Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*Please igonore the already chosen option.* Increasing the relative proportion of debt financing in a company's capital structure has which of the following expected effects

*Please igonore the already chosen option.*

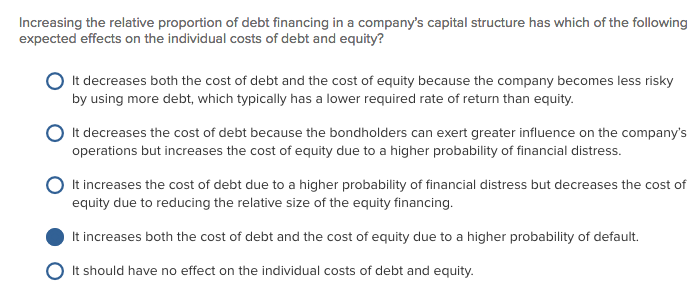

Increasing the relative proportion of debt financing in a company's capital structure has which of the following expected effects on the individual costs of debt and equity? It decreases both the cost of debt and the cost of equity because the company becomes less risky by using more debt, which typically has a lower required rate of return than equity. It decreases the cost of debt because the bondholders can exert greater influence on the company's operations but increases the cost of equity due to a higher probability of financial distress. It increases the cost of debt due to a higher probability of financial distress but decreases the cost of equity due to reducing the relative size of the equity financing. It increases both the cost of debt and the cost of equity due to a higher probability of default. It should have no effect on the individual costs of debt and equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started