Question

PLEASE IGNORE THIS QUESTION. IT NO LONGER NEEDS TO BE ANSWERED. CHEGG DOES NOT ALLOW DELETION OF QUESTIONS. THANK YOU. Please provide downloadable excel sheet

PLEASE IGNORE THIS QUESTION. IT NO LONGER NEEDS TO BE ANSWERED. CHEGG DOES NOT ALLOW DELETION OF QUESTIONS. THANK YOU.

Please provide downloadable excel sheet and graphs, not pictures. Do not bother to answer if no excel sheets. I cannot learn to solve these problems if I cannot view the formula used to solve them. Must provide excel sheet and curve in downloadable format that allows for viewing complete work. NO PICTURES.

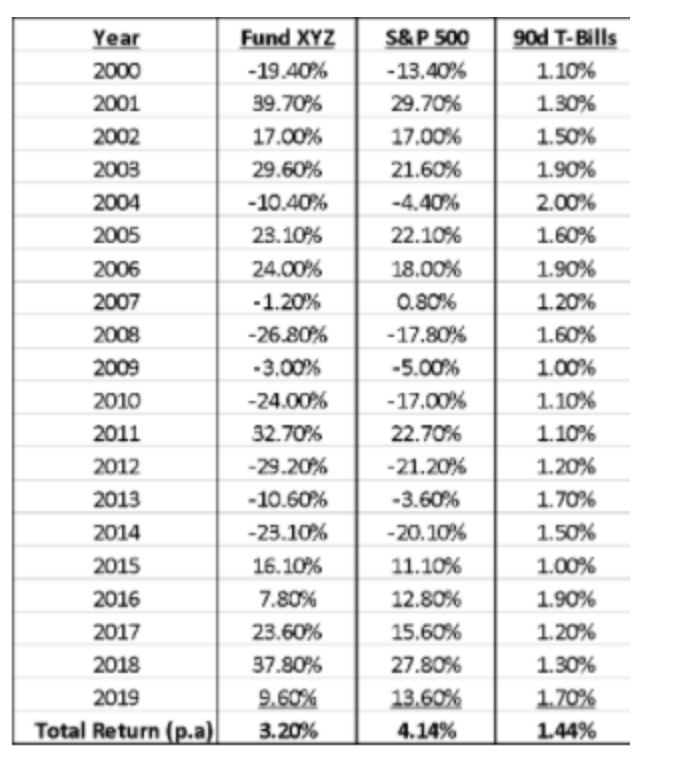

Return data for mutual fund XYZ, the S&P 500, and 90-day T-Bills can be found in the attached Excel file

a) Plot the risk premium of Fund XYZ vs. the market premium (10 pts)

b) What is Fund XYZ's beta? Hint: use the "slope function" in Excel. (5 pts)

c) What is Fund XYZ's alpha? Hint: use the "intercept function" in Excel. (5 pts)

Upload the completed Excel file below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started