Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please I want the right solution The alternatives are mutually exclusive and the MARR is 6% per year. Then, the * annual worth of vendor

Please I want the right solution

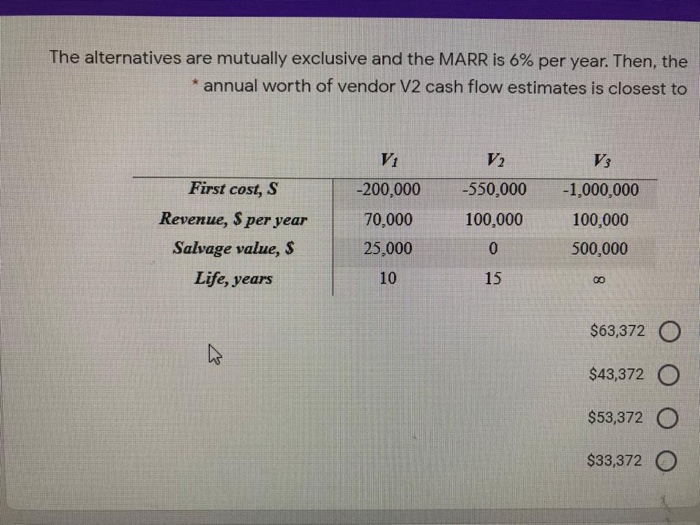

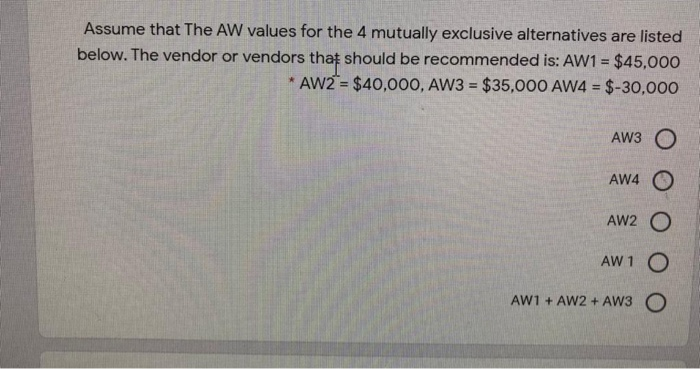

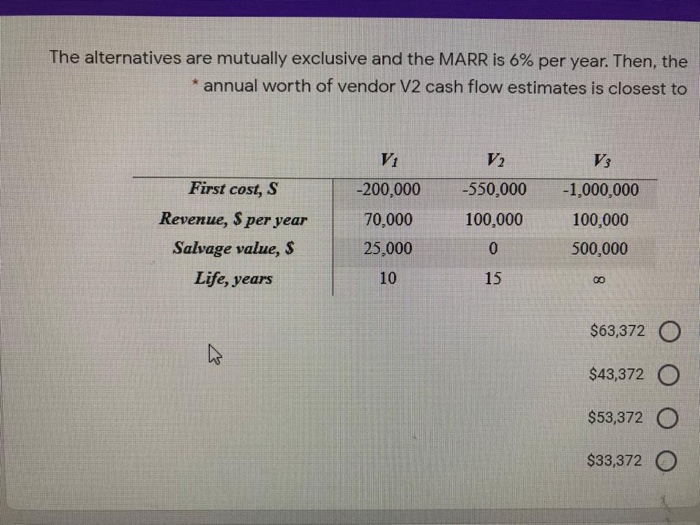

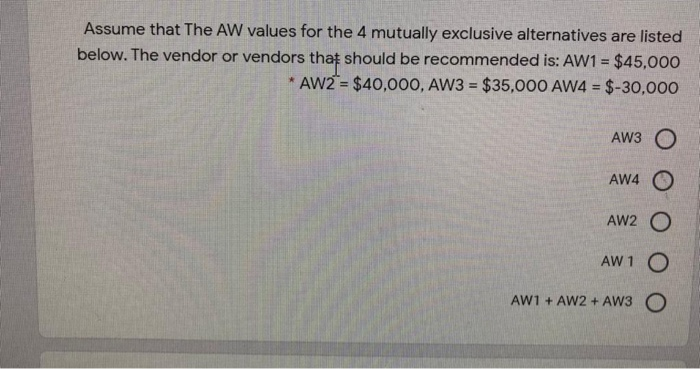

The alternatives are mutually exclusive and the MARR is 6% per year. Then, the * annual worth of vendor V2 cash flow estimates is closest to V2 -550,000 100,000 First cost, s Revenue, $ per year Salvage value, $ Life, years -200,000 70,000 25,000 10 -1,000,000 100,000 500,000 IS $63,372 O $43,372 O $53,372 O $33,372 O Assume that The AW values for the 4 mutually exclusive alternatives are listed below. The vendor or vendors that should be recommended is: AW1 = $45,000 * AW2 = $40,000, AW3 = $35,000 AW4 = $-30,000 AW3 O AW4 O AW2 O Ooooo AW1 O AW1 + AW2 + AW3 O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started