please include formulas!

please include formulas!

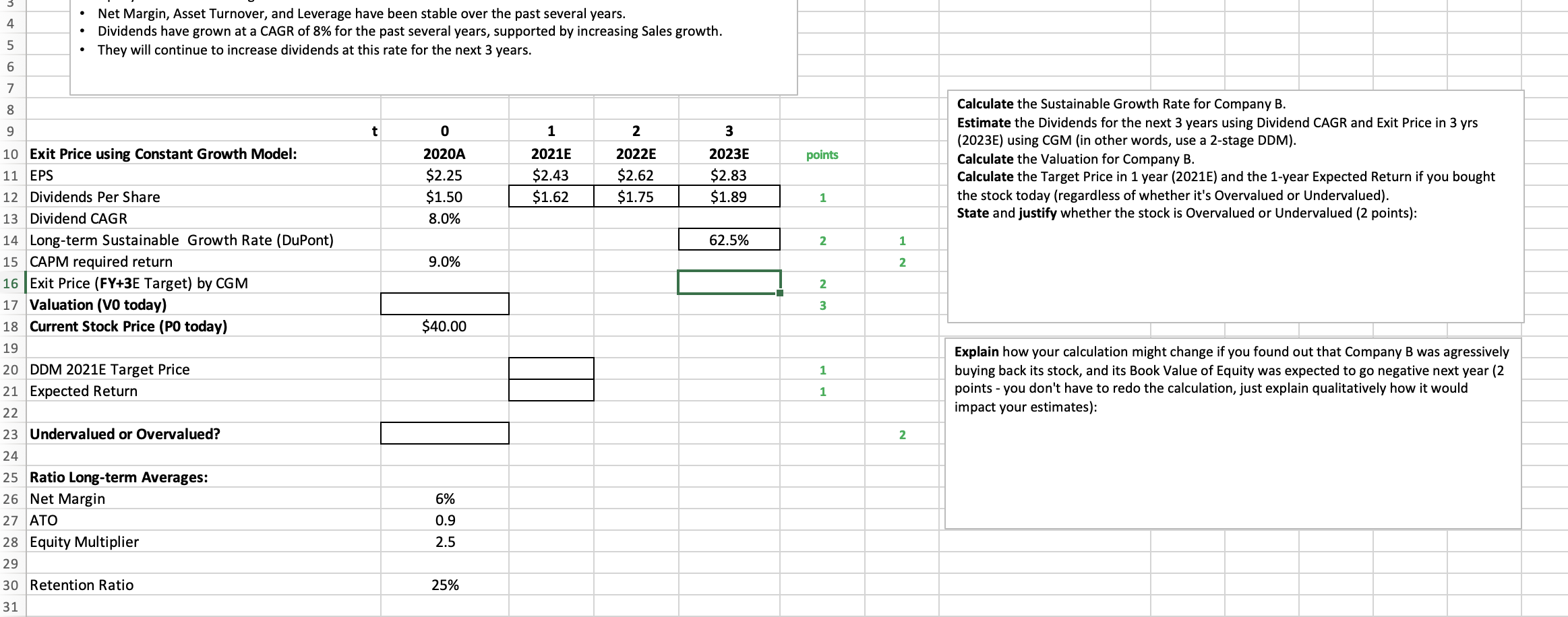

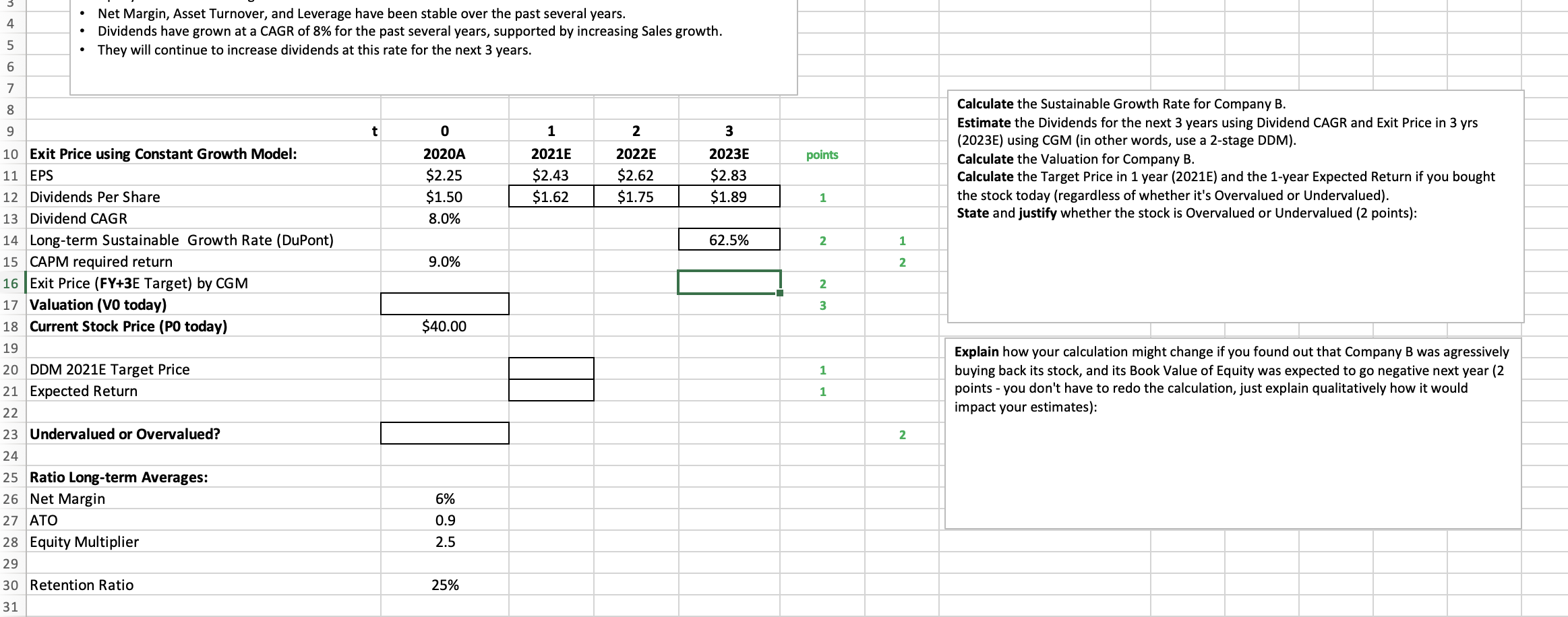

4 Net Margin, Asset Turnover, and Leverage have been stable over the past several years. Dividends have grown at a CAGR of 8% for the past several years, supported by increasing Sales growth. They will continue to increase dividends at this rate for the next 3 years. 5 6 7 8 9 t 0 1 2 3 2021E points 2020A $2.25 $1.50 8.0% 2022E $2.62 $1.75 $2.43 $1.62 Calculate the Sustainable Growth Rate for Company B. Estimate the Dividends for the next 3 years using Dividend CAGR and Exit Price in 3 yrs (2023E) using CGM (in other words, use a 2-stage DDM). Calculate the Valuation for Company B. Calculate the Target Price in 1 year (2021E) and the 1-year Expected Return if you bought the stock today (regardless of whether it's Overvalued or Undervalued). State and justify whether the stock is Overvalued or Undervalued (2 points): 2023E $2.83 $1.89 1 62.5% 2 NP 9.0% w N $40.00 1 10 Exit Price using Constant Growth Model: 11 EPS 12 Dividends Per Share 13 Dividend CAGR 14 Long-term Sustainable Growth Rate (DuPont) 15 CAPM required return 16 Exit Price (FY+3E Target) by CGM 17 Valuation (V0 today) 18 Current Stock Price (PO today) 19 20 DDM 2021E Target Price 21 Expected Return 22 23 Undervalued or Overvalued? 24 25 Ratio Long-term Averages: 26 Net Margin 27 ATO 28 Equity Multiplier 29 30 Retention Ratio 31 1 Explain how your calculation might change if you found out that Company B was agressively buying back its stock, and its Book Value of Equity was expected to go negative next year (2 points - you don't have to redo the calculation, just explain qualitatively how it would impact your estimates): 1 2 6% 0.9 2.5 25% 4 Net Margin, Asset Turnover, and Leverage have been stable over the past several years. Dividends have grown at a CAGR of 8% for the past several years, supported by increasing Sales growth. They will continue to increase dividends at this rate for the next 3 years. 5 6 7 8 9 t 0 1 2 3 2021E points 2020A $2.25 $1.50 8.0% 2022E $2.62 $1.75 $2.43 $1.62 Calculate the Sustainable Growth Rate for Company B. Estimate the Dividends for the next 3 years using Dividend CAGR and Exit Price in 3 yrs (2023E) using CGM (in other words, use a 2-stage DDM). Calculate the Valuation for Company B. Calculate the Target Price in 1 year (2021E) and the 1-year Expected Return if you bought the stock today (regardless of whether it's Overvalued or Undervalued). State and justify whether the stock is Overvalued or Undervalued (2 points): 2023E $2.83 $1.89 1 62.5% 2 NP 9.0% w N $40.00 1 10 Exit Price using Constant Growth Model: 11 EPS 12 Dividends Per Share 13 Dividend CAGR 14 Long-term Sustainable Growth Rate (DuPont) 15 CAPM required return 16 Exit Price (FY+3E Target) by CGM 17 Valuation (V0 today) 18 Current Stock Price (PO today) 19 20 DDM 2021E Target Price 21 Expected Return 22 23 Undervalued or Overvalued? 24 25 Ratio Long-term Averages: 26 Net Margin 27 ATO 28 Equity Multiplier 29 30 Retention Ratio 31 1 Explain how your calculation might change if you found out that Company B was agressively buying back its stock, and its Book Value of Equity was expected to go negative next year (2 points - you don't have to redo the calculation, just explain qualitatively how it would impact your estimates): 1 2 6% 0.9 2.5 25%

please include formulas!

please include formulas!