Answered step by step

Verified Expert Solution

Question

1 Approved Answer

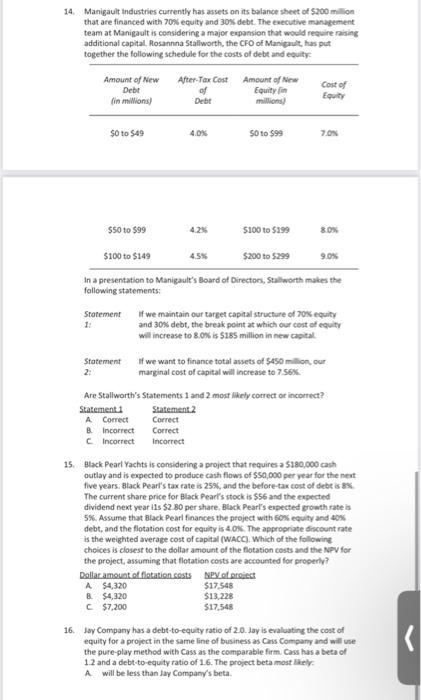

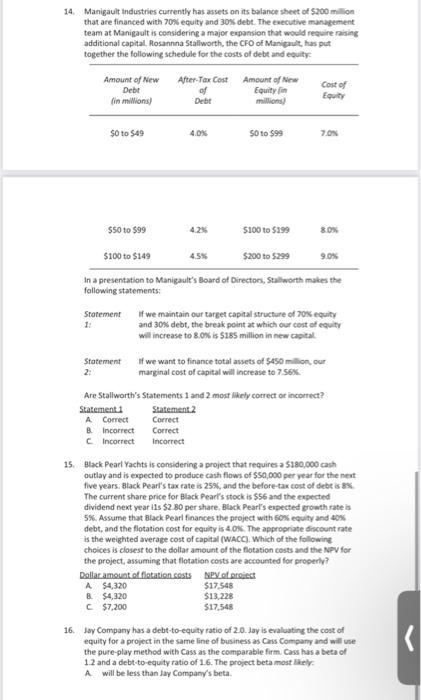

please I need the method how you find the answer. 14. Manigault Industries currently has assets on its balance sheet of $200 million that are

please I need the method how you find the answer.

14. Manigault Industries currently has assets on its balance sheet of $200 million that are financed with 70% equity and 30% debt. The executive management team at Manigault is considering a major expansion that would require raising additional capital, Rosannna Stallworth, the CFO of Manigault has put together the following schedule for the costs of debt and equity Amount of New Debt fin milions) After Tax Cost of Amount of New Equity in millions Cost of Equity Debt $0 to 549 4.0 So to 999 7.03 $50 to $99 $100 to $199 8.0% 4.5% $100 to $149 $200 to $299 9.0% In a presentation to Manigaul's Board of Directores, Stallworth makes the following statements: Statement if we maintain our target capital structure of 70% equity and 30% debt, the break point at which our cost of equity will increase to 8.0% is $185 million in new capital Statement if we want to finance total assets of $450 million, our 2: marginal cost of capital will increase to 7.56% Are Stallworth's Statements 1 and 2 most ikely correct or incorrect? Statement Statement 2 A Correct Correct B Incorrect Correct Incorrect Incorrect 15. Black Pearl Yachts is considering a project that requires a $180,000 cash outlay and is expected to produce cash flows of $50,000 per year for the next five years. Black Pearl's tax rate is 25%, and the before-tax cost of debts 8% The current share price for Black Pearl's stock is $56 and the expected dividend next year ils $2.80 per share. Black Pearl's expected growth rate is 5%. Assume that Black Pearl finances the project with 50% equity and 40% debt, and the flotation cost for equity is 40%. The appropriate discount rate is the weighted average cost of capital (WACC), Which of the following choices is closest to the dollar amount of the flotation costs and the NPV for the project, assuming that flotation costs are accounted for properly? Dollar amount of flotation costs NPV al proiect A $4,320 $17,548 & $4,320 $13,228 $7,200 517,548

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started