Please I need the answers for these questions ASAP It is due in half an hour

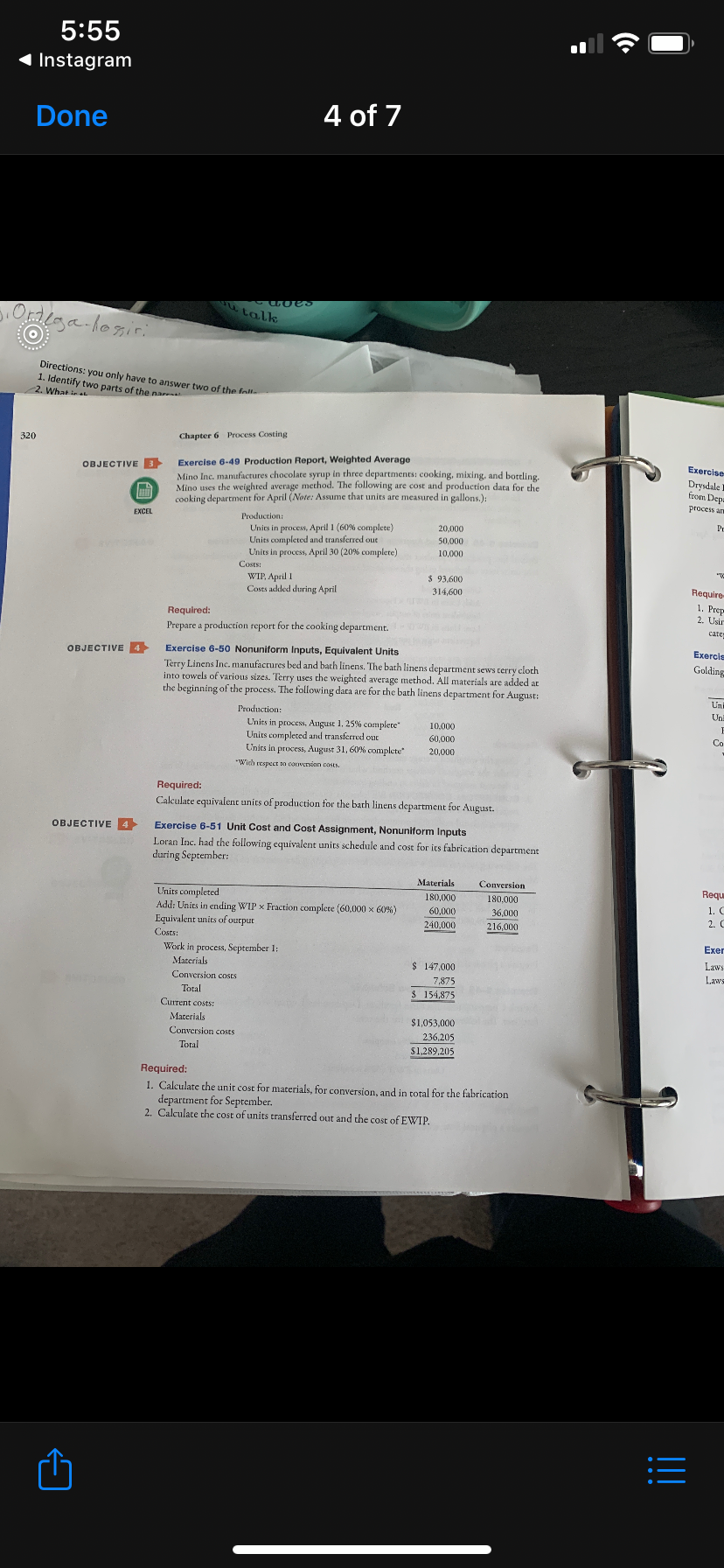

5:55 Instagram Done 4 of 7 . woes u talk Directions: you only have to answer two of the fall- 1. Identify two parts of the narests 2. What in AL 320 Chapter 6 Process Costing OBJECTIVE E Exercise 6-49 Production Report, Weighted Average Exercise Mino Inc. manufactures chocolate syrup in three departments: cooking, mixing, and bottling. Mino uses the weighted average method. The following are cost and production data for the Drysdale cooking department for April (Note: Assume that units are measured in gallons.): from Dep process EXCEL Production: Units in process, April 1 (60% complete) 20,000 Units completed and transferred out 50,000 Units in process, April 30 (20% complete) 10,000 Costs: WIP, April 1 $ 93.600 Costs added during April 314,600 Require 1. Prep Required: 2. Usin Prepare a production report for the cooking department. care OBJECTIVE 4 Exercise 6-50 Nonuniform Inputs, Equivalent Units Exercis Terry Linens Inc. manufactures bed and bath linens. The bath linens department sews terry cloth Golding into towels of various sizes. Terry uses the weighted average method. All materials are added ac the beginning of the process, The following dara are for the bath linens department for August: Production: Units in process, August 1, 25% complete" 10,000 Units completed and transferred our 60,000 Units in process, August 31, 60% complete" 20,000 With respect to conversion costs. Required: Calculate equivalent units of production for the bach linens department for August. OBJECTIVE 4 Exercise 6-51 Unit Cost and Cost Assignment, Nonuniform Inputs Loran Inc. had the following equivalent units schedule and cost for its fabrication department during September: Materials Conversion Units completed 180,000 180,000 Requ Add: Units in ending WIP x Fraction complete (60,000 x 60%) 60,000 36,000 Equivalent units of ourpu 240,000 216,000 Costs: Work in process, September 1: Exer Materials $ 147,000 Laws Conversion costs 7.875 Laws Total 3 154,875 Current costs: Materials $ 1,053,000 Conversion costs 236,205 Total $1,289,205 Required: 1. Calculate the unit cost for materials, for conversion, and in total for the fabrication department for September. 2. Calculate the cost of units transferred out and the cost of EWIP. E