Please include all steps. Thank you so much.

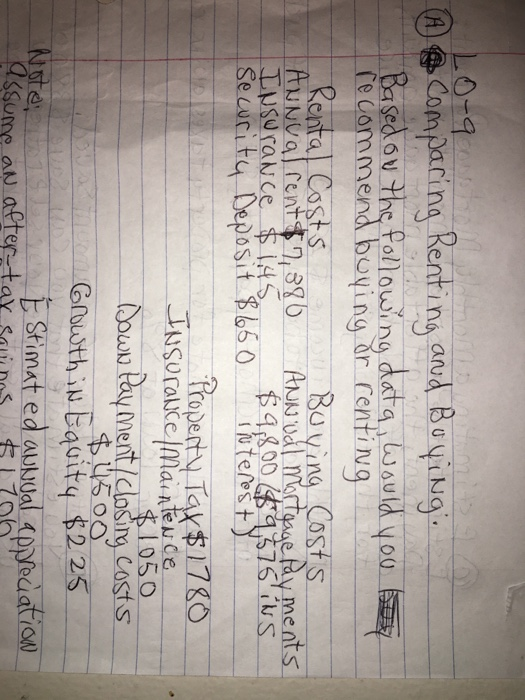

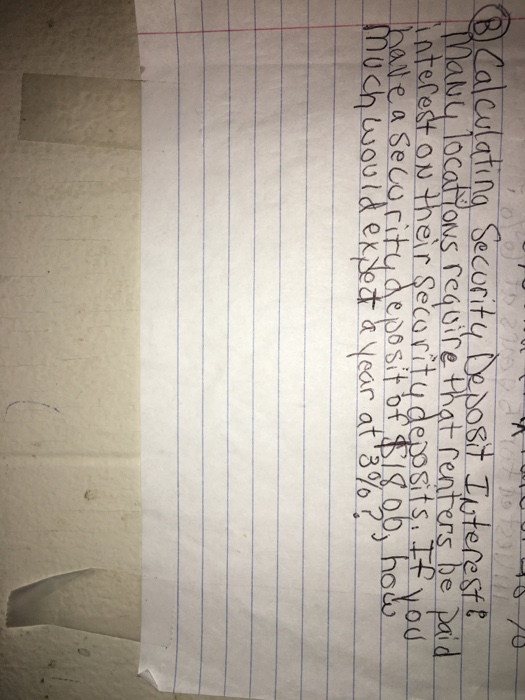

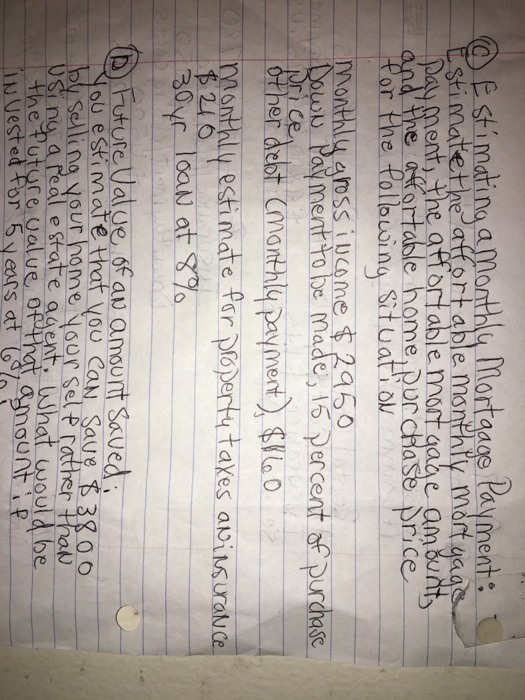

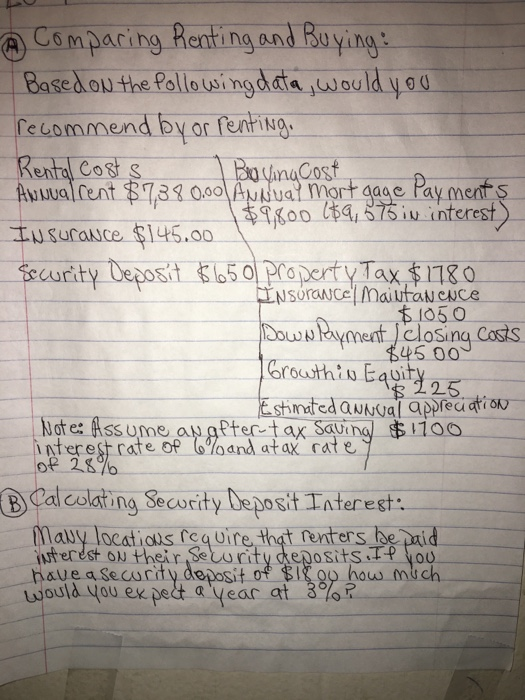

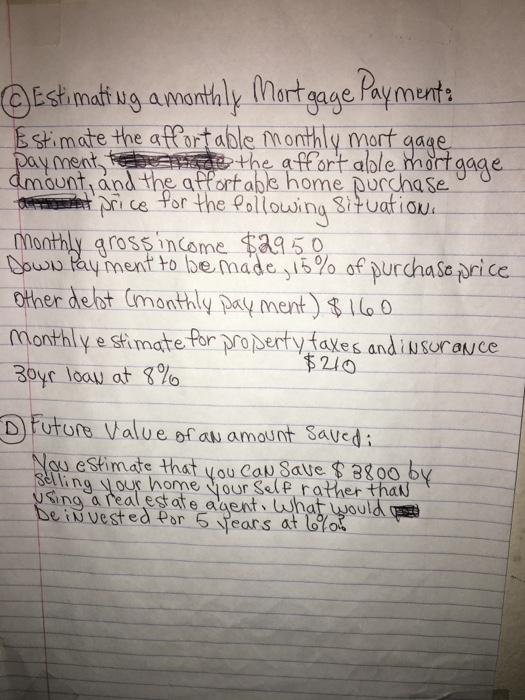

Lo-qov e comparing Renting and Boxing, Basedow the following data, would you buy recommend buying or renting Rental Costs anou Buying Costs Annual rent $7,386 ANN val mortgage Payments Insurance $1.45 $9.800($9.575 ins Security Deposit $650 interest you Property Tax$ 1780 Insurance Maintence $1050 Down Payment (closing costs Growth in bariton Note Stimat ed annual appreciation assume an after tar saunos $ 1796 B Calculating Security Deposit Intereste Many locations require that renters be paid interest on their ecority deposits: If you have a security deposit of $180b, how much would expect a year at 3%? Estimating a monthly Mortgage Payment: Estimatethe affortable monthly mrt yage Day ment, the affortable Mortgage amount and the affortable home purchase price for the following situation in monthly gross income $2950 Down Payment to be made, 15 percent of purchase other debt (monthly payment) $1600 monthly estimate for property taxes an insurance $210 30yr loan at 8% (b Future Value of an amount saved: Vou estimate that you can save $ 3800 by selling your home your self rather than Using a real estate agent. What i the future value of that what would be invested for 5 years at 6% is at that amount if @ comparing Renting and Buying: Based on the following data, would you recommend byor renting. Rental Costs Boxing Cost Annual rent $7,38 0.00 Annual mort gage Payments $9,800 ($9,575 in interest Insurance $145.00 Security Deposit $650 Property Tax, $1780 Insurance Maintanence $1050 ayment ) closing costs $45000 16rowthis Equity 498225 Estimated annual appreciation Note: Assume anafter-tax saving $1100 interest rate of 6% and at ax rate? of 28% B Calculating Security Deposit Interest: Many locations require that renters be paid interest on their security depositsiff you have a security deposit of $18 ou how much would you expect a year at 3%? Estimating a monthly Mortgage Payment: Estimate the affortable monthly mort gage payment t o the a mogage amount, and the affortable home purchase d et price for the following situations Monthly gross income $2950 Down Payment to be made, 15% of purchase price other delt (monthly payment) $160 Monthly estimate for property faxes and insurance 30yr loan at 8% $210 D Future Value of an amount savedi You estimate that you can save $3800 by Selling your home your Self rather than using a real estate agent, what would pa De invested for 5 years at 6%? Lo-qov e comparing Renting and Boxing, Basedow the following data, would you buy recommend buying or renting Rental Costs anou Buying Costs Annual rent $7,386 ANN val mortgage Payments Insurance $1.45 $9.800($9.575 ins Security Deposit $650 interest you Property Tax$ 1780 Insurance Maintence $1050 Down Payment (closing costs Growth in bariton Note Stimat ed annual appreciation assume an after tar saunos $ 1796 B Calculating Security Deposit Intereste Many locations require that renters be paid interest on their ecority deposits: If you have a security deposit of $180b, how much would expect a year at 3%? Estimating a monthly Mortgage Payment: Estimatethe affortable monthly mrt yage Day ment, the affortable Mortgage amount and the affortable home purchase price for the following situation in monthly gross income $2950 Down Payment to be made, 15 percent of purchase other debt (monthly payment) $1600 monthly estimate for property taxes an insurance $210 30yr loan at 8% (b Future Value of an amount saved: Vou estimate that you can save $ 3800 by selling your home your self rather than Using a real estate agent. What i the future value of that what would be invested for 5 years at 6% is at that amount if @ comparing Renting and Buying: Based on the following data, would you recommend byor renting. Rental Costs Boxing Cost Annual rent $7,38 0.00 Annual mort gage Payments $9,800 ($9,575 in interest Insurance $145.00 Security Deposit $650 Property Tax, $1780 Insurance Maintanence $1050 ayment ) closing costs $45000 16rowthis Equity 498225 Estimated annual appreciation Note: Assume anafter-tax saving $1100 interest rate of 6% and at ax rate? of 28% B Calculating Security Deposit Interest: Many locations require that renters be paid interest on their security depositsiff you have a security deposit of $18 ou how much would you expect a year at 3%? Estimating a monthly Mortgage Payment: Estimate the affortable monthly mort gage payment t o the a mogage amount, and the affortable home purchase d et price for the following situations Monthly gross income $2950 Down Payment to be made, 15% of purchase price other delt (monthly payment) $160 Monthly estimate for property faxes and insurance 30yr loan at 8% $210 D Future Value of an amount savedi You estimate that you can save $3800 by Selling your home your Self rather than using a real estate agent, what would pa De invested for 5 years at 6%