Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please ignore 30 June 2014. This should be 30th JUNE 2016 Typing error 1. Using the list of balances below, prepare a Trial Balance and

Please ignore 30 June 2014. This should be 30th JUNE 2016

Typing error

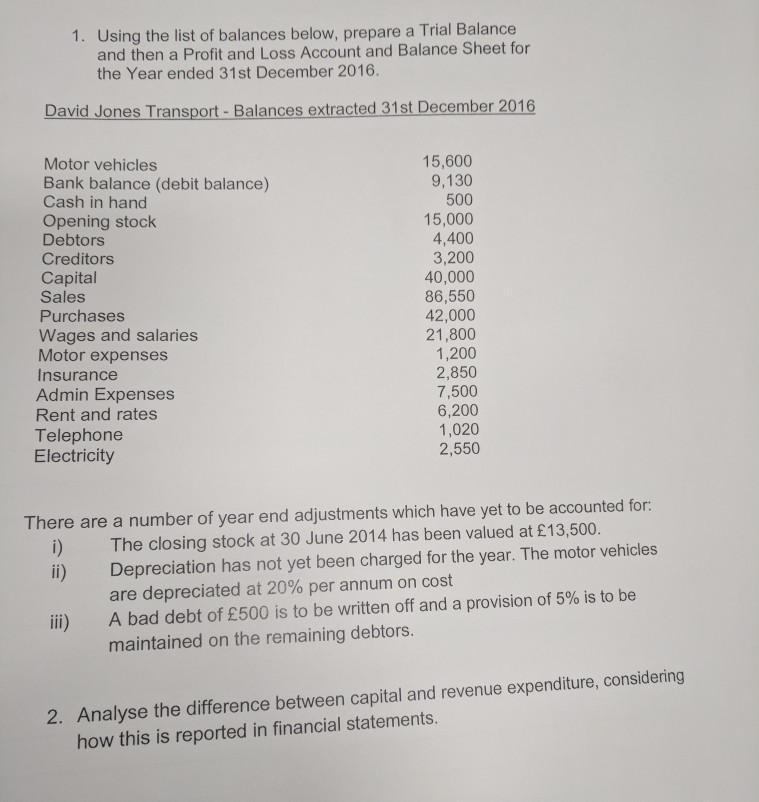

1. Using the list of balances below, prepare a Trial Balance and then a Profit and Loss Account and Balance Sheet for the Year ended 31st December 2016. David Jones Transport- Balances extracted 31st December 2016 Motor vehicles Bank balance (debit balance) Cash in hand Opening stock Debtors Creditors Capital Sales Purchases Wages and salaries Motor expenses Insurance Admin Expenses Rent and rates Telephone Electricity 15,600 9,130 500 15,000 4,400 3,200 40,000 86,550 42,000 21,800 1,200 2,850 7,500 6,200 1,020 2,550 There are a number of year end adjustments which have yet to be accounted for: i) The closing stock at 30 June 2014 has been valued at 13,500. ii) Depreciation has not yet been charged for the year. The motor vehicles are depreciated at 20% per annum on cost A bad debt of 500 is to be written off and a provision of 5% is to be maintained on the remaining debtors. iii) 2. Analyse the difference between capital and revenue expenditure, considering how this is reported in financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started