Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please include excel formulas to fill in the yellow blanks for this question! Thank you very much!!! A United States investor writes eight naked call

Please include excel formulas to fill in the yellow blanks for this question! Thank you very much!!!

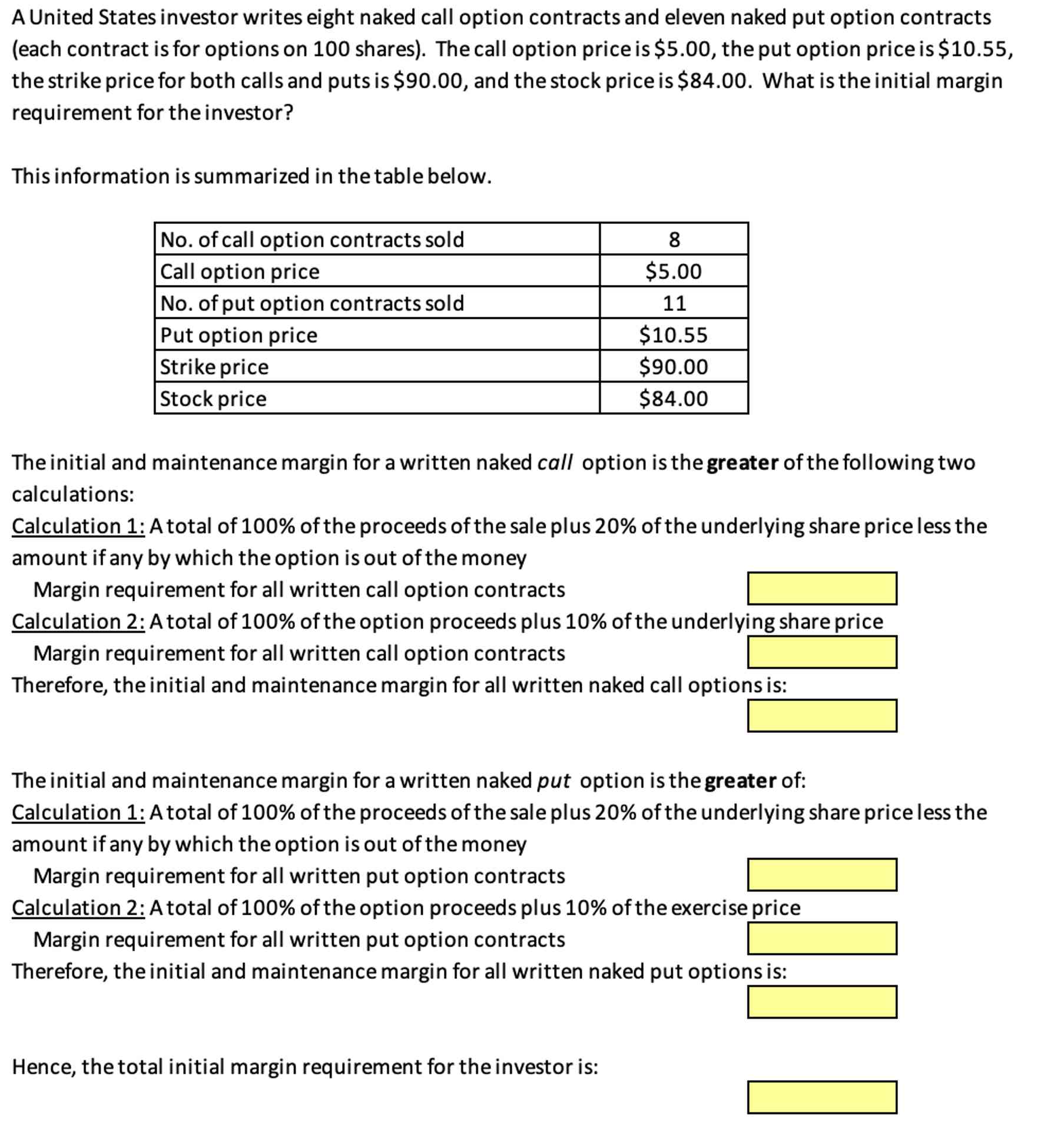

A United States investor writes eight naked call option contracts and eleven naked put option contracts

each contract is for options on shares The call option price is $ the put option price is $

the strike price for both calls and puts is $ and the stock price is $ What is the initial margin

requirement for the investor?

This information is summarized in the table below.

The initial and maintenance margin for a written naked call option is the greater of the following two

calculations:

Calculation : A total of of the proceeds of the sale plus of the underlying share price less the

amount if any by which the option is out of the money

Margin requirement for all written call option contracts

Calculation : A total of of the option proceeds plus of the underlying share price

Margin requirement for all written call option contracts

Therefore, the initial and maintenance margin for all written naked call options is:

The initial and maintenance margin for a written naked put option is the greater of:

Calculation : A total of of the proceeds of the sale plus of the underlying share price less the

Please include excel formulas for the yellow blanks! Thank you!!

Margin requirement for all written put option contracts

Calculation : A total of of the option proceeds plus of the exercise price

Margin requirement for all written put option contracts

Therefore, the initial and maintenance margin for all written naked put options is:

Hence, the total initial margin requirement for the investor is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started