Answered step by step

Verified Expert Solution

Question

1 Approved Answer

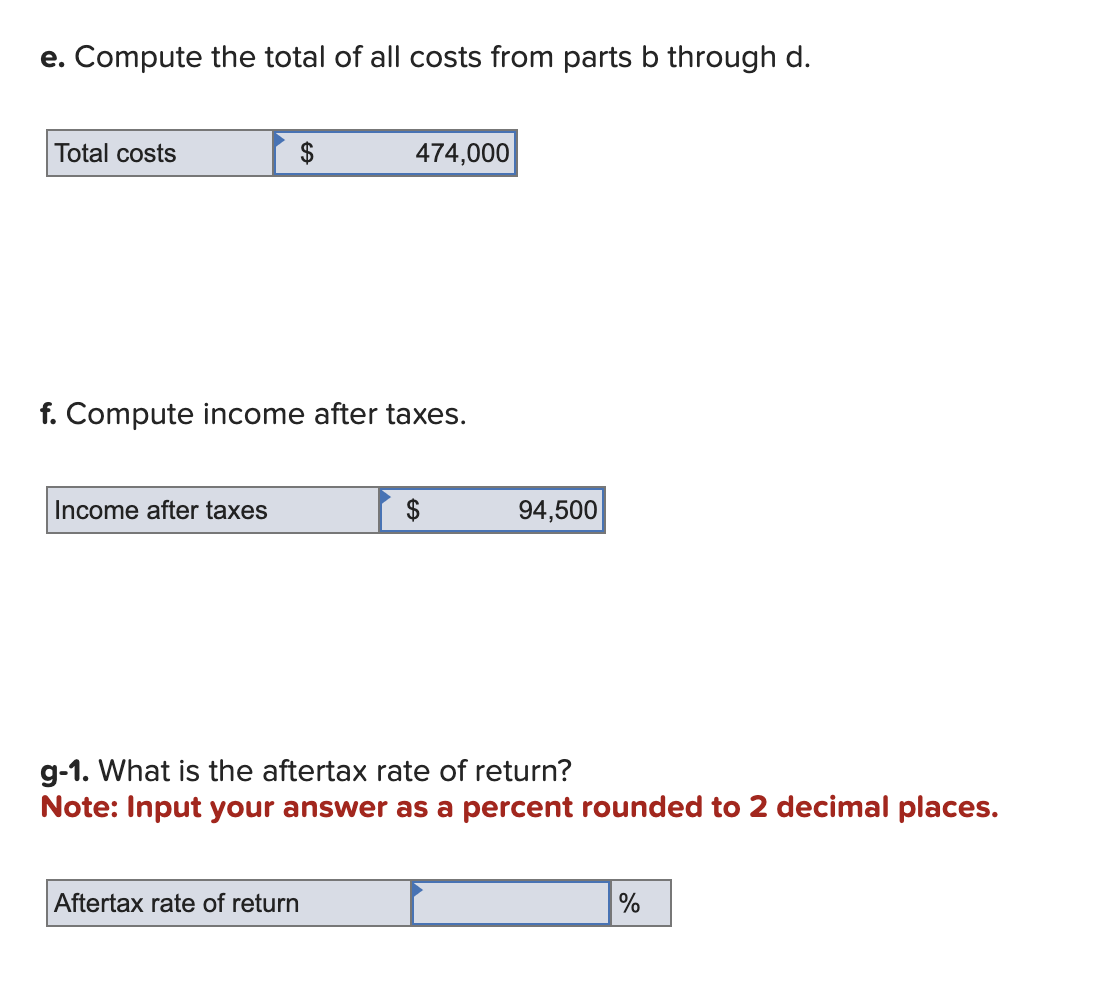

Please, I only need help with g-1. I already posted this question and the result was wrong. The answer is not 15.75%. c. Compute the

Please, I only need help with g-1. I already posted this question and the result was wrong. The answer is not 15.75%.

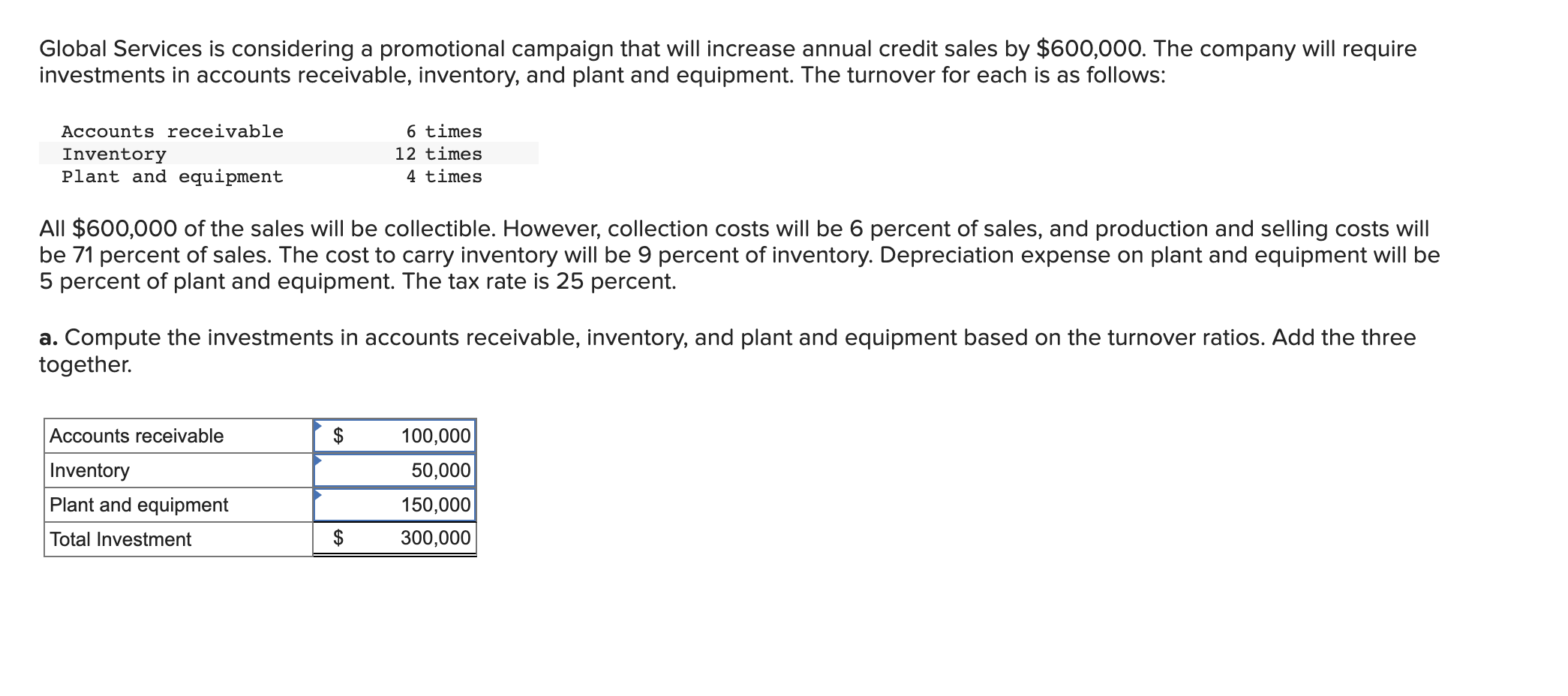

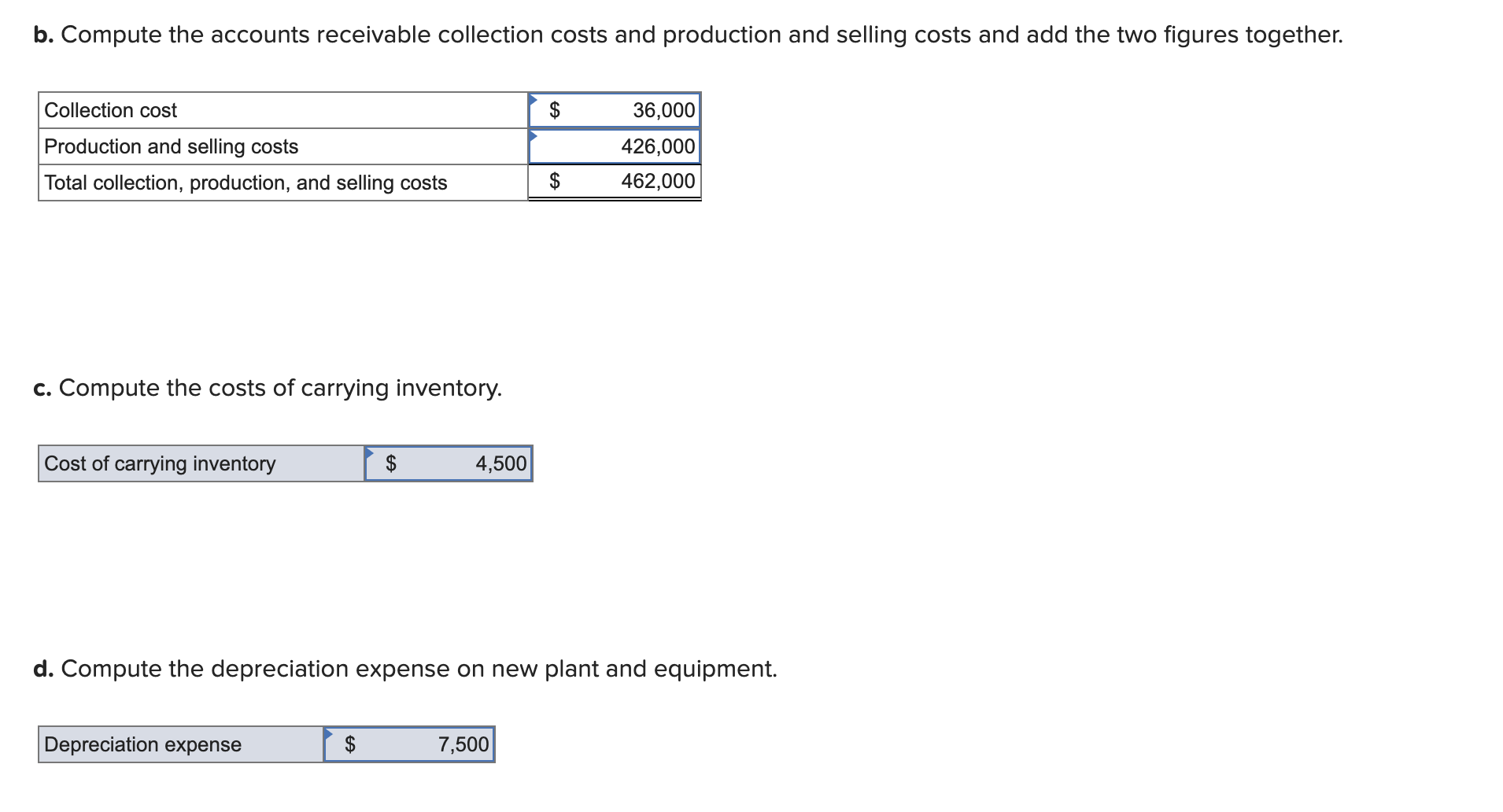

c. Compute the costs of carrying inventory. d. Compute the depreciation expense on new plant and equipment. Global Services is considering a promotional campaign that will increase annual credit sales by $600,000. The company will require investments in accounts receivable, inventory, and plant and equipment. The turnover for each is as follows: All $600,000 of the sales will be collectible. However, collection costs will be 6 percent of sales, and production and selling costs will be 71 percent of sales. The cost to carry inventory will be 9 percent of inventory. Depreciation expense on plant and equipment will be 5 percent of plant and equipment. The tax rate is 25 percent. a. Compute the investments in accounts receivable, inventory, and plant and equipment based on the turnover ratios. Add the three together. e. Compute the total of all costs from parts b through d. Total costs f. Compute income after taxes. g-1. What is the aftertax rate of return? Note: Input your answer as a percent rounded to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started