Question

Please, i need Unique answer, Use your own words (don't copy and paste). *Please, don't use handwriting. Course: Advanced Financial Accounting Q1. Explain the term

Please, i need Unique answer, Use your own words (don't copy and paste).

*Please, don't use handwriting.

Course: Advanced Financial Accounting

Q1. Explain the term Acquisition and investments in intercorporate Entities.

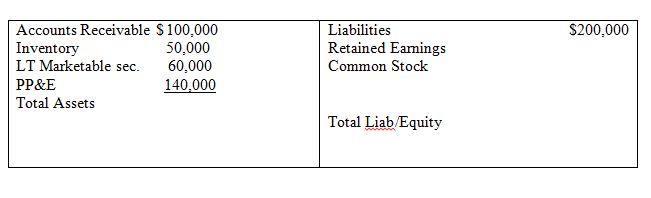

Q2. X Inc. acquired 100% of the outstanding common stock of Y Inc. for $250,000 cash and 20,000 shares of its own common stock ($5 par value), which was trading at $10 per share at the acquisition date. The estimated fair market values of assets, liabilities, and equity accounts of Y. Inc are as follows:

Require:

- Calculate Acquisition cost of X.Inc

- Calculate Good will of X.Inc

- Pass journal entry in books of X. Inc

Q3. SALMAN Company acquires 60 percent of HAMAD Companys common stock for $200,000 at the beginning of the year and gains significant influence over HAMAD. During the year, HAMAD has net income of $40,000 and pays dividends of $30,000.

Required: prepare the journal entries in books of SALMAN company under the Equity and Cost Method

Q4. From the Given information Calculate the Book Value and pass Basic Elimination entry :

- PQR Ltd owns 100% of STV Ltd.

- STV Ltd s net income for 20X4 is SAR 250,000

- STV Ltds declares dividends of SAR 36,000 during 20X4.

- STV Ltd has 20,000 shares of $5 par stock outstanding that were originally issued at $15 per share.

- STV Ltds beginning balance in Retained Earnings for 20X4 is SAR 150,000

Q5. How are direct combination costs, contingent consideration, and a bargain purchase reflected in recording an acquisition transaction?

$200,000 Accounts Receivable $100,000 Inventory LT Marketable sec. 60,000 PP&E Total Assets Liabilities 50,000 Retained Eamings Common Stock 140,000 Total Liab/Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started