Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please im running out of time generally ignore sunk costs when evaluating a project's NPV. O You should generally ignore opportunity costs when evaluating a

please im running out of time

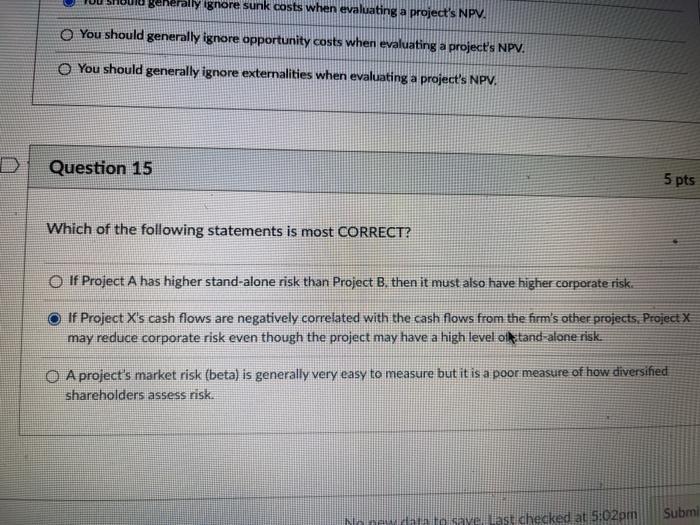

generally ignore sunk costs when evaluating a project's NPV. O You should generally ignore opportunity costs when evaluating a project's NPV. O You should generally ignore externalities when evaluating a project's NPV. Question 15 5 pts Which of the following statements is most CORRECT? O If Project A has higher stand-alone risk than Project B. then it must also have higher corporate risk. If Project X's cash flows are negatively correlated with the cash flows from the firm's other projects Project X may reduce corporate risk even though the project may have a high level of tand-alone risk. A project's market risk (beta) is generally very easy to measure but it is a poor measure of how diversified shareholders assess risk. Submi No newala to save last checked at 5:02pm Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started