Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i will really Appreciate if done asap thanks Fortune Company uses a predetermined overhead rate based on direct labor hours to apply manufacturing overhead

please i will really Appreciate if done asap thanks

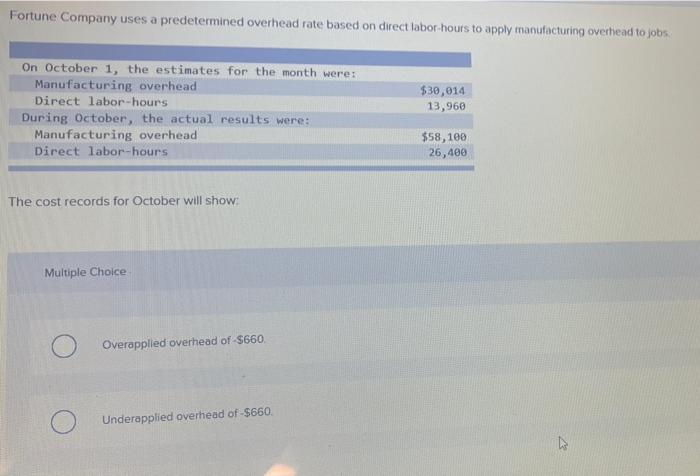

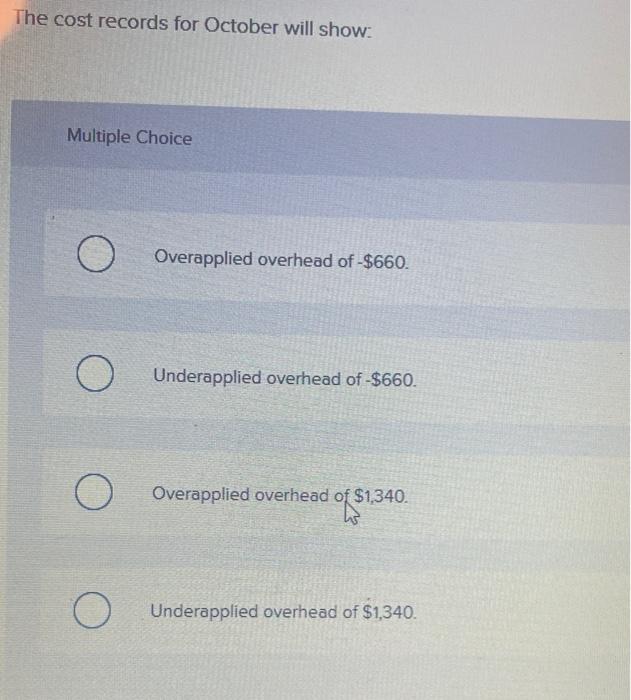

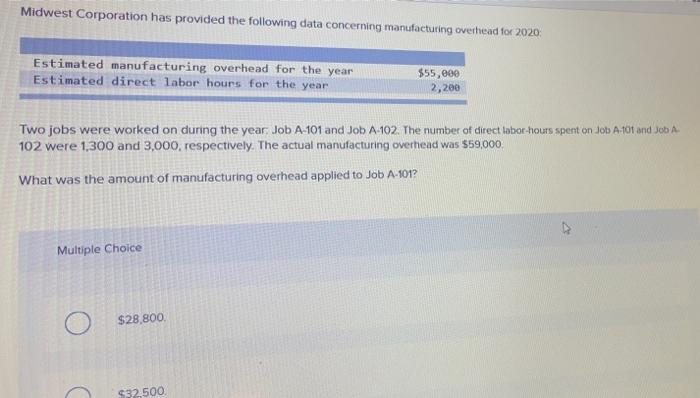

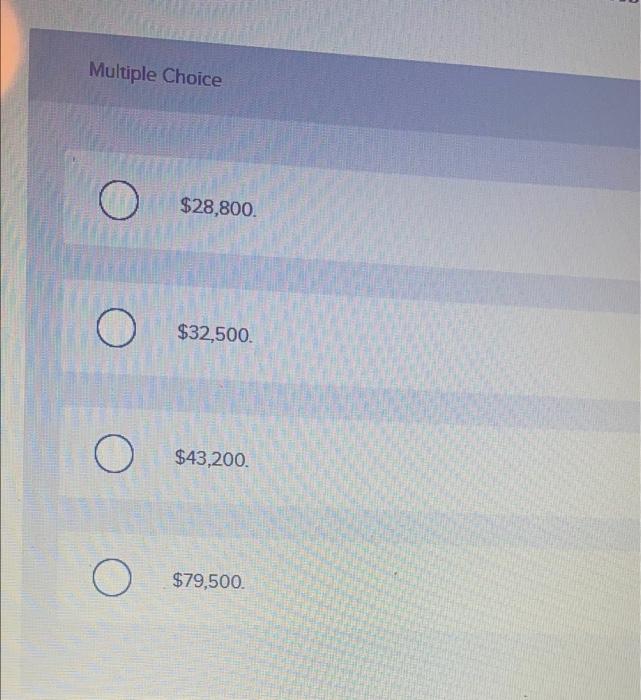

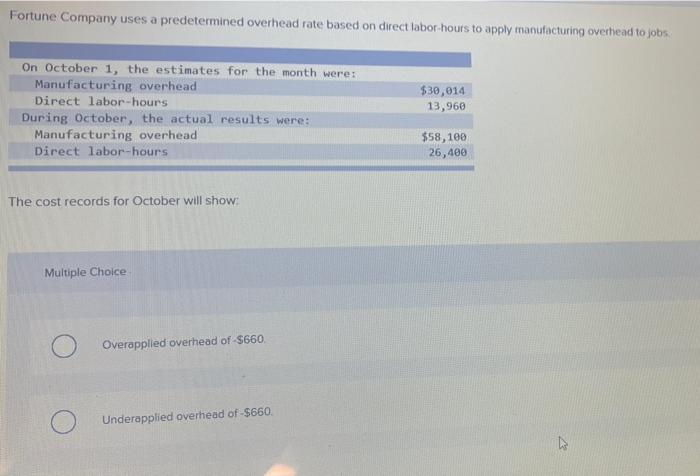

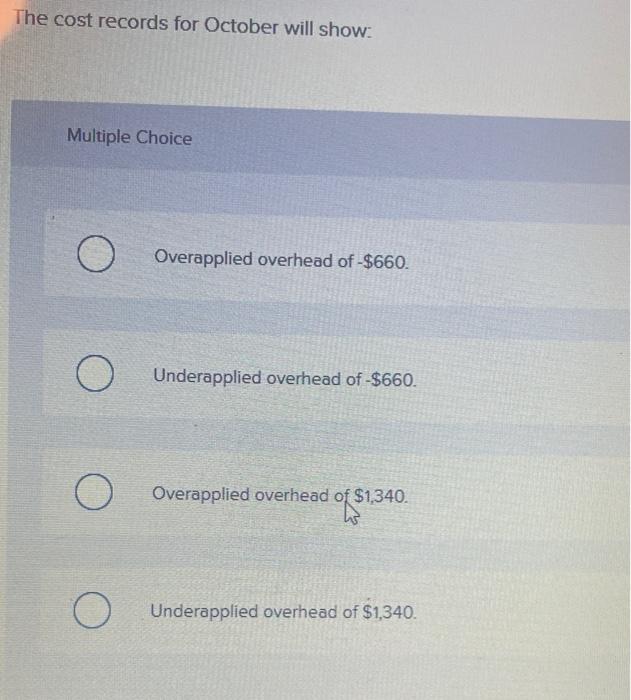

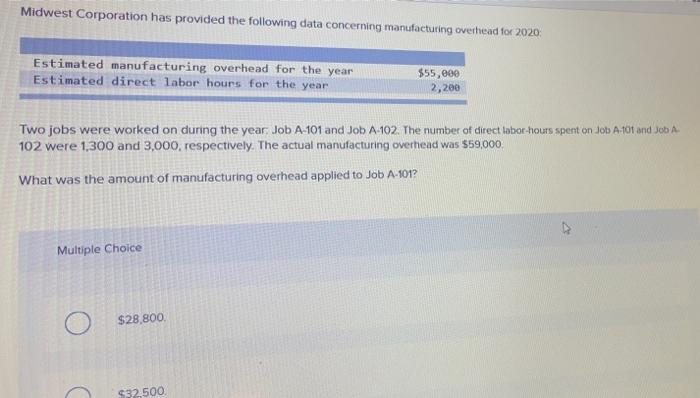

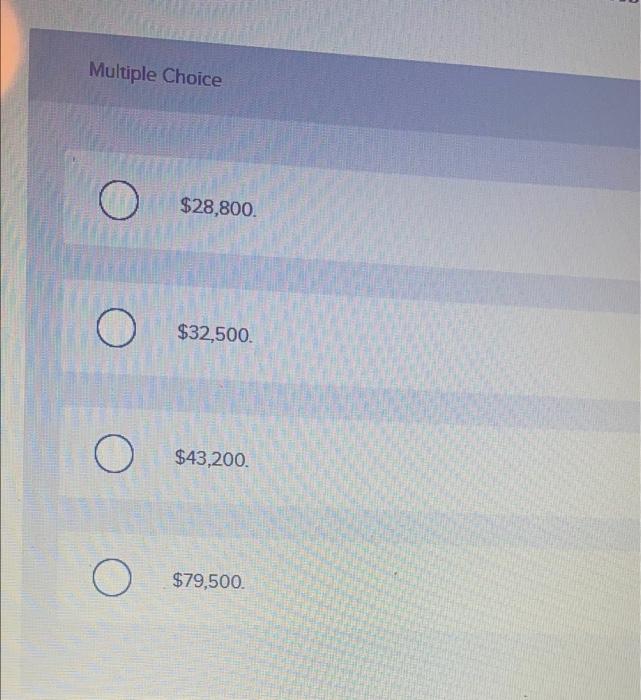

Fortune Company uses a predetermined overhead rate based on direct labor hours to apply manufacturing overhead to jobs. On October 1, the estimates for the month were: Manufacturing overhead Direct labor-hours During October, the actual results were: Manufacturing overhead Direct labor-hours $30,014 13,960 $58,100 26,400 The cost records for October will show Multiple Choice Overapplied overhead of -S660 Underapplied overhead of-$660. The cost records for October will show: Multiple Choice Overapplied overhead of -$660. 0 Underapplied overhead of -8660. O Overapplied overhead of $1,340. *f$1340 Underapplied overhead of $1,340. Midwest Corporation has provided the following data concerning manufacturing overhead for 2020 Estimated manufacturing overhead for the year Estimated direct labor hours for the year $55,000 2,200 Two jobs were worked on during the year Job A-101 and Job A 102. The number of direct labor-hours spent on Job A 101 and Job A. 102 were 1,300 and 3,000, respectively. The actual manufacturing overhead was $59.000 What was the amount of manufacturing overhead applied to Job A-101? Multiple Choice $28,800 $32 500 Multiple Choice $28,800. O $32,500. O $43,200. O $79,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started