Answered step by step

Verified Expert Solution

Question

1 Approved Answer

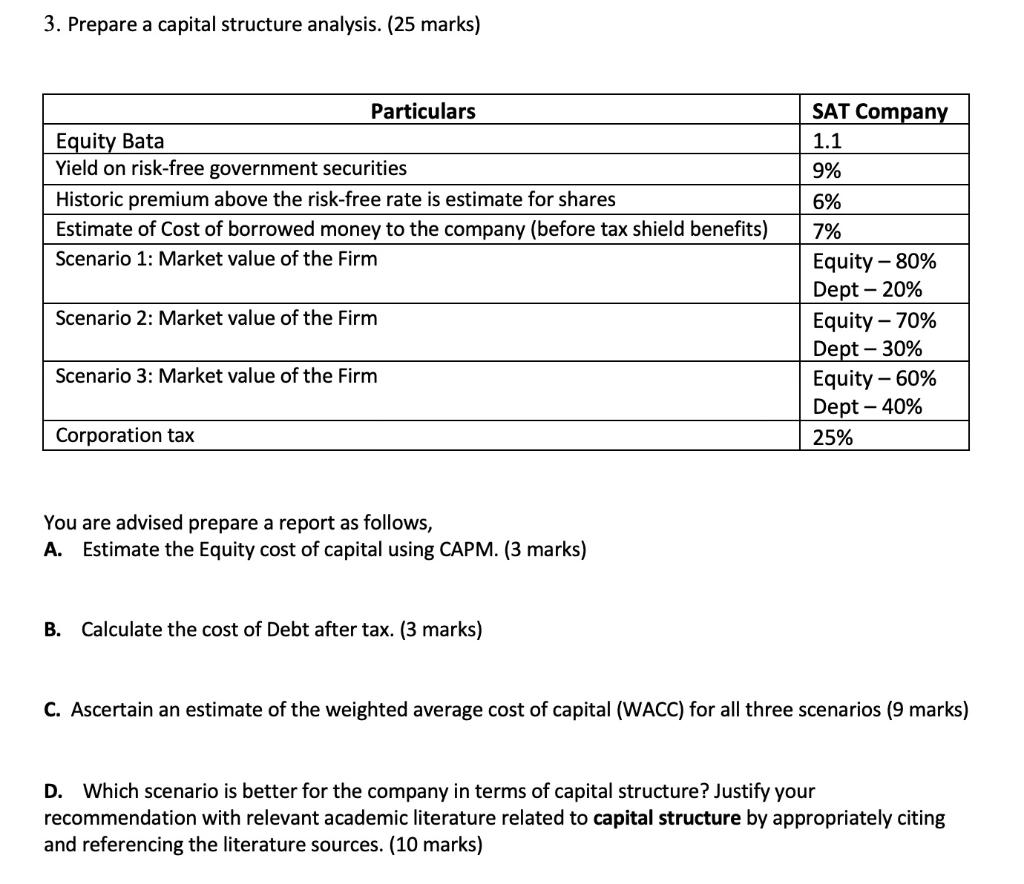

Please, I want the line clear when solving and I want all steps of the solution 3. Prepare a capital structure analysis. (25 marks) SAT

Please, I want the line clear when solving and I want all steps of the solution

3. Prepare a capital structure analysis. (25 marks) SAT Company 1.1 9% Particulars Equity Bata Yield on risk-free government securities Historic premium above the risk-free rate is estimate for shares Estimate of Cost of borrowed money to the company (before tax shield benefits) Scenario 1: Market value of the Firm 6% 7% Scenario 2: Market value of the Firm Equity - 80% Dept - 20% Equity - 70% Dept -30% Equity - 60% Dept -40% 25% Scenario 3: Market value of the Firm Corporation tax You are advised prepare a report as follows, A. Estimate the Equity cost of capital using CAPM. (3 marks) B. Calculate the cost of Debt after tax. (3 marks) C. Ascertain an estimate of the weighted average cost of capital (WACC) for all three scenarios (9 marks) D. Which scenario is better for the company in terms of capital structure? Justify your recommendation with relevant academic literature related to capital structure by appropriately citing and referencing the literature sources. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started