Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I want the answer now , it's about Financial Management Score Part 3: Ratio analysis ( 12 %) Please calculate the ratios and answer

please I want the answer now , it's about Financial Management

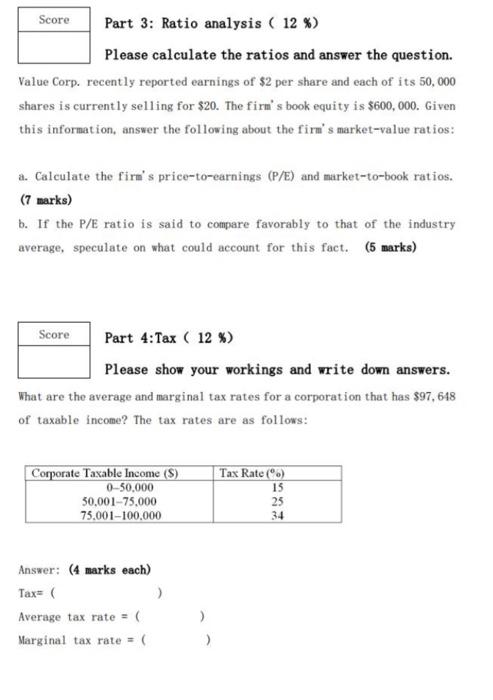

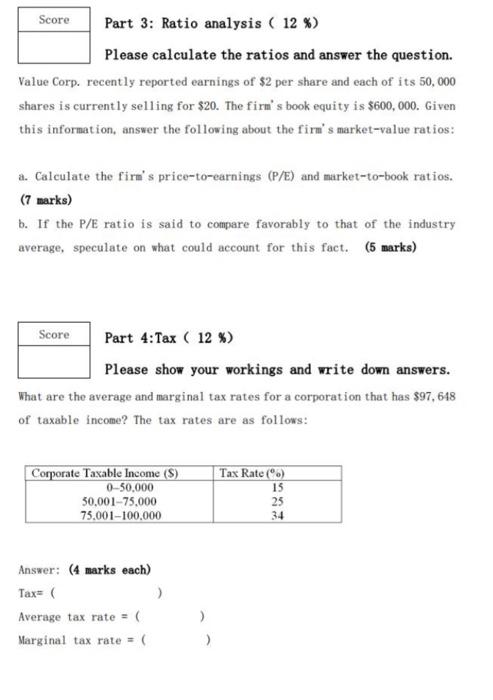

Score Part 3: Ratio analysis ( 12 %) Please calculate the ratios and answer the question. Value Corp. recently reported earnings of $2 per share and each of its 50,000 shares is currently selling for $20. The firm's book equity is $600, 000. Given this information, answer the following about the firm's market-value ratios: a. Calculate the firm's price-to-earnings (P/E) and market-to-book ratios. (7 marks) b. If the P/E ratio is said to compare favorably to that of the industry average, speculate on what could account for this fact. (5 marks) Score Part 4:Tax (12 %) Please show your workings and write down answers. What are the average and marginal tax rates for a corporation that has $97, 648 of taxable income? The tax rates are as follows: Corporate Taxable Income (S) Tax Rate(%) 0-50,000 15 50,001-75,000 25 75.001-100,000 34 Answer: (4 marks each) Tax= ( Average tax rate= ( Marginal tax rate = (

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started