Answered step by step

Verified Expert Solution

Question

1 Approved Answer

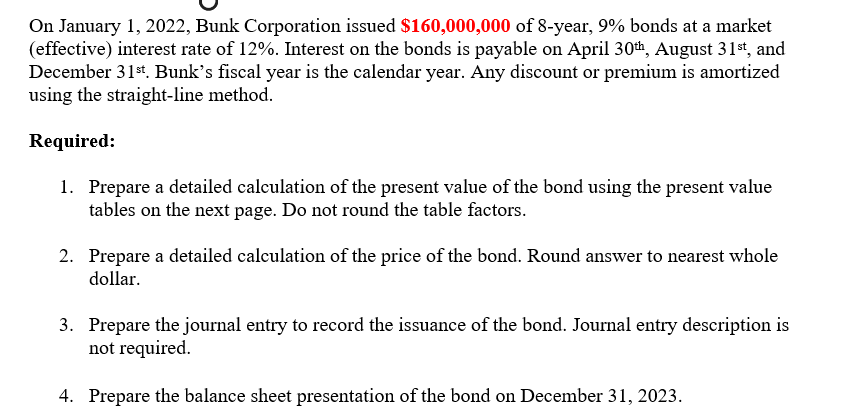

Please include calculations On January 1, 2022, Bunk Corporation issued $160,000,000 of 8-year, 9% bonds at a market (effective) interest rate of 12%. Interest on

Please include calculations

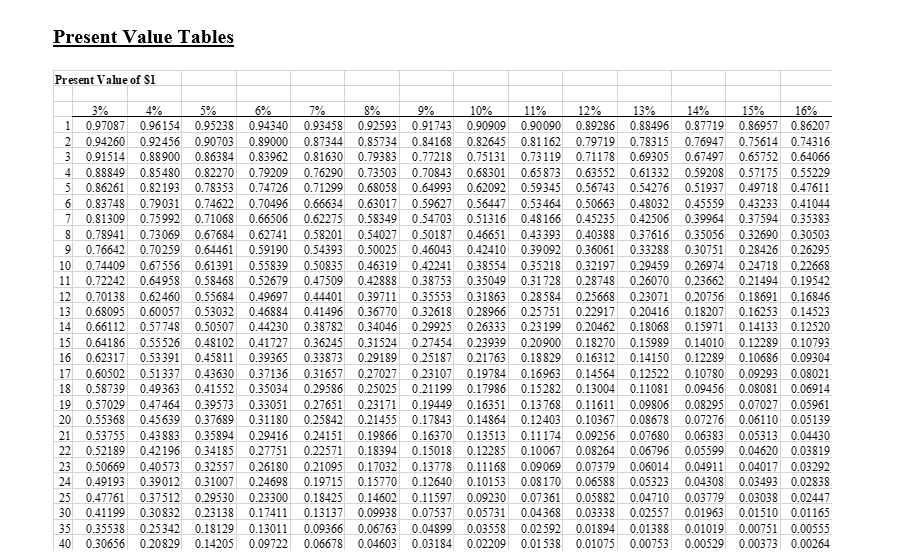

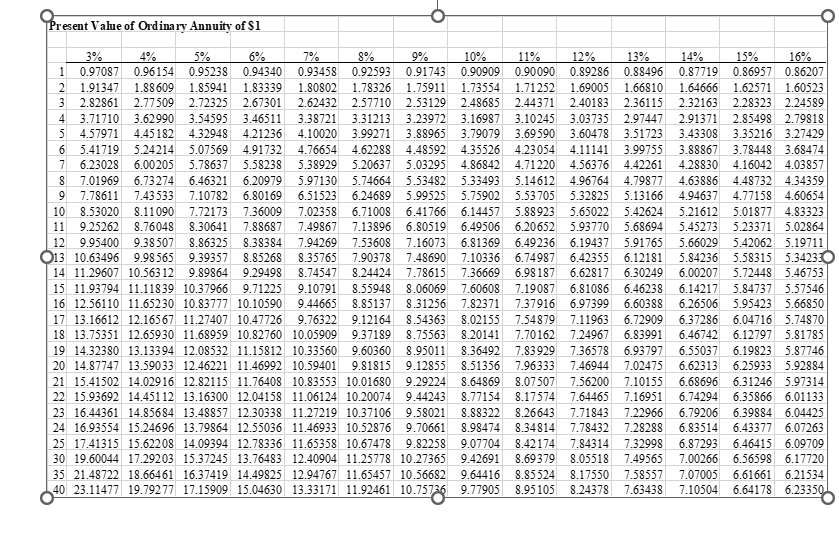

On January 1, 2022, Bunk Corporation issued $160,000,000 of 8-year, 9% bonds at a market (effective) interest rate of 12%. Interest on the bonds is payable on April 30th, August 31st, and December 31st. Bunk's fiscal year is the calendar year. Any discount or premium is amortized using the straight-line method. Required: 1. Prepare a detailed calculation of the present value of the bond using the present value tables on the next page. Do not round the table factors. 2. Prepare a detailed calculation of the price of the bond. Round answer to nearest whole dollar. 3. Prepare the journal entry to record the issuance of the bond. Journal entry description is not required. 4. Prepare the balance sheet presentation of the bond on December 31, 2023. Present Value Tables Present Value of $1 3% 4% 5% 6% 1 0.97087 0.96154 7 8 6 0.83748 0.79031 0.74622 0.70496 0.66634 0.81309 0.75992 0.71068 0.66506 0.62275 0.78941 0.73069 0.67684 0.62741 0.58201 0.70259 0.64461 0.59190 0.54393 0.67556 0.61391 0.55839 0.50835 0.64958 0.58468 0.52679 0.47509 0.62460 0.55684 0.49697 0.44401 0.60057 0.53032 0.46884 0.42888 0.38753 0.35049 0.31728 0.28748 0.26070 0.39711 0.35553 0.31863 0.28584 0.25668 0.23071 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.20416 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 2 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.78315 0.76947 0.75614 0.74316 3 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 0.69305 0.67497 0.65752 0.64066 4 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.61332 0.59208 0.57175 0.55229 5 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.54276 0.51937 0.49718 0.47611 0.63017 0.59627 0.56447 0.53464 0.50663 0.48032 0.45559 0.43233 0.41044 0.58349 0.54703 0.51316 0.48166 0.45235 0.42506 0.39964 0.37594 0.35383 0.54027 0.50187 0.46651 0.43393 0.40388 0.37616 0.35056 0.32690 0.30503 9 0.76642 0.50025 0.46043 0.42410 0.39092 0.36061 0.33288 0.30751 0.28426 0.26295 10 0.74409 0.46319 0.42241 0.38554 0.35218 0.32197 0.29459 0.26974 0.24718 0.22668 11 0.72242 0.23662 0.21494 0.19542 12 0.70138 0.20756 0.18691 0.16846 13 0.68095 0.18207 0.16253 0.14523 14 0.66112 0.57748 0.50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.23 199 0.20462 0.18068 0.15971 0.14133 0.12520 15 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.15989 0.14010 0.12289 0.10793 16 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.14150 0.12289 0.10686 0.09304 17 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 0.12522 0.10780 0.09293 0.08021 18 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.11081 0.09456 0.08081 0.06914 19 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.09806 0.08295 0.07027 0.05961 20 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.08678 0.07276 0.06110 0.05139 21 0.53755 0.43 883 0.35894 0.29416 0.24151 0.19866 0.16370 0.13513 0.11174 0.09256 0.07680 0.06383 0.05313 0.04430 22 0.52189 0.42196 0.34185 0.27751 0.22571 0.18394 0.15018 0.12285 0.10067 0.08264 0.06796 0.05599 0.04620 0.03819 23 0.50669 0.40573 0.32557 0.26180 0.21095 0.17032 0.13778 0.11168 0.09069 0.07379 0.06014 0.04911 0.04017 0.03292 24 0.49193 0.39012 0.31007 0.24698 0.19715 0.15770 0.12640 0.10153 0.08170 0,06588 0.05323 0.04308 0.03493 0.02838 25 0.47761 0.37512 0.29530 0.23300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 0.03038 0.02447 30 0.41199 0.30832 0.23138 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 0.02557 0.01963 0.01510 0.01165 35 0.35538 0.25342 0.18129 0.13011 0.09366 0.06763 0.04899 0.03558 0.02592 0.01894 0.01388 0.01019 0.00751 0.00555 40 0.30656 0.20829 0.14205 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.00753 0.00529 0.00373 0.00264 CREBES Present Value of Ordinary Annuity of $1 3% 5% 6% 7% 8% 9% 13% 14% 15% 16% 0.97087 0.96154 0.95238 0.94340 1.91347 1.88609 1.85941 1.83339 2.82861 2.77509 2.72325 1.64666 3.71710 3.62990 3.54595 5 4.57971 4.45182 4.32948 4.21236 4.10020 10% 11% 12% 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.66810 1.62571 1.60523 2.67301 2.62432 2.57710 2.53129 2.48685 2.44371 2.40183 2.36115 2.32163 2.28323 2.24589 3.46511 3.38721 3.31213 3.23972 3.16987 3.10245 3.03735 2.97447 2.91371 2.85498 2.79818 3.99271 3.88965 3.79079 3.69 590 3.60478 3.51723 3.43308 3.35216 3.27429 6 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.99755 3.88867 3.78448 3.68474 6.23028 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.42261 4.28830 4.16042 4.03857 7.01969 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.79877 4.63886 4.48732 4.34359 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 5.13166 4.94637 4.77158 4.60654 10 8.53020 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.42624 5.21612 5.01877 4.83323 11 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.68694 5.45273 5.23371 5.02864 12 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.91765 5.66029 5.42062 5.19711 O13 10.63496 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 6.12181 5.84236 5.58315 5.34233 14 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 6.30249 6.00207 5.72448 5.46753 15 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 6.46238 6.14217 5.84737 5.57546 16 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 6.60388 6.26506 5.95423 5.66850 17 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.72909 6.37286 6.04716 5.74870 18 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.83991 6.46742 6.12797 5.81785 19 14.32380 13.13394 12.08532 11.15812 10.33560 9.60360 8.95011 8.36492 7.83929 7.36578 6.93797 6.55037 6.19823 5.87746 20 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 7.02475 6.62313 6.25933 5.92884 21 15.41502 14.02916 12.82115 11.76408 10.83553 10.01680 9.29224 8.64869 8.07507 7.56200 7.10155 6.68696 6.31246 5.97314 22 15.93692 14.45112 13.16300 12.04158 11.06124 10.20074 9.44243 8.77154 8.17574 7.64465 7.16951 6.74294 6.35866 6.01133 23 16.44361 14.85684 13.48857 12.30338 11.27219 10.37106 9.58021 8.88322 8.26643 7.71843 7.22966 6.79206 6.39884 6.04425 24 16.93554 15.24696 13.79864 12.55036 11.46933 10.52876 9.70661 8.98474 8.34814 7.78432 7.28288 6.83514 6.43377 6.07263 25 17.41315 15.62208 14.09394 12.78336 11.65358 10.67478 9.82258 9.07704 8.42174 7.84314 7.32998 6.87293 6.46415 6.09709 30 19.60044 17.29203 15.37245 13.76483 12.40904 11.25778 10.27365 9.42691 8.69379 8.05518 7.49565 7.00266 6.56598 6.17720 35 21.48722 18.66461 16.37419 14.49825 12.94767 11.65457 10.56682 9.64416 8.85524 8.17550 7.58557 7.07005 6.61661 6.21534 8.24378 7.63438 7.10504 6.64178 6.23350, 40 23.11477 19.79277 17.15909 15.04630 13.33171 11.92461 10.75736 15736 9.77905 8.95105 123489 7 4%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started