Please include formulas and explanation to get to each answer.

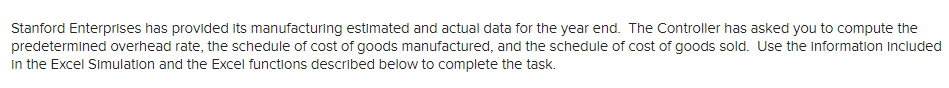

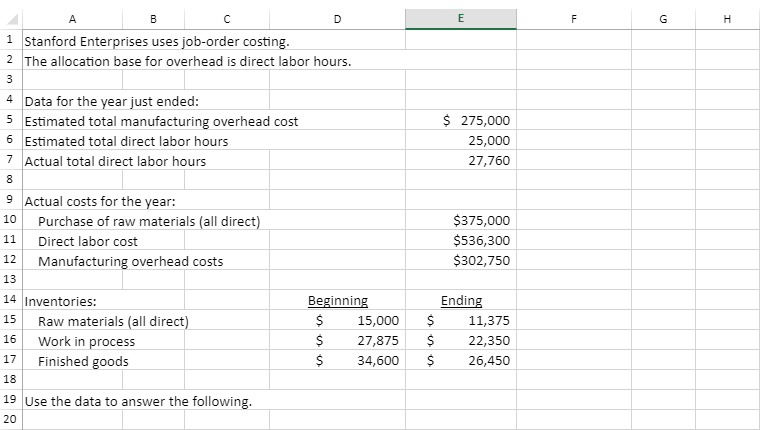

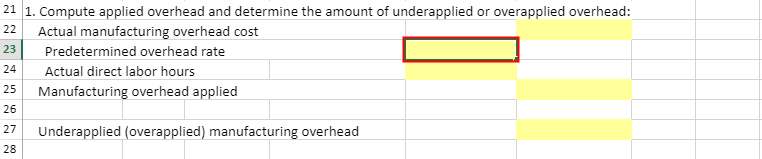

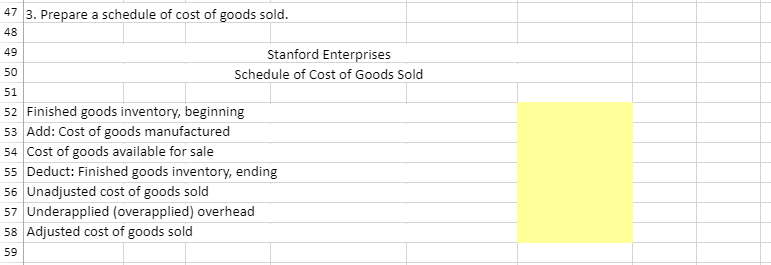

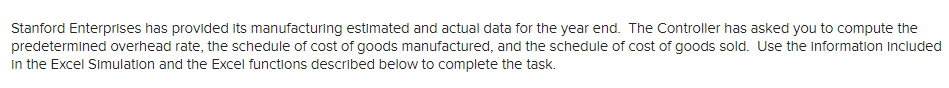

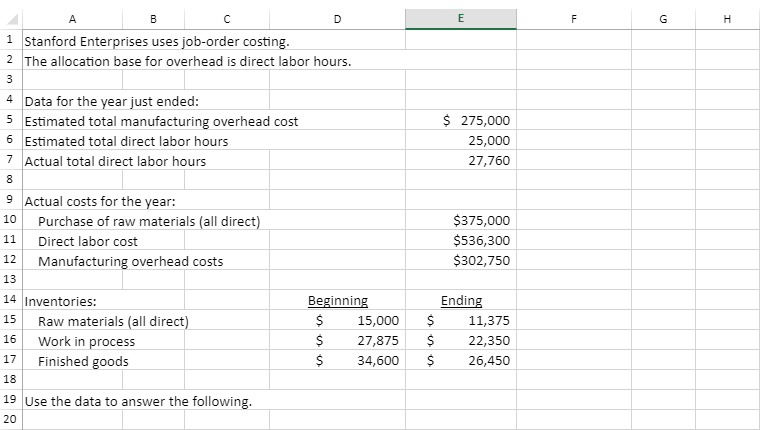

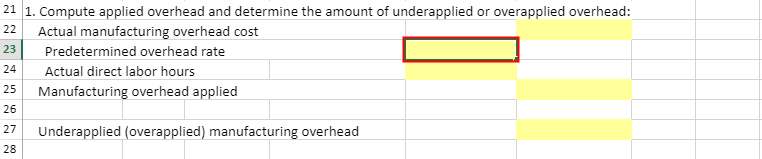

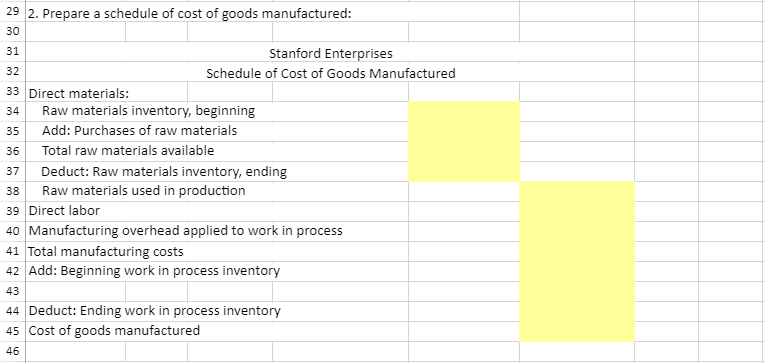

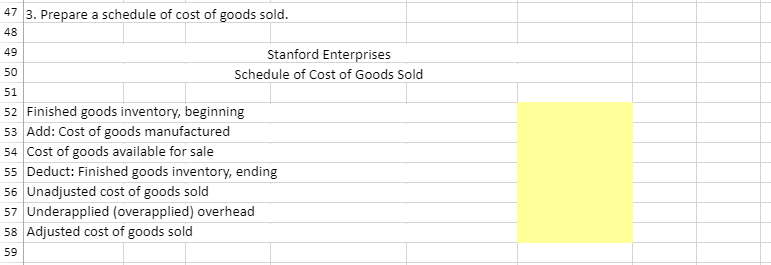

Stanford Enterprises has provided its manufacturing estimated and actual data for the year end. The Controller has asked you to compute the predetermined overhead rate, the schedule of cost of goods manufactured, and the schedule of cost of goods sold. Use the Information Included In the Excel Simulation and the Excel functions described below to complete the task. 1 Stanford Enterprises uses job-order costing. 2 The allocation base for overhead is direct labor hours. 4 Data for the year just ended: 5 Estimated total manufacturing overhead cost \begin{tabular}{c|l} 6 & Estimated total direct labc \\ 7 & Actual total direct labor ho \\ 8 & \\ \hline 9 & Actual costs for the year: \\ \hline 10 & Purchase of \end{tabular} \begin{tabular}{l|l|} \hline 10 & Purchase of raw materials \\ 11 & Direct labor cost \\ \hline 12 & Manufacturing overhead \\ 13 & \\ 14 & Inventories: \\ 15 & Raw materials (all direct) \\ \hline 15 & Work in process \end{tabular} 16 Work in process 17 Finished goods 18 19 Use the data to answer the following. 21 1. Compute applied overhead and determine the amount of underapplied or overapplied overhead: Actual manufacturing overhead cost Predetermined overhead rate Actual direct labor hours Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead 29 2. Prepare a schedule of cost of goods manufactured: \begin{tabular}{l|l|l|l} \hline 30 & 2. Prepare a schedule of cost of goods manufactured: \\ \hline 31 & Stanford Enterprises \\ \hline 32 & & Schedule of Cost of Goods Man \\ \hline \end{tabular} 32 Schedule of Cost of Goods Manufactured 33 Direct materials: 34 Raw materials inventory, beginning 35 Add: Purchases of raw materials 36 Total raw materials available 37 Deduct: Raw materials inventory, ending 38 Raw materials used in production 39 Direct labor 40 Manufacturing overhead applied to work in process 41 Total manufacturing costs 42 Add: Beginning work in process inventory 44 Deduct: Ending work in process inventory 45 Cost of goods manufactured 47 3. Prepare a schedule of cost of goods sold. Stanford Enterprises Schedule of Cost of Goods Sold Finished goods inventory, beginning 53 Add: Cost of goods manufactured 54 Cost of goods available for sale 55 Deduct: Finished goods inventory, ending 56 Unadjusted cost of goods sold 57 Underapplied (overapplied) overhead 58 Adjusted cost of goods sold