Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i will appreciate a honest help on this problem. the working excel code, and comments and explanations. i beseach non expert not to waste

please i will appreciate a honest help on this problem. the working excel code, and comments and explanations. i beseach non expert not to waste my chances by answering wrongly or gambling the solution

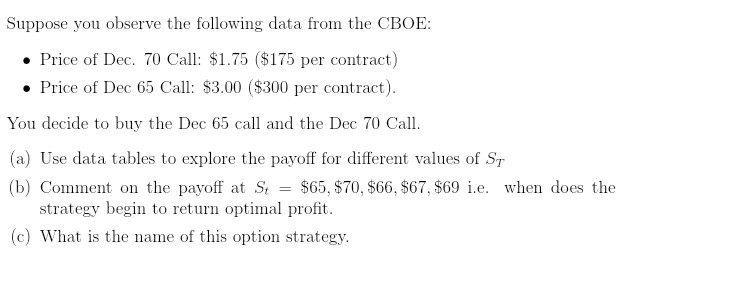

Suppose you observe the following data from the CBOE .Price of Dec. 70 Call: $1.75 ($175 per contract) Price of Dec 65 Call: $3.00 ($300 per contract) You decide to buy the Dec 65 call and the Dec 70 Call. a) Use data tables to explore the payoff for different values of ST (b) Comment on the payoff at S$65, $70, $66, $67, $69 i.e. when does the strategy begin to return optimal profit (c) What is the name of this option strategyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started