Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need the work, please. thank you $13.320 Assessing Financial Statement Effects of Transactions and Adjustments Selected accounts of Piotroski Properties, a real estate

please I need the work, please. thank you

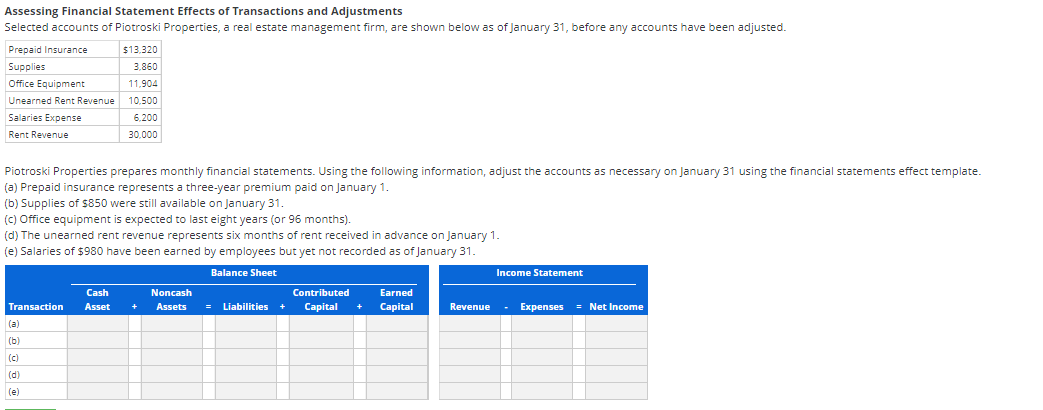

$13.320 Assessing Financial Statement Effects of Transactions and Adjustments Selected accounts of Piotroski Properties, a real estate management firm, are shown below as of January 31, before any accounts have been adjusted. Prepaid Insurance Supplies 3,860 Office Equipment 11.904 Unearned Rent Revenue 10.500 Salaries Expense 6.200 Rent Revenue 30,000 Piotroski Properties prepares monthly financial statements. Using the following information, adjust the accounts as necessary on January 31 using the financial statements effect template. (a) Prepaid insurance represents a three-year premium paid on January 1. (b) Supplies of $850 were still available on January 31. (c) Office equipment is expected to last eight years (or 96 months). (d) The unearned rent revenue represents six months of rent received in advance on January 1. (e) Salaries of $980 have been earned by employees but yet not recorded as of January 31. Balance Sheet Income Statement Cash Asset Noncash Assets Contributed Capital Earned Capital Transaction + = Liabilities + + Revenue Expenses = Net Income (b) (c) (d) (e)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started