Answered step by step

Verified Expert Solution

Question

1 Approved Answer

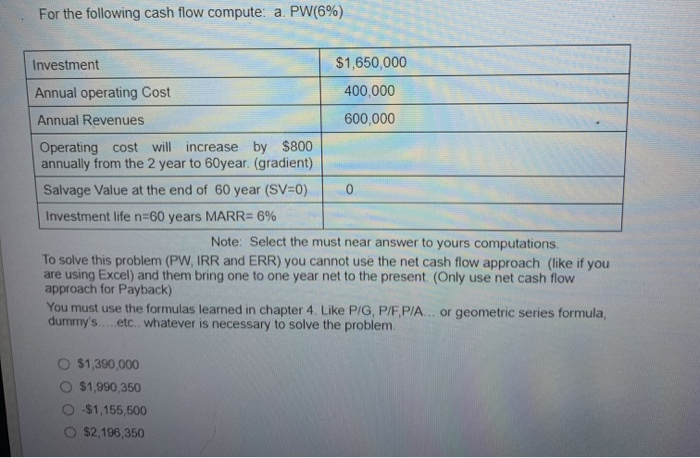

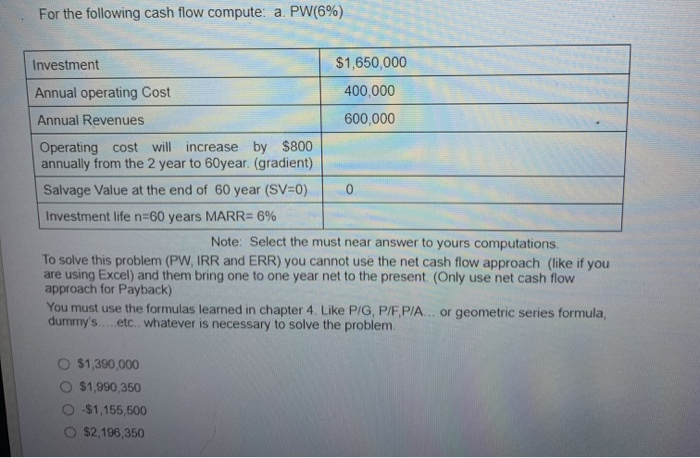

PLEASE I NEED THIS ASAO use formulas necessary to solve the problem For the following cash flow compute: a. PW(6%) Investment $1,650,000 Annual operating Cost

PLEASE I NEED THIS ASAO

use formulas necessary to solve the problem

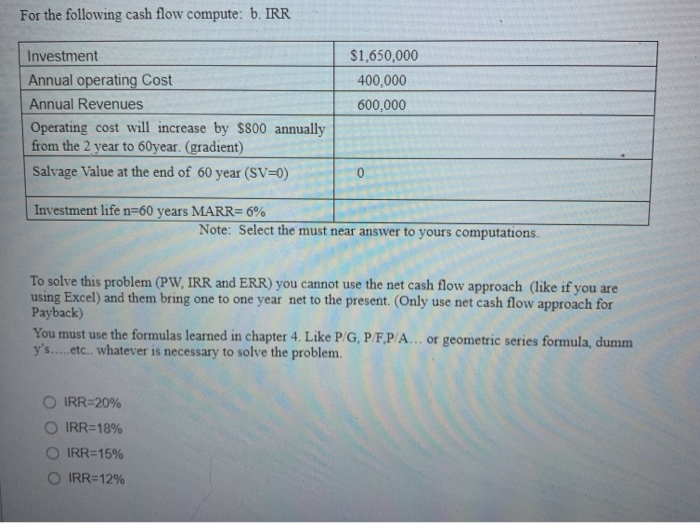

For the following cash flow compute: a. PW(6%) Investment $1,650,000 Annual operating Cost 400,000 Annual Revenues 600,000 Operating cost will increase by $800 annually from the 2 year to 60year. (gradient) Salvage Value at the end of 60 year (SV=0) 0 Investment life n=60 years MARR= 6% Note: Select the must near answer to yours computations To solve this problem (PW, IRR and ERR) you cannot use the net cash flow approach (like if you are using Excel) and them bring one to one year net to the present (Only use net cash flow approach for Payback) You must use the formulas learned in chapter 4. Like PIG, P/FP/A... or geometric series formula, dummy's...etc. whatever is necessary to solve the problem O $1,390,000 O $1,990,350 -$1,155,500 O $2,196,350 For the following cash flow compute: 6. IRR $1,650,000 400,000 600,000 Investment Annual operating Cost Annual Revenues Operating cost will increase by $800 annually from the 2 year to 60year. (gradient) Salvage Value at the end of 60 year (SV=0) 0 Investment life n=60 years MARR= 6% Note: Select the must near answer to yours computations. To solve this problem (PW, IRR and ERR) you cannot use the net cash flow approach (like if you are using Excel) and them bring one to one year net to the present. (Only use net cash flow approach for Payback) You must use the formulas learned in chapter 4. Like PG, P/FP/A... or geometric series formula, dumm y's.....etc.. whatever is necessary to solve the problem. IRR=20% O IRR=18% IRR=15% O IRR=12% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started