Answered step by step

Verified Expert Solution

Question

1 Approved Answer

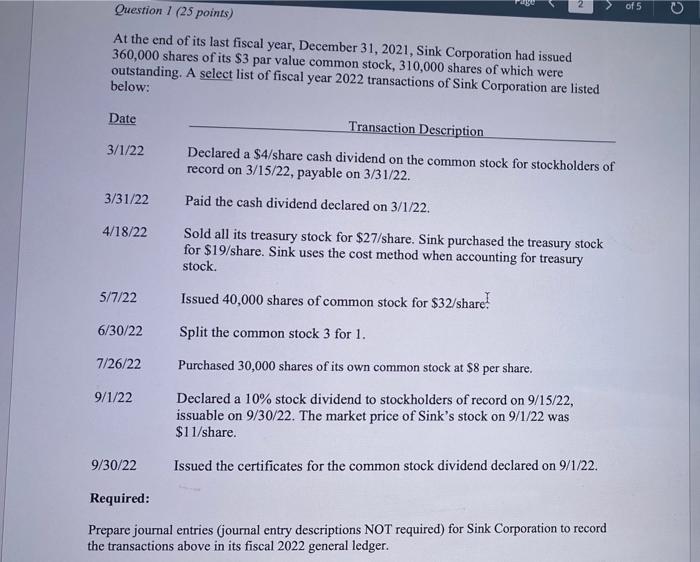

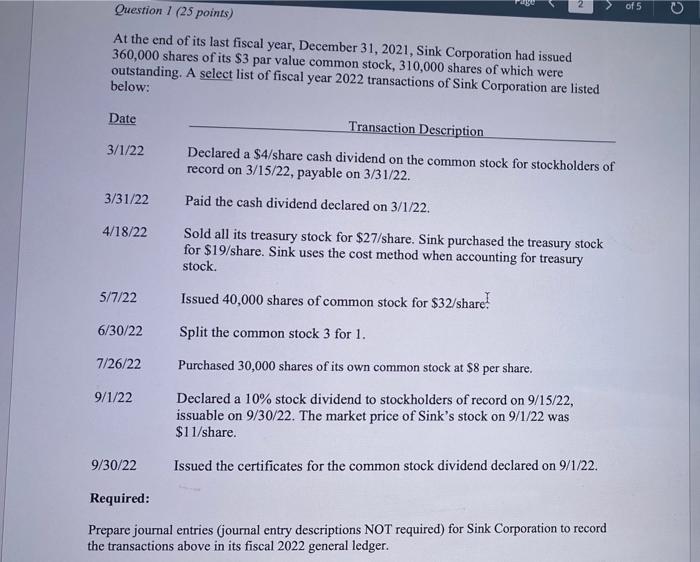

please include all supporting calculations Question 1 (25 points) At the end of its last fiscal year, December 31, 2021, Sink Corporation had issued 360,000

please include all supporting calculations

Question 1 (25 points) At the end of its last fiscal year, December 31, 2021, Sink Corporation had issued 360,000 shares of its $3 par value common stock, 310,000 shares of which were outstanding. A select list of fiscal year 2022 transactions of Sink Corporation are listed below: Date 3/1/22 3/31/22 4/18/22 5/7/22 6/30/22 7/26/22 9/1/22 9/30/22 Transaction Description Declared a $4/share cash dividend on the common stock for stockholders of record on 3/15/22, payable on 3/31/22. Paid the cash dividend declared on 3/1/22. Sold all its treasury stock for $27/share. Sink purchased the treasury stock for $19/share. Sink uses the cost method when accounting for treasury stock. Issued 40,000 shares of common stock for $32/share! Split the common stock 3 for 1. Purchased 30,000 shares of its own common stock at $8 per share. Declared a 10% stock dividend to stockholders of record on 9/15/22, issuable on 9/30/22. The market price of Sink's stock on 9/1/22 was $11/share. Issued the certificates for the common stock dividend declared on 9/1/22. Required: Prepare journal entries (journal entry descriptions NOT required) for Sink Corporation to record the transactions above in its fiscal 2022 general ledger. of 5 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started