Answered step by step

Verified Expert Solution

Question

1 Approved Answer

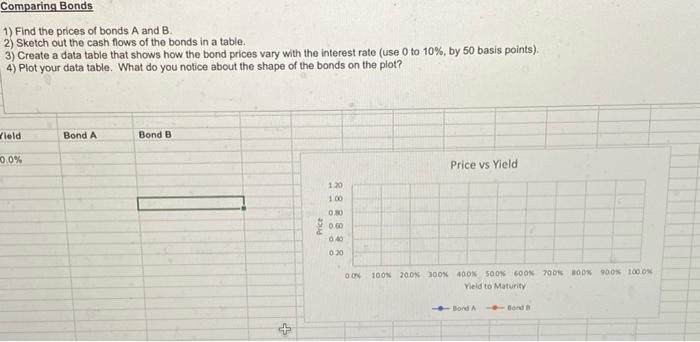

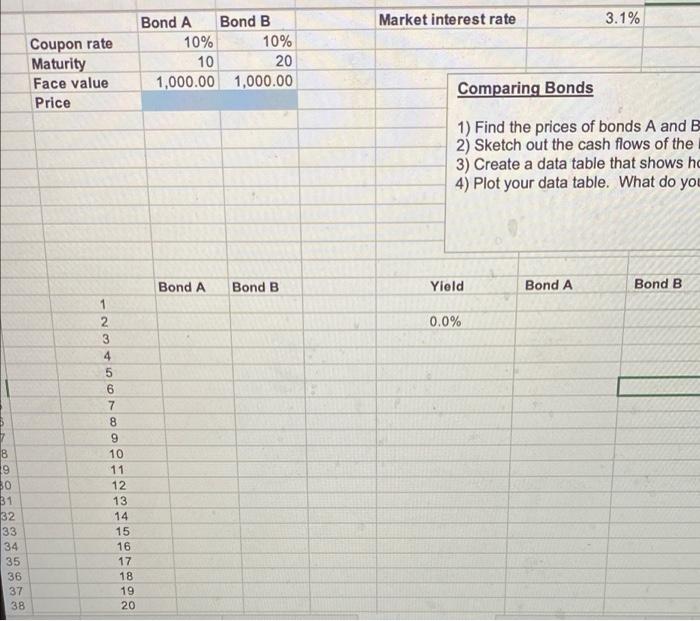

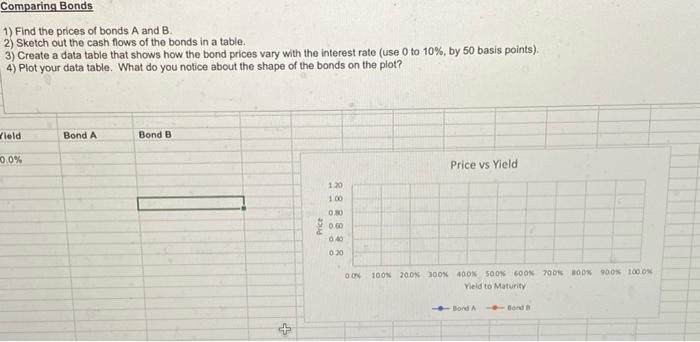

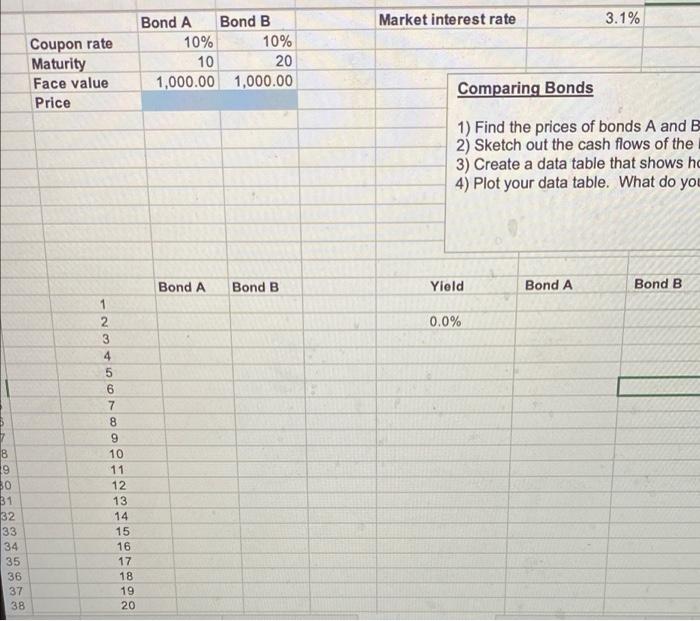

please include excel formulas and i will upvote Comparing Bonds 1) Find the prices of bonds A and B. 2) Sketch out the cash flows

please include excel formulas and i will upvote

Comparing Bonds 1) Find the prices of bonds A and B. 2) Sketch out the cash flows of the bonds in a table. 3) Create a data table that shows how the bond prices vary with the interest rate (use 0 to 10%, by 50 basis points) 4) Plot your data table. What do you notice about the shape of the bonds on the plot? Zeld Bond A Bond B 0.0% Price vs Yield 1:20 100 030 0.60 0.40 Price 020 DON 100N 2006 100% 400 500% GOON 7005 ROD 90 1000 Yield to Maturity Bond A - + Market interest rate 3.1% Coupon rate Maturity Face value Price Bond A Bond B 10% 10% 10 20 1,000.00 1,000.00 Comparing Bonds 1) Find the prices of bonds A and B 2) Sketch out the cash flows of the 3) Create a data table that shows hc 4) Plot your data table. What do you Bond A Bond B Yield Bond A Bond B 0.0% AN 19 30 31 32 33 34 35 36 37 38 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started