Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please ignore GST, but show all your workings PLEASE. (i)Prepare a Statement of Cash Flows for Williams Ltd for the year ended 30 June 2020

Please ignore GST, but show all your workings PLEASE.

(i)Prepare a Statement of Cash Flows for Williams Ltd for the year ended 30 June 2020 using the direct method.

(ii)Prepare a reconciliation of net profit after tax to net cash provided from operating activities.

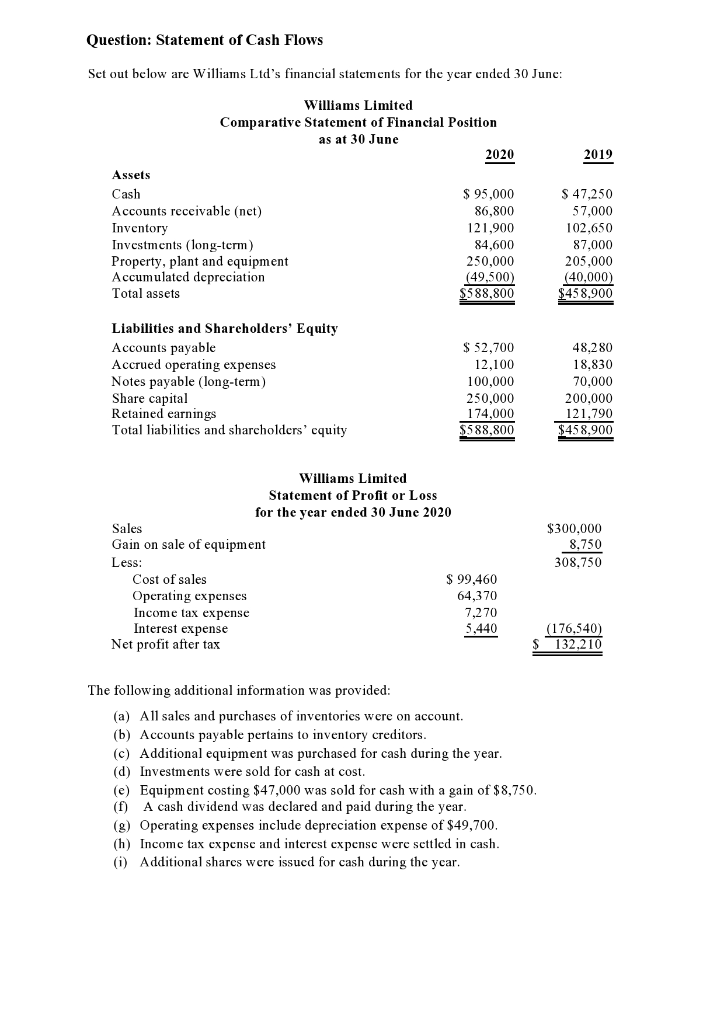

Question: Statement of Cash Flows Set out below are Williams Ltd's financial statements for the year ended 30 June: 2019 Williams Limited Comparative Statement of Financial Position as at 30 June 2020 Assets Cash $ 95,000 Accounts receivable (net) 86,800 Inventory 121,900 Investments (long-term) 84,600 Property, plant and equipment 250,000 Accumulated depreciation (49,500) Total assets $588,800 $ 47,250 57.000 102.650 87.000 205,000 (40,000) $458,900 Liabilities and Shareholders' Equity Accounts payable Accrued operating expenses Notes payable (long-term) Share capital Retained earnings Total liabilities and shareholders' equity $ 52,700 12,100 100,000 250,000 174,000 $588,800 48.280 18,830 70,000 200.000 121,790 $458,900 Williams Limited Statement of Profit or Loss for the year ended 30 June 2020 Sales Gain on sale of equipment Less: Cost of sales $ 99,460 Operating expenses 64,370 Income tax expense 7,270 Interest expense 5.440 Net profit after tax $300.000 8.750 308.750 (176,540) 132.210 The following additional information was provided: (a) All sales and purchases of inventories were on account. (b) Accounts payable pertains to inventory creditors. (c) Additional equipment was purchased for cash during the year. (d) Investments were sold for cash at cost. (e) Equipment costing $47,000 was sold for cash with a gain of $8,750. A cash dividend was declared and paid during the year. (8) Operating expenses include depreciation expense of $49,700, (h) Income tax expense and interest expense were settled in cash. (i) Additional shares were issued for cash during the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started