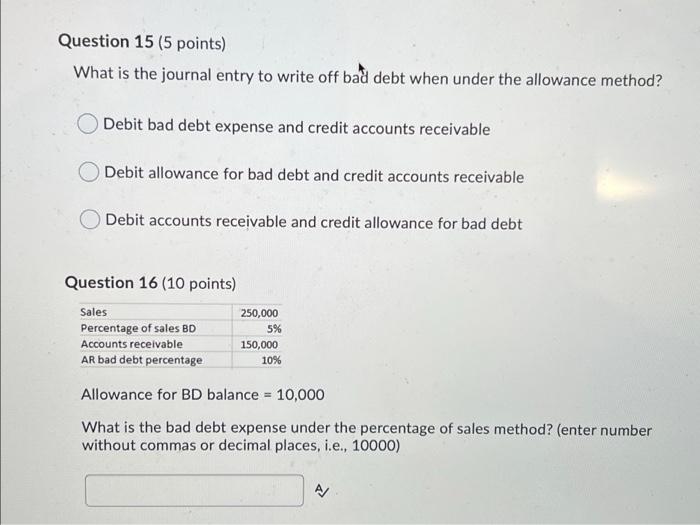

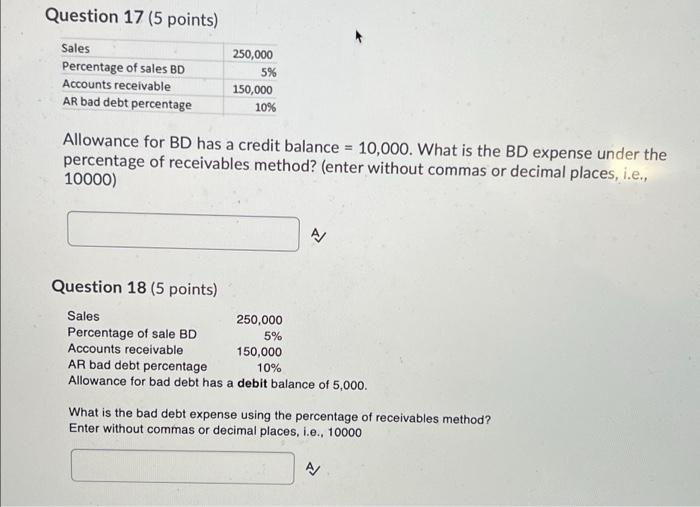

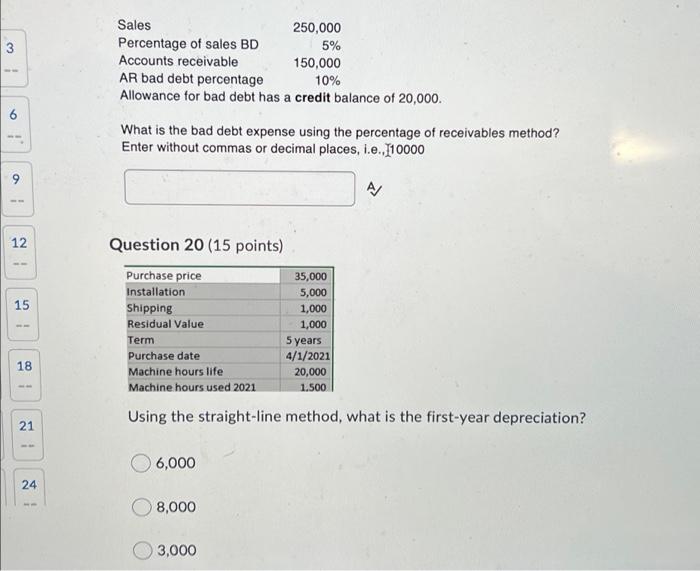

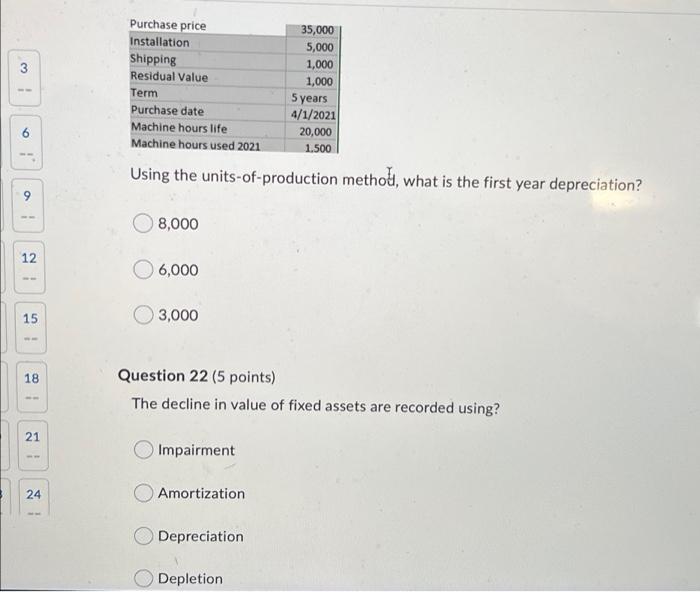

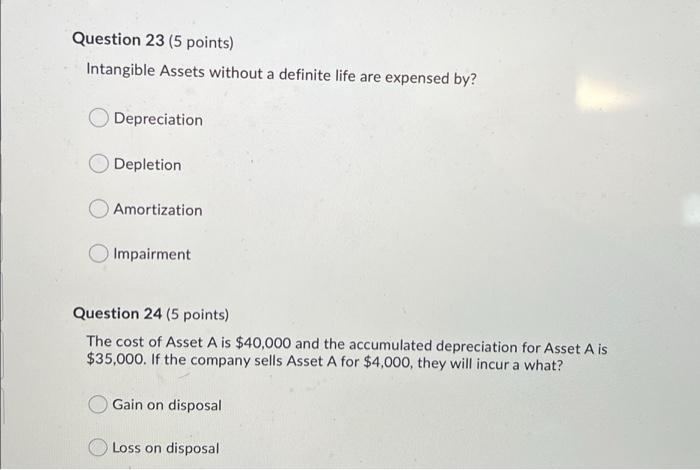

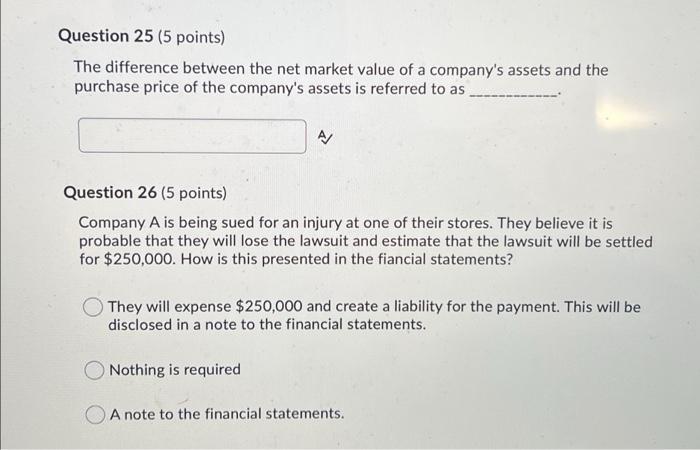

Question 1 (5 points) Sales 400,000 Cost of goods sold 250,000 Operating expenses 100,000 Interest expense 10,000 What is the gross profit? (format the answer as no decimal places and no commas, i.e. 10000) P Question 2 (5 points) Sales Cost of goods sold Operating expenses Interest expense 400,000 250,000 100,000 10,000 What is the gross profit percentage? (enter as a three decimal number, i.e. .111) A/ Question 3 (5 points) Sales Cost of goods sold Operating expenses Interest expense 400,000 250,000 100,000 10,000 What is net income? (enter as a number without decimals or commas, i.e., 10000) A/ Question 4 (5 points) Which inventory system requires monthly physical counts of inventory? Perpetual Periodic Question 5 (5 points) Purchases Returns Discounts Freight in Freight out 100,000 8,000 5,000 3,000 1,500 What is the net cost of inventory purchased? (enter as a number without decimals or commas, i.e., 10000) A/ Question 6 (5 points) Company A purchases $30,000 of inventory on account on March 1 with terms 3/10 net 30. If they pay the invoice on March 9, how much would they pay? 29,100 30,000 27,000 Question 7 (5 points) Company A purchases $30,000 of inventory on account on March 1 with terms 3/10 net 30. If they pay the invoice on March 11, how much would they pay? 30,000 27,000 29,100 5 - Question 8 (5 points) Which of the following are the terms for FOB destination? B Buyer takes ownership when the goods are shipped and seller pays the freight. 1 Buyer takes ownership when the goods are delivered and seller pays the freight. 24 Buyer takes ownership when the goods are shipped and buyer pays the freight. Buyer takes ownership when the goods are delivered and buyer pays the freight Question 9 (5 points) What is the term used to account for theft, breakage and other reasons for missing inventory? Question 10 (5 points) All of the following are goals of internal control except? Safeguard assets Penalize the CFO and CEO if there is financial fraud 1 Encourage employees to follow company policies 24 Promote operational efficiency Question 11 (5 points) What divides responsibilities between two or more people to limit fraud and promote accuracy of accounting records? Firewall Collusion Internal control Separation of duties Question 12 (10 points) Bank Balance Book Balance 15,300 16,450 Outstanding checks Deposits in transit Bank fees not recorded Non sufficient checks Customer ACH deposit 450 1,500 50 300 250 What is the adjusted bank balance? Question 12 (10 points) Bank Balance Book Balance 15,300 16,450 Outstanding checks Deposits in transit Bank fees not recorded Non sufficient checks Customer ACH deposit 450 1,500 50 300 250 2 What is the adjusted bank balance? 14,250 15 16,250 8 16,350 Question 13 (5 points) Which of the following methods for accpunting for uncollectible receivables isn't allowed for GAAP? Aging of receivables method Direct write-off method Percentage of receivables method Sales percentage method Question 14 (5 points) Which of the following methods for writing off bad debts is considered the income statement approach? Percentage of receivables method Percentage of sales method Aging of receivable method Direct write-off method Question 15 (5 points) What is the journal entry to write off bad debt when under the allowance method? Debit bad debt expense and credit accounts receivable Debit allowance for bad debt and credit accounts receivable Debit accounts receivable and credit allowance for bad debt Question 16 (10 points) Sales 250,000 Percentage of sales BD 5% Accounts receivable 150,000 AR bad debt percentage 10% Allowance for BD balance = 10,000 What is the bad debt expense under the percentage of sales method? (enter number without commas or decimal places, i.e., 10000) A/ Question 17 (5 points) Sales Percentage of sales BD Accounts receivable AR bad debt percentage 250,000 5% 150,000 10% Allowance for BD has a credit balance = 10,000. What is the BD expense under the percentage of receivables method? (enter without commas or decimal places, i.e., 10000) A/ Question 18 (5 points) Sales 250,000 Percentage of sale BD 5% Accounts receivable 150,000 AR bad debt percentage 10% Allowance for bad debt has a debit balance of 5,000. What is the bad debt expense using the percentage of receivables method? Enter without commas or decimal places, i.e., 10000 A/ 3 Sales 250,000 Percentage of sales BD 5% Accounts receivable 150,000 AR bad debt percentage 10% Allowance for bad debt has a credit balance of 20,000. 6 - What is the bad debt expense using the percentage of receivables method? Enter without commas or decimal places, i.e., [10000 9 12 -- 15 -- Question 20 (15 points) Purchase price 35,000 Installation 5,000 Shipping 1,000 Residual Value 1,000 Term 5 years Purchase date 4/1/2021 Machine hours life 20,000 Machine hours used 2021 Using the straight-line method, what is the first-year depreciation? 18 -- 1.500 21 6,000 24 8,000 3,000 2 Purchase price 35,000 Installation 5,000 Shipping 1,000 Residual Value 1,000 Term 5 years Purchase date 4/1/2021 Machine hours life 20,000 Machine hours used 2021 1.500 Using the units-of-production method, what is the first year depreciation? 6 . 9 8,000 12 -- 6,000 15 3,000 18 Question 22 (5 points) The decline in value of fixed assets are recorded using? I 21 Impairment 24 -- Amortization Depreciation Depletion Question 23 (5 points) Intangible Assets without a definite life are expensed by? Depreciation Depletion Amortization Impairment Question 24 (5 points) The cost of Asset A is $40,000 and the accumulated depreciation for Asset Ais $35,000. If the company sells Asset A for $4,000, they will incur a what? Gain on disposal Loss on disposal Question 25 (5 points) The difference between the net market value of a company's assets and the purchase price of the company's assets is referred to as Question 26 (5 points) Company A is being sued for an injury at one of their stores. They believe it is probable that they will lose the lawsuit and estimate that the lawsuit will be settled for $250,000. How is this presented in the fiancial statements? They will expense $250,000 and create a liability for the payment. This will be disclosed in a note to the financial statements. Nothing is required A note to the financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started