Answered step by step

Verified Expert Solution

Question

1 Approved Answer

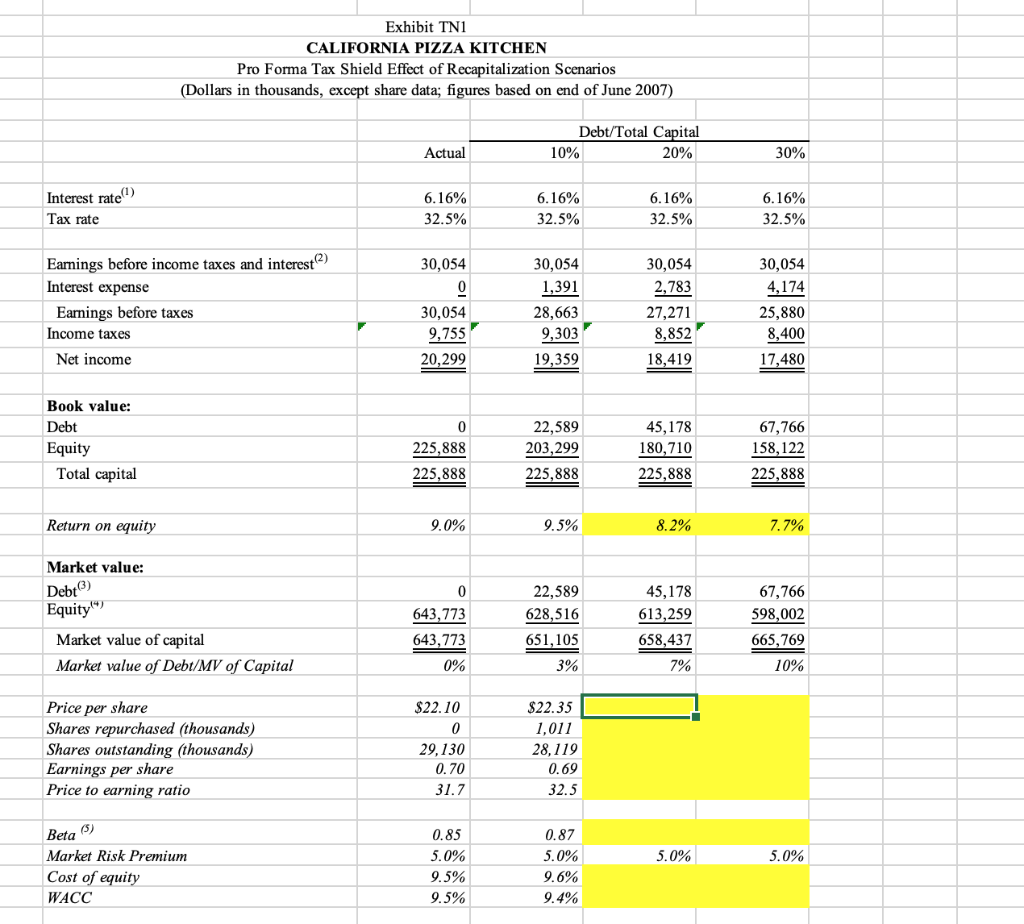

PLEASE INCLUDE CALCULATIONS Exhibit TNI CALIFORNIA PIZZA KITCHEN Pro Forma Tax Shield Effect of Recapitalization Scenarios (Dollars in thousands, except share data; figures based on

PLEASE INCLUDE CALCULATIONS

Exhibit TNI CALIFORNIA PIZZA KITCHEN Pro Forma Tax Shield Effect of Recapitalization Scenarios (Dollars in thousands, except share data; figures based on end of June 2007) Debt/Total Capital 10% 20% Actual 30% Interest rate) Tax rate 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% Earnings before income taxes and interest(2) Interest expense Earnings before taxes Income taxes Net income 30,054 9 30,054 9,755 20,299 30,054 1,391 28,663 9,303 19,359 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17,480 Book value: Debt Equity Total capital 0 225,888 225,888 22,589 203,299 225,888 45,178 180,710 225,888 67,766 158,122 225,888 Return on equity 9.0% 9.5% 8.2% 7.7% 0 Market value: Debt) Equity") Market value of capital Market value of Debt/MV of Capital 643,773 643,773 0% 22,589 628,516 651,105 3% 45,178 613,259 658,437 7% 67,766 598,002 665,769 10% Price per share Shares repurchased (thousands) Shares outstanding (thousands) Earnings per share Price to earning ratio $22.10 0 29, 130 0.70 31.7 $22.35 1,011 28,119 0.69 32.5 Beta (5) 5.0% 5.0% Market Risk Premium Cost of equity WACC 0.85 5.0% 9.5% 9.5% 0.87 5.0% 9.6% 9.4% Exhibit TNI CALIFORNIA PIZZA KITCHEN Pro Forma Tax Shield Effect of Recapitalization Scenarios (Dollars in thousands, except share data; figures based on end of June 2007) Debt/Total Capital 10% 20% Actual 30% Interest rate) Tax rate 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% Earnings before income taxes and interest(2) Interest expense Earnings before taxes Income taxes Net income 30,054 9 30,054 9,755 20,299 30,054 1,391 28,663 9,303 19,359 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17,480 Book value: Debt Equity Total capital 0 225,888 225,888 22,589 203,299 225,888 45,178 180,710 225,888 67,766 158,122 225,888 Return on equity 9.0% 9.5% 8.2% 7.7% 0 Market value: Debt) Equity") Market value of capital Market value of Debt/MV of Capital 643,773 643,773 0% 22,589 628,516 651,105 3% 45,178 613,259 658,437 7% 67,766 598,002 665,769 10% Price per share Shares repurchased (thousands) Shares outstanding (thousands) Earnings per share Price to earning ratio $22.10 0 29, 130 0.70 31.7 $22.35 1,011 28,119 0.69 32.5 Beta (5) 5.0% 5.0% Market Risk Premium Cost of equity WACC 0.85 5.0% 9.5% 9.5% 0.87 5.0% 9.6% 9.4%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started