Answered step by step

Verified Expert Solution

Question

1 Approved Answer

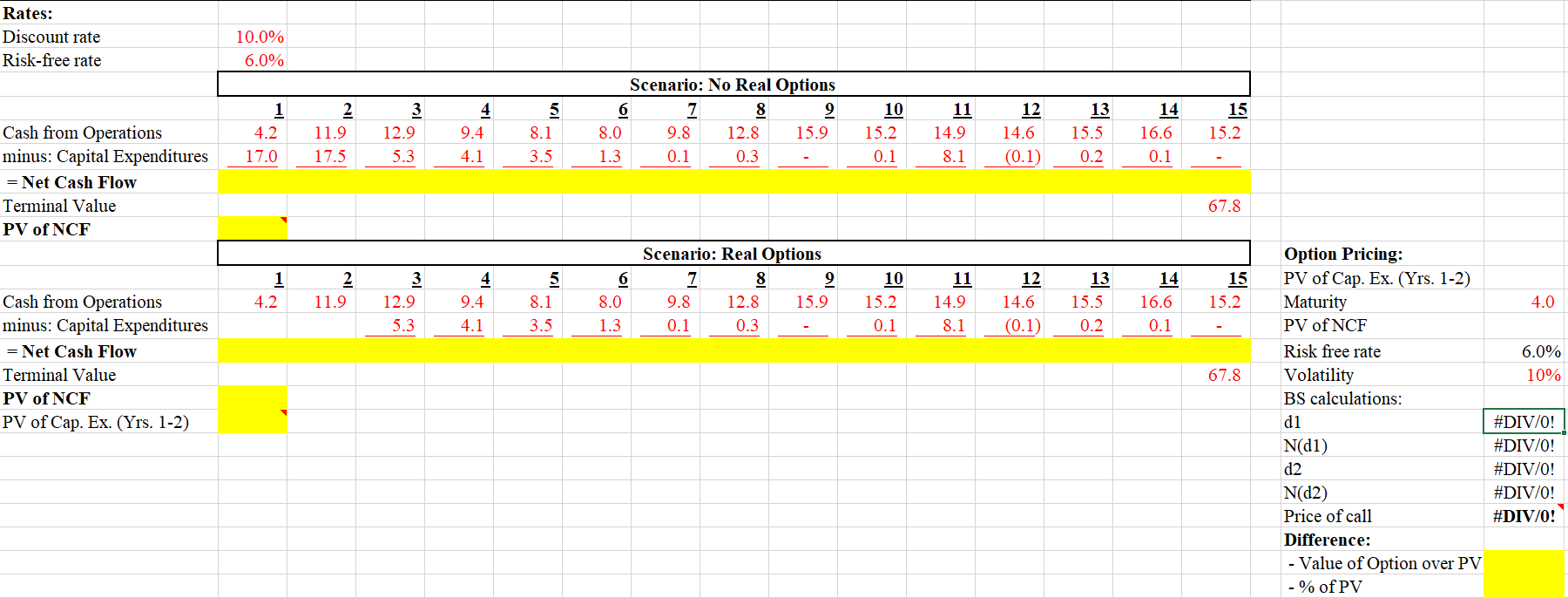

Please include excel formulas JTM Airlines, where you work, is looking at potentially buying more gates at their home airport. If it pays the airport

Please include excel formulas

JTM Airlines, where you work, is looking at potentially buying more gates at their home airport. If it pays the airport $1M, JTM will hold exclusive rights to buy those gates for $17M (at the start) and $17.5M (one year later) at any time in the next 4 years. The option expires at the end of year 4. JTM's discount rate is 10%. What is the NPV of the gate purchases if it bought them today? Use the data in the Excel template provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started