Please i really need help with this assignment.

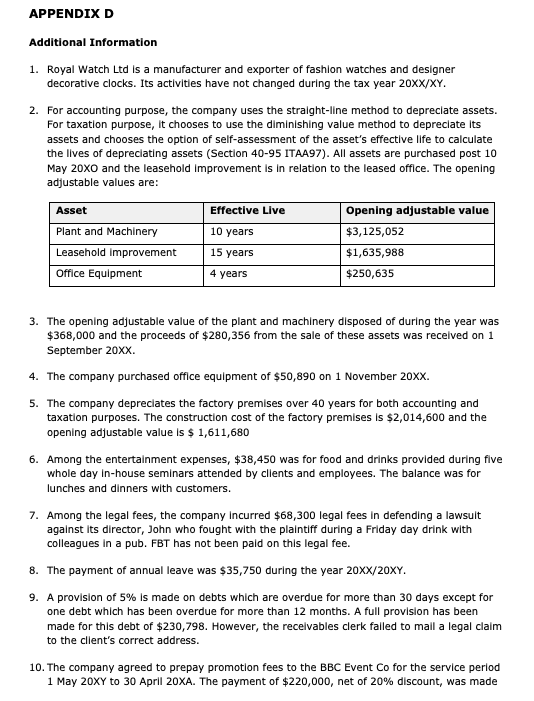

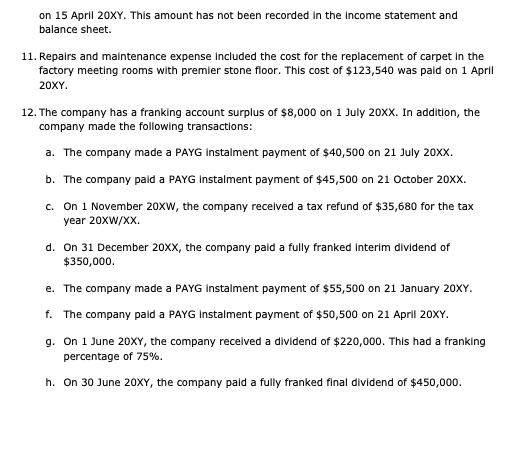

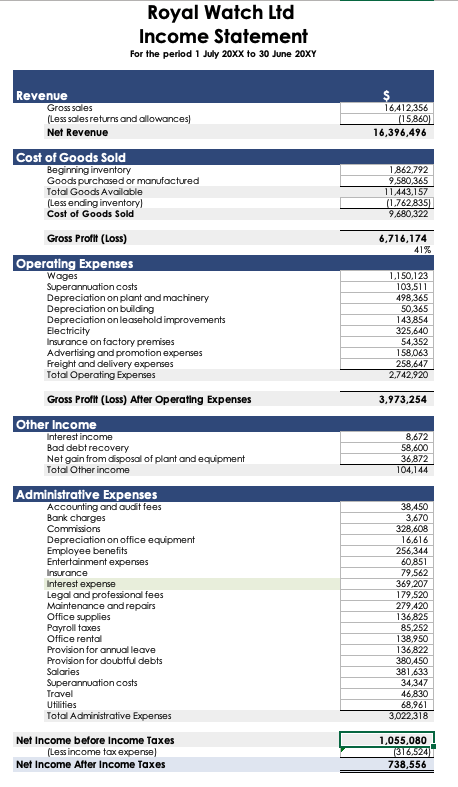

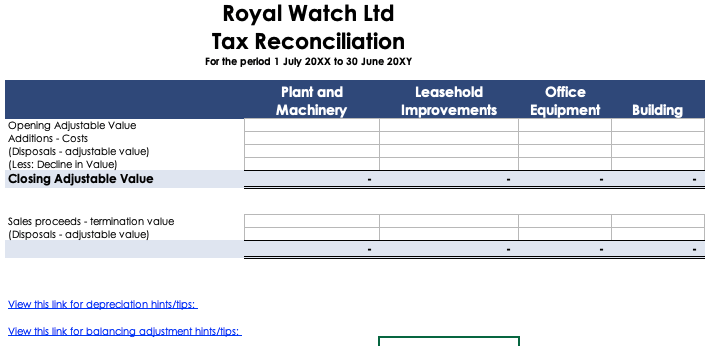

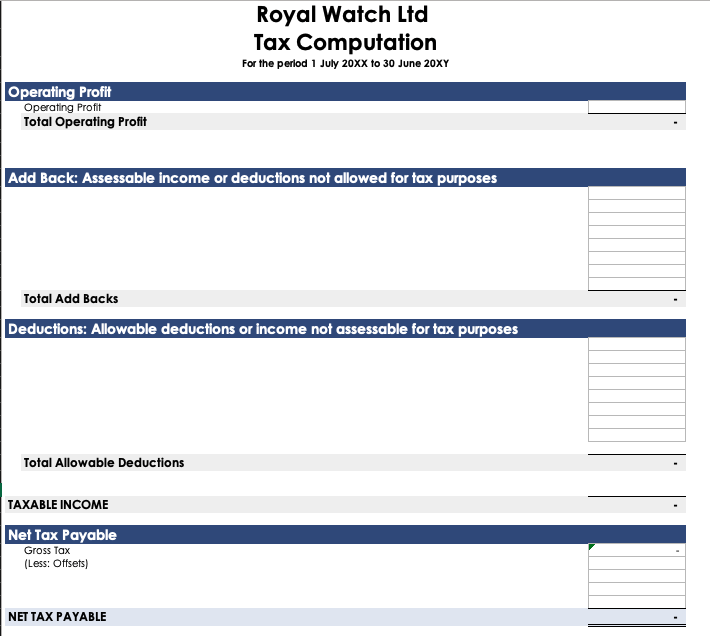

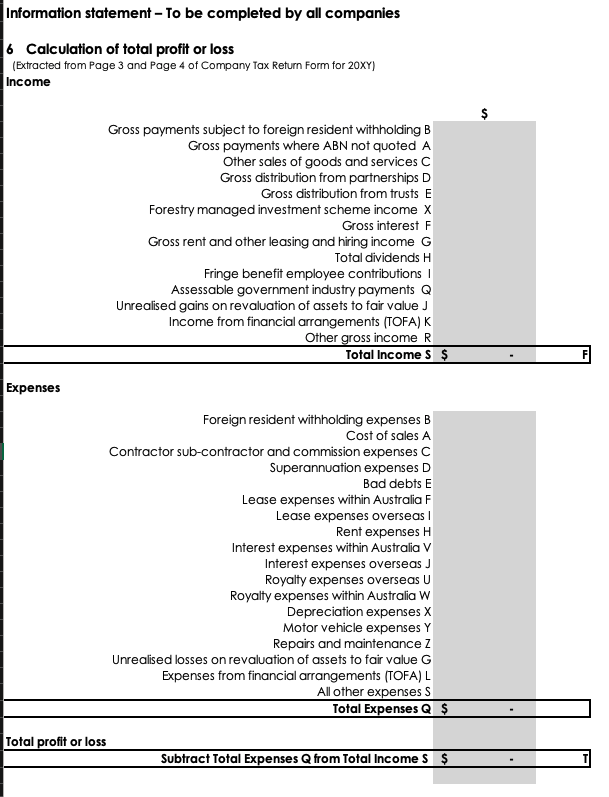

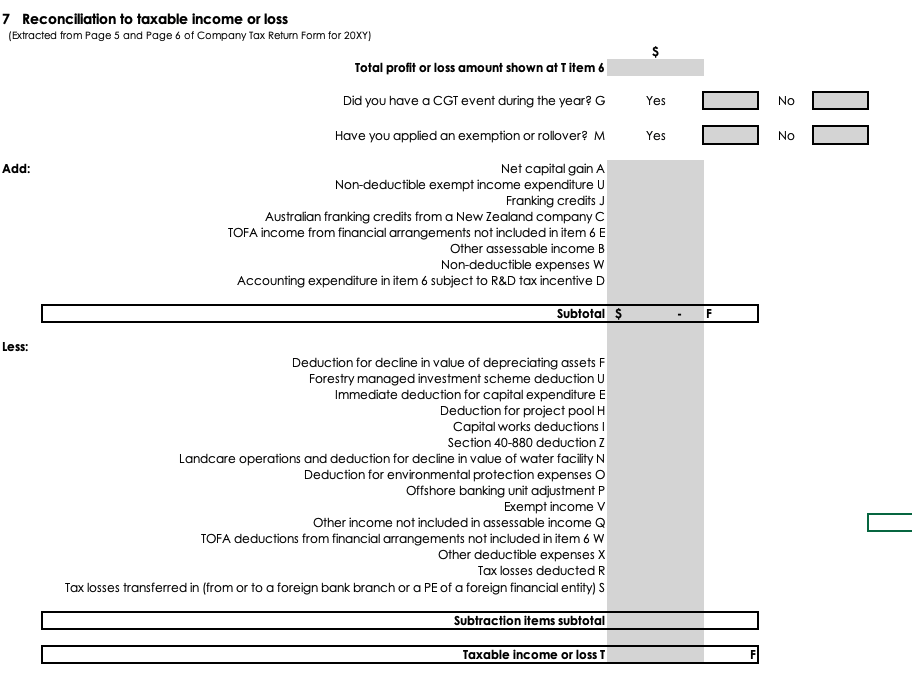

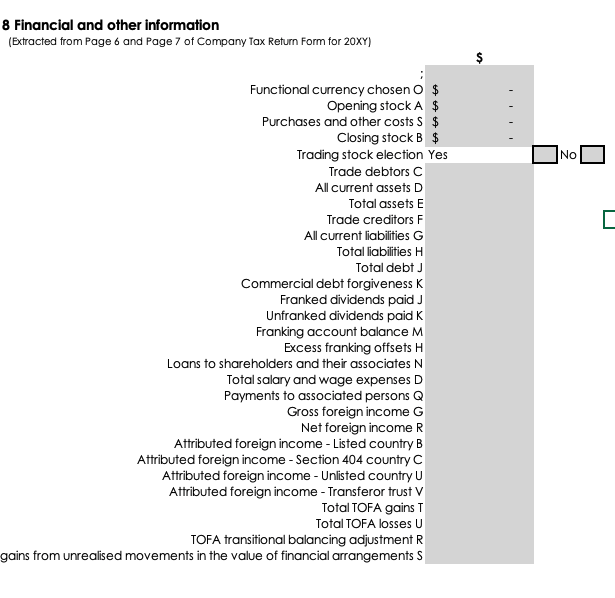

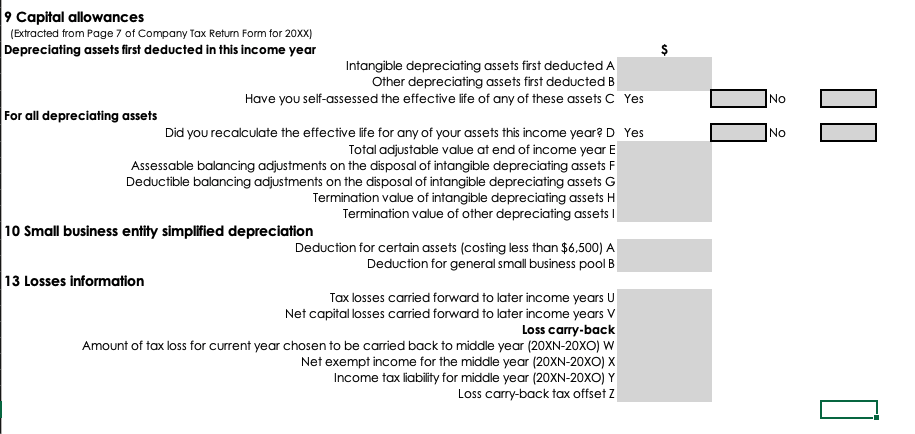

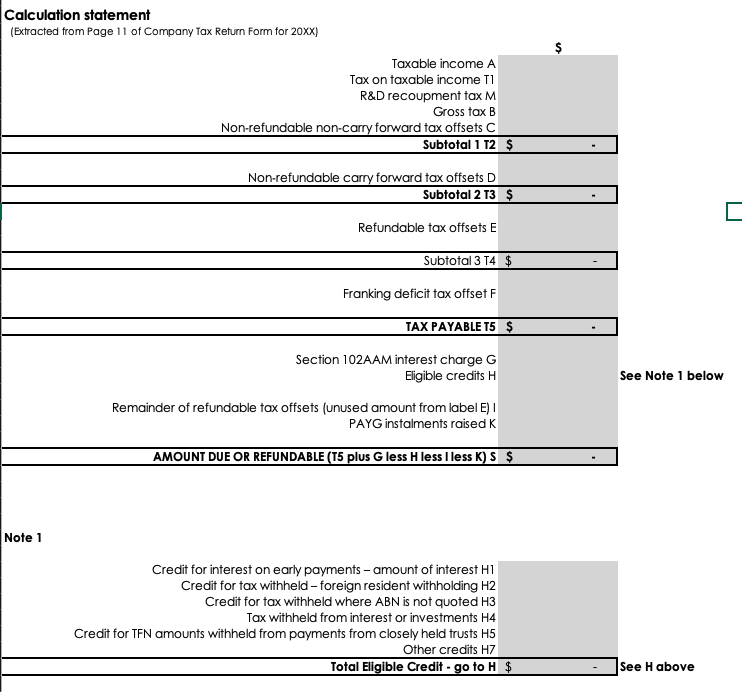

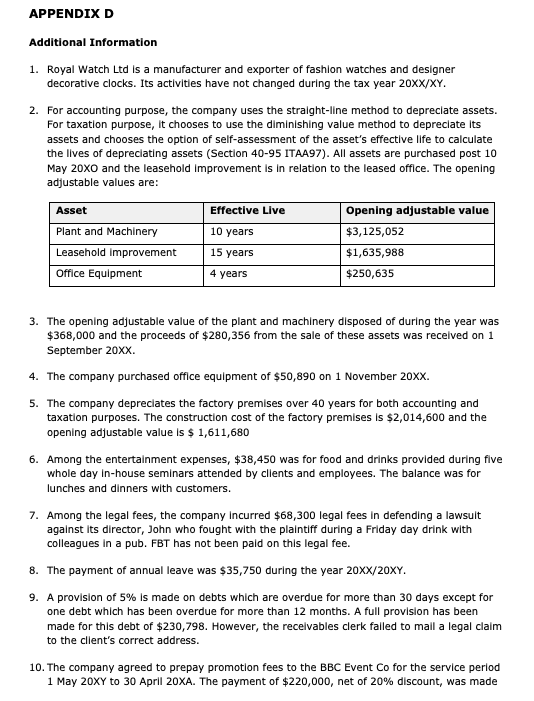

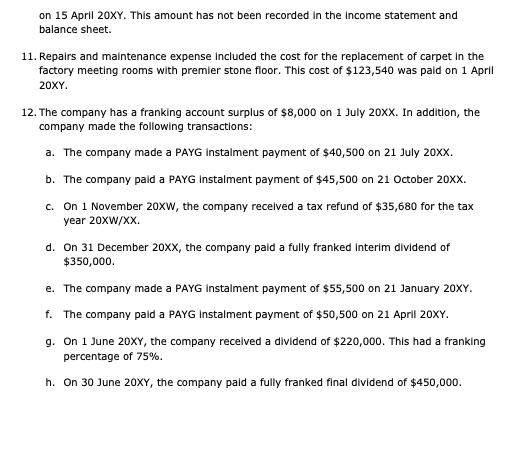

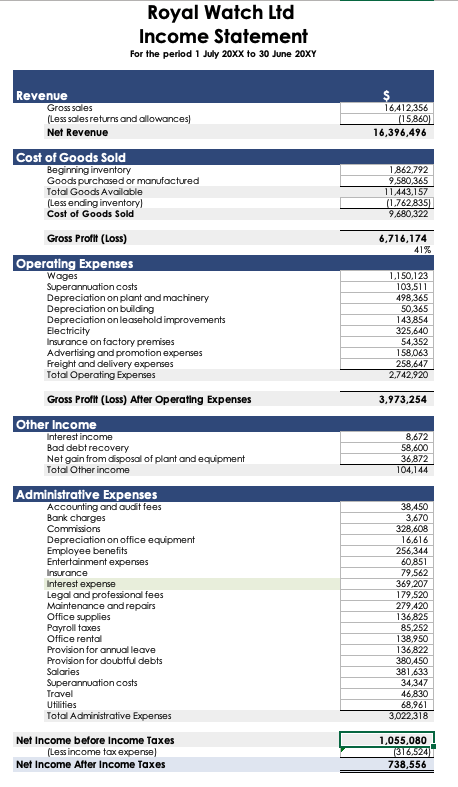

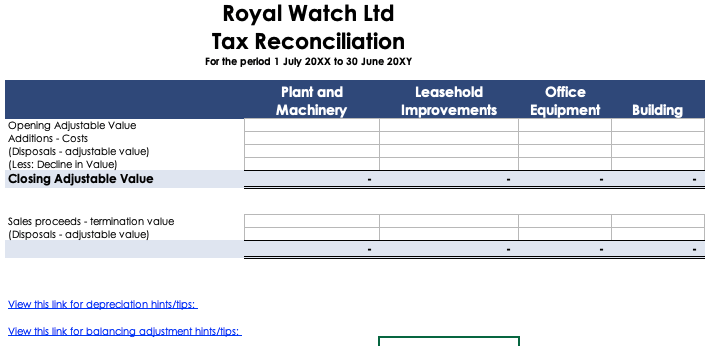

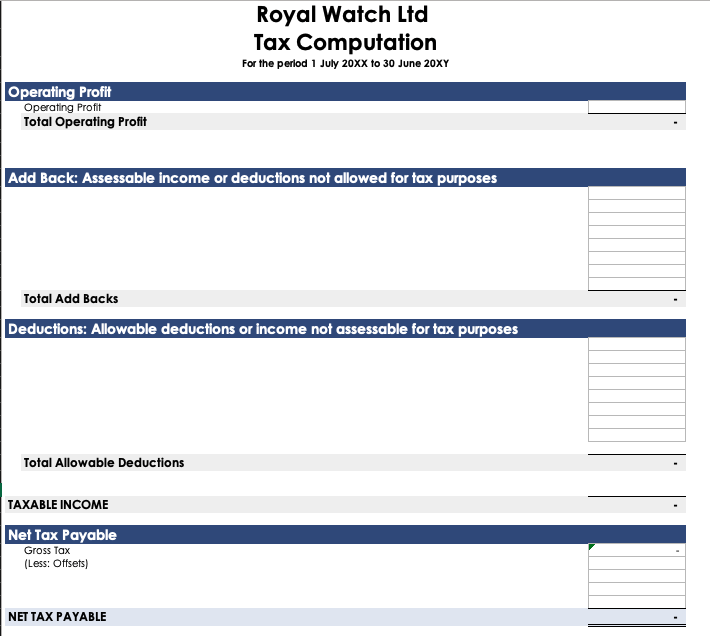

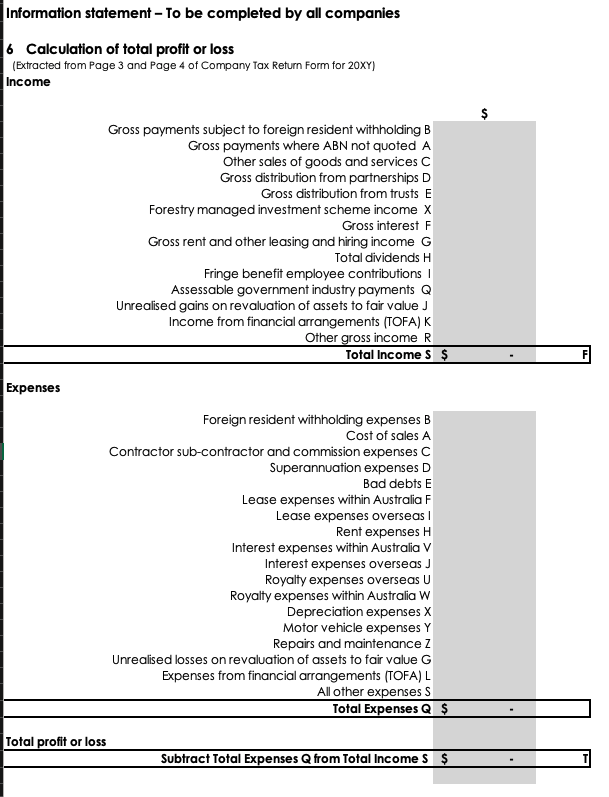

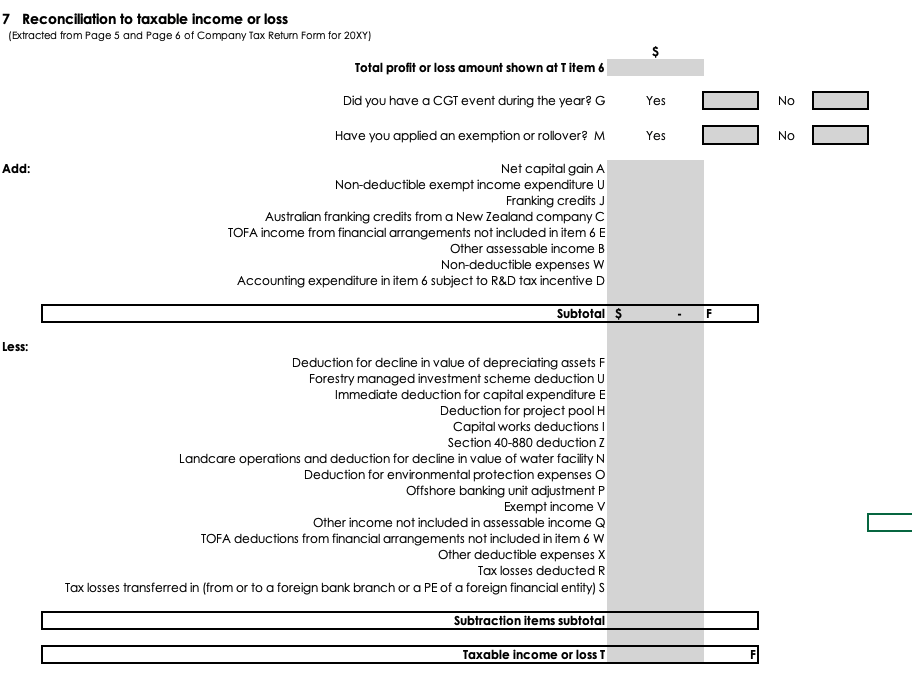

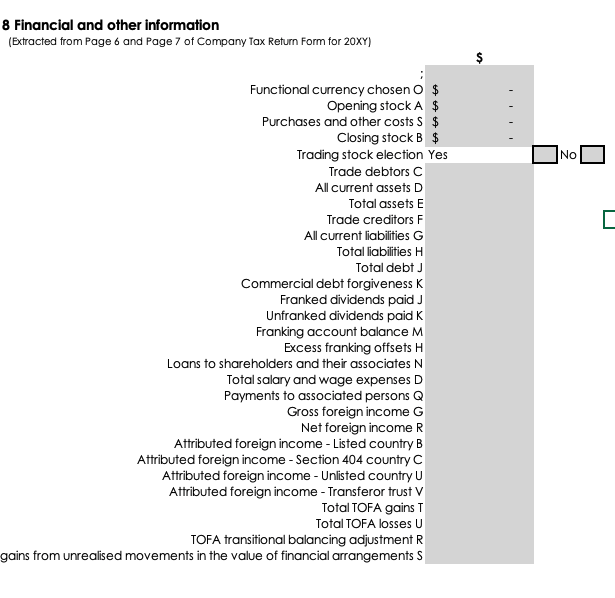

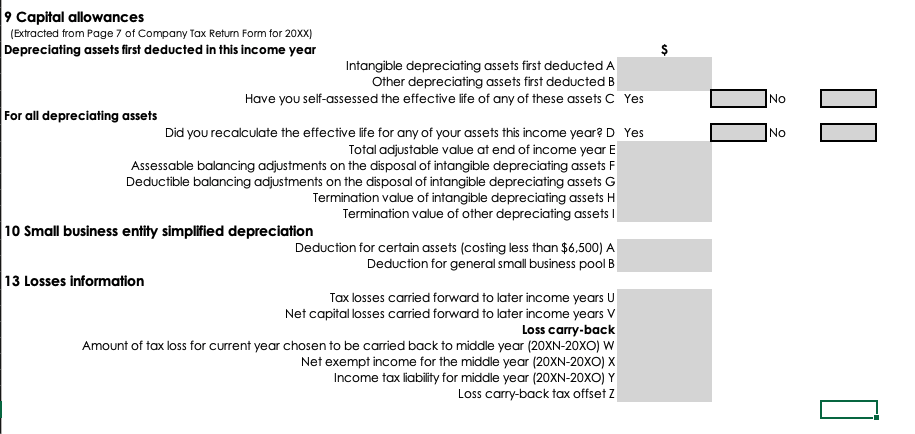

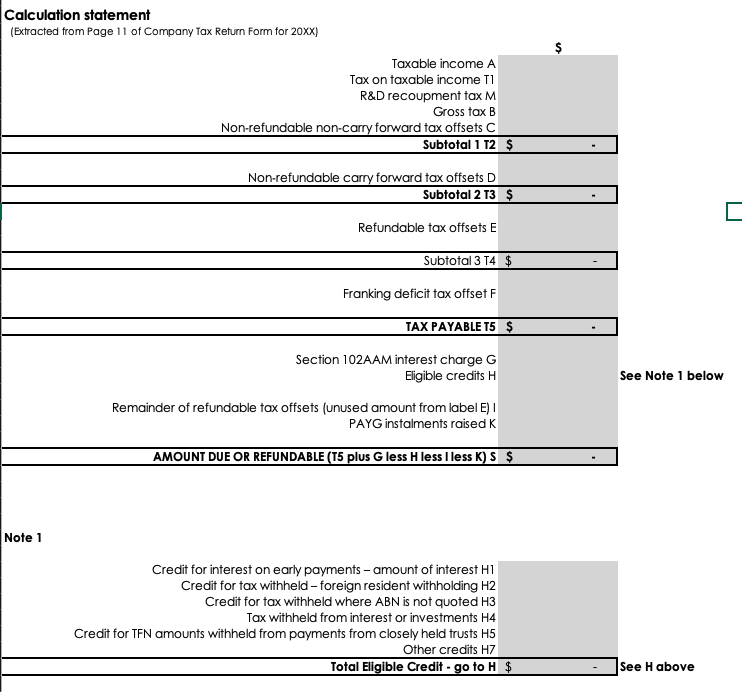

APPENDIX D Additional Information 1. Royal Watch Ltd is a manufacturer and exporter of fashion watches and designer decorative clocks. Its activities have not changed during the tax year 20xX/XY. 2. For accounting purpose, the company uses the straight-line method to depreciate assets. For taxation purpose, it chooses to use the diminishing value method to depreciate its assets and chooses the option of self-assessment of the asset's effective life to calculate the lives of depreciating assets (Section 40-95 ITAA97). All assets are purchased post 10 May 20X0 and the leasehold Improvement is in relation to the leased office. The opening adjustable values are: Asset Effective Live Opening adjustable value Plant and Machinery 10 years $3,125,052 Leasehold improvement $1,635,988 15 years 4 years Office Equipment $250,635 3. The opening adjustable value of the plant and machinery disposed of during the year was $368,000 and the proceeds of $280,356 from the sale of these assets was received on 1 September 20xx. 4. The company purchased office equipment of $50,890 on 1 November 20XX. 5. The company depreciates the factory premises over 40 years for both accounting and taxation purposes. The construction cost of the factory premises is $2,014,600 and the opening adjustable value is $ 1,611,680 6. Among the entertainment expenses, $38,450 was for food and drinks provided during five whole day in-house seminars attended by clients and employees. The balance was for lunches and dinners with customers. 7. Among the legal fees, the company incurred $68,300 legal fees in defending a lawsult against its director, John who fought with the plaintiff during a Friday day drink with colleagues in a pub. FBT has not been paid on this legal fee. 8. The payment of annual leave was $35,750 during the year 20xX/20XY. 9. A provision of 5% is made on debts which are overdue for more than 30 days except for one debt which has been overdue for more than 12 months. A full provision has been made for this debt of $230,798. However, the recelvables clerk falled to mail a legal claim to the client's correct address. 10. The company agreed to prepay promotion fees to the BBC Event Co for the service period 1 May 20XY to 30 April 20XA. The payment of $220,000, net of 20% discount, was made on 15 April 20xY. This amount has not been recorded in the income statement and balance sheet. 11. Repairs and maintenance expense Included the cost for the replacement of carpet in the factory meeting rooms with premier stone floor. This cost of $123,540 was paid on 1 April 20XY. 12. The company has a franking account surplus of $8,000 on 1 July 20XX. In addition, the company made the following transactions: a. The company made a PAYG Instalment payment of $40,500 on 21 July 20xx. b. The company paid a PAYG Instalment payment of $45,500 on 21 October 20xx. c. On 1 November 20xw, the company received a tax refund of $35,680 for the tax year 20X/XX. d. On 31 December 20XX, the company paid a fully franked Interim dividend of $350,000. e. The company made a PAYG Instalment payment of $55,500 on 21 January 20xY. f. The company paid a PAYG Instalment payment of $50,500 on 21 April 20xY. g. On 1 June 20xY, the company received a dividend of $220,000. This had a franking percentage of 75%. h. On 30 June 20xY, the company paid a fully franked final dividend of $450,000. Royal Watch Ltd Income Statement For the period 1 July 20XX to 30 June 20XY Revenue Gross sales (Less sales returns and allowances) Net Revenue 16,412,356 (15.860) 16,396,496 Cost of Goods Sold Beginning inventory Goods purchased or manufactured Total Goods Available (Less ending inventory] 1862.792 9.580,365 11.443,157 (1.762.835) 9,680,322 Cost of Goods Sold Gross Profit (Loss) 6,716,174 41% Operating Expenses Wages Superannuation costs Depreciation on plant and machinery Depreciation on building Depreciation on leasehold improvements Electricity Insurance on factory premises Advertising and promotion expenses Freight and delivery expenses Total Operating Expenses 1.150.123 103,511 498,365 50.365 143,854 325,640 54.352 158,063 258,647 2.742.920 Gross Profit (Loss) After Operating Expenses 3,973,254 Other Income Interest income Bod debt recovery Net gain from disposal of plant and equipment Total Other income 8.672 58,600 36872 104,144 Administrative Expenses Accounting and audit fees Bank charges Commissions Depreciation on office equipment Employee benefits Entertainment expenses Insurance Interest expense Legal and professional fees Maintenance and repairs Office supplies Payroll taxes Office rental Provision for annual leave Provision for doubtful debts Salaries Superannuation costs Travel Utilities Total Administrative Expenses 38,450 3.670 328,608 16.616 256,344 60,851 79,562 369,207 179,520 279 420 136,825 85.252 138,950 136,822 380,450 381.633 34.347 46,830 68.961 3,022,318 Net Income before Income Taxes (Less income tax expense) Net Income After Income Taxes 1,055,080 1316.5201 738,556 Royal Watch Ltd Tax Reconciliation For the period 1 July 20XX to 30 June 20XY Plant and Machinery Leasehold Improvements Office Equipment Building Opening Adjustable Value Additions - Costs (Disposals - adjustable value) (Less: Decline in Value) Closing Adjustable Value Sales proceeds - termination value (Disposals. adjustable value) View this link for depreciation hints/tips: View this link for balancing adjustment hints/tips View this link for Franking Account Information View this link for Franking Deficit Tax Offset Information Royal Watch Ltd Franking Account For the period 1 July 20XX to 30 June 20XY Date Details Debit Credit Balance 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8.000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 8,000 Royal Watch Ltd Tax Computation For the period 1 July 20XX to 30 June 20XY Operating Profit Operating Profit Total Operating Profit Add Back: Assessable income or deductions not allowed for tax purposes Total Add Backs Deductions: Allowable deductions or income not assessable for tax purposes Total Allowable Deductions TAXABLE INCOME Net Tax Payable Gross Tax (Less: Offsets) NET TAX PAYABLE Information statement - To be completed by all companies 6 Calculation of total profit or loss (Extracted from Page 3 and Page 4 of Company Tax Return Form for 20XY) Income Gross payments subject to foreign resident withholding B Gross payments where ABN not quoted A Other sales of goods and services C Gross distribution from partnerships D Gross distribution from trusts E Forestry managed investment scheme income X Gross interest F Gross rent and other leasing and hiring income G Total dividends H Fringe benefit employee contributions Assessable government industry payments Q Unrealised gains on revaluation of assets to fair value Income from financial arrangements (TOFA) K Other gross income R Total Income s $ Expenses Foreign resident withholding expenses B Cost of sales A Contractor sub-contractor and commission expenses C Superannuation expenses D Bad debts E Lease expenses within Australia F Lease expenses overseas Rent expenses H Interest expenses within Australia V Interest expenses overseas Royalty expenses overseas U Royalty expenses within Australia W Depreciation expenses X Motor vehicle expenses Y Repairs and maintenance z Unrealised losses on revaluation of assets to fair value G Expenses from financial arrangements (TOFA) L All other expenses S Total Expenses Q $ Total profit or loss Subtract Total Expenses Q from Total Income s $ 7 Reconciliation to taxable income or loss (Extracted from Page 5 and Page 6 of Company Tax Return Form for 20XY) Total profit or loss amount shown at Titem 6 Z Did you have a CGT event during the year? G Yes Have you applied an exemption or rollover? M Yes No Add: Net capital gain a Non-deductible exempt income expenditure U Franking credits Australian franking credits from a New Zealand company C TOFA income from financial arrangements not included in item 6 E Other assessable income B Non-deductible expenses W Accounting expenditure in item 6 subject to R&D tax incentive D Subtotal $ F Less: Deduction for decline in value of depreciating assets F Forestry managed investment scheme deduction U Immediate deduction for capital expenditure E Deduction for project pool H Capital works deductions Section 40-880 deduction Z Landcare operations and deduction for decline in value of water facility N Deduction for environmental protection expenses o Offshore banking unit adjustment P Exempt income V Other income not included in assessable income Q TOFA deductions from financial arrangements not included in item 6 W Other deductible expenses X Tax losses deducted R Tax losses transferred in (from or to a foreign bank branch or a PE of a foreign financial entity) Subtraction items subtotal Taxable income or loss T 8 Financial and other information (Extracted from Page 6 and Page 7 of Company Tax Return Form for 20XY) $ INo Functional currency chosen o $ Opening stock A $ Purchases and other costs $ $ Closing stock B $ Trading stock election Yes Trade debtors C All current assets D Total assets E Trade creditors F All current liabilities G Total liabilities H Total debt Commercial debt forgiveness K Franked dividends paid J Unfranked dividends paid K Franking account balance M Excess franking offsets H Loans to shareholders and their associates N Total salary and wage expenses D Payments to associated persons Q Gross foreign income G Net foreign income R Attributed foreign income - Listed country B Attributed foreign income - Section 404 country C Attributed foreign income - Unlisted country U Attributed foreign income - Transferor trust V Total TOFA gains T Total TOFA losses U TOFA transitional balancing adjustment R gains from unrealised movements in the value of financial arrangements $ No No 9 Capital allowances (Extracted from Page 7 of Company Tax Return Form for 20XX) Depreciating assets first deducted in this income year Intangible depreciating assets first deducted A Other depreciating assets first deducted B Have you self-assessed the effective life of any of these assets C Yes For all depreciating assets Did you recalculate the effective life for any of your assets this income year? D Yes Total adjustable value at end of income year E Assessable balancing adjustments on the disposal of intangible depreciating assets F Deductible balancing adjustments on the disposal of intangible depreciating assets G Termination value of intangible depreciating assets H Termination value of other depreciating assets 10 Small business entity simplified depreciation Deduction for certain assets (costing less than $6,500) A Deduction for general small business pool B 13 Losses information Tax losses carried forward to later income years U Net capital losses carried forward to later income years V Loss carry-back Amount of tax loss for current year chosen to be carried back to middle year (20XN-20XO) W Net exempt income for the middle year (20XN-20XO) X Income tax liability for middle year (20XN-20XO) Y Loss carry-back tax offsetz Calculation statement (Extracted from Page 11 of Company Tax Return Form for 20XX) $ Taxable income A Tax on taxable income T1 R&D recoupment tax M Gross tax B Non-refundable non-carry forward tax offsets C Subtotal 1 12 $ Non-refundable carry forward tax offsets D Subtotal 2 T3 $ Refundable tax offsets E Subtotal 3 T4 $ Franking deficit tax offset F TAX PAYABLETS $ Section 102AAM interest charge G Eligible credits H See Note 1 below Remainder of refundable tax offsets (unused amount from label E) 1 PAYG instalments raised K AMOUNT DUE OR REFUNDABLE (T5 plus G less H less Iless K) S $ Note 1 Credit for interest on early payments - amount of interest H1 Credit for tax withheld foreign resident withholding H2 Credit for tax withheld where ABN is not quoted H3 Tax withheld from interest or investments H4 Credit for TFN amounts withheld from payments from closely held trusts H5 Other credits H7 Total Eligible Credit - go to H $ See H above