Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE INCLUDE FORMULAS FOR EACH CELL!! Determine the cost assigned to ending inventory and to cost of goods sold using the FIFO method. Sydney Corporation

PLEASE INCLUDE FORMULAS FOR EACH CELL!!

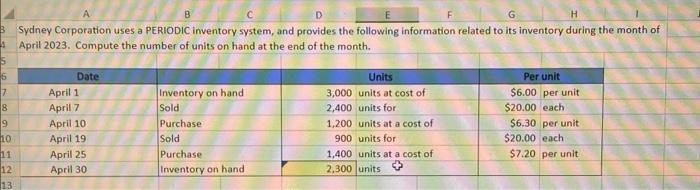

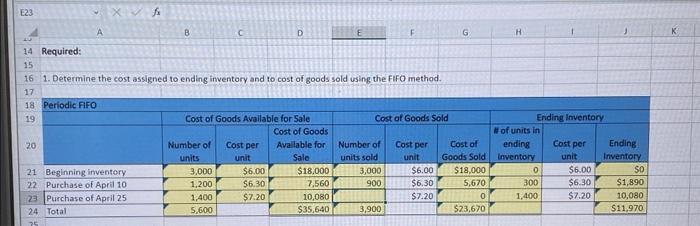

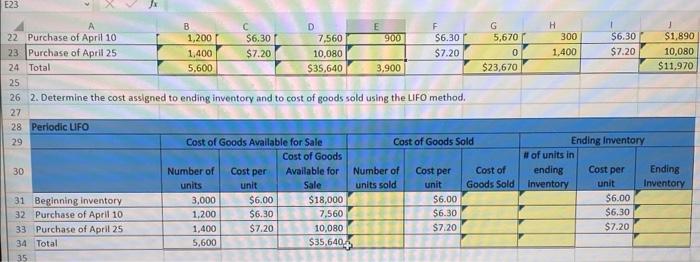

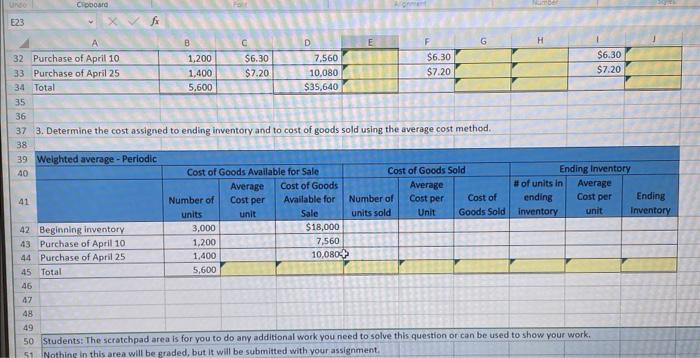

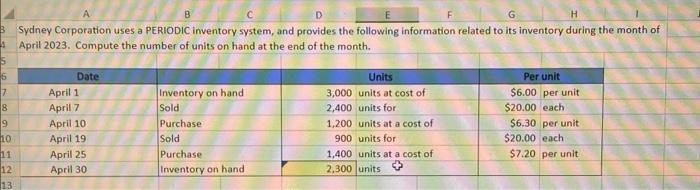

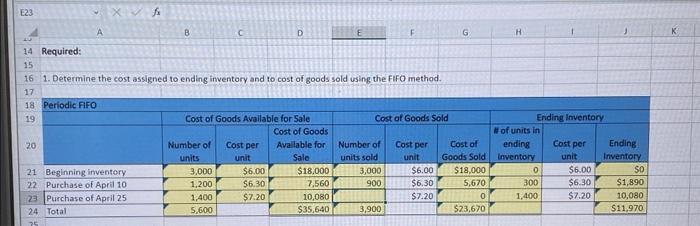

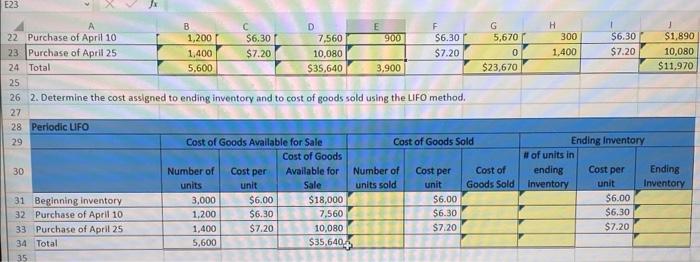

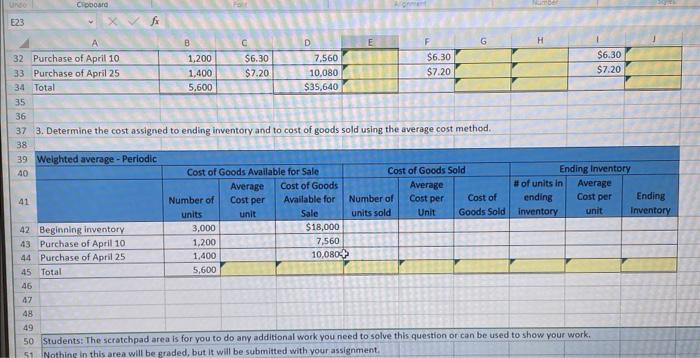

Determine the cost assigned to ending inventory and to cost of goods sold using the FIFO method. Sydney Corporation uses a PERIODIC inventory system, and provides the following information related to its inventory during the month of April 2023. Compute the number of units on hand at the end of the month. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline 22 & Purchase of April 10 & B1,200 & \begin{tabular}{l} C \\ $6.30I \end{tabular} & \begin{tabular}{l} D \\ 7,560 \end{tabular} & E 900 & \begin{tabular}{l} F \\ $6.30 \end{tabular} & 5,670G & H300 & $6.30 & $1,890 \\ \hline 23. & Purchase of April 25 & 1,400 & $7.20 & 10,080 & & $7.20 & 0 & 1,400 & $7.20 & 10,080 \\ \hline 24 & Total & 5,600 & & $35,640 & 3.900 & & $23,670 & & & $11,970 \\ \hline 25 & & & & 3. & & & & & & \\ \hline 26 & \multicolumn{7}{|c|}{ 2. Determine the cost assigned to ending inventory and to cost of goods sold using the LIFO method. } & & & \\ \hline 27 & & & & & & & & & & \\ \hline 28 & \multicolumn{10}{|l|}{ Periodic UFO } \\ \hline 29 & & \multicolumn{3}{|c|}{ Cost of Goods Avaliable for Sale } & \multicolumn{3}{|c|}{ Cost of Goods Sold } & \multicolumn{3}{|c|}{ Ending Imventory } \\ \hline 30 & & \begin{tabular}{c} Number of \\ units \end{tabular} & \begin{tabular}{l} Cost per \\ unit \end{tabular} & \begin{tabular}{c} Cost of Goods \\ Avallable for \\ Sale \end{tabular} & \begin{tabular}{l} Number of \\ units sold \end{tabular} & \begin{tabular}{l} Cost per \\ unit \end{tabular} & \begin{tabular}{l} Cost of \\ Goods Sold \end{tabular} & \begin{tabular}{c} \# of units in \\ ending \\ Inventory \end{tabular} & \begin{tabular}{l} Cost per \\ unit \end{tabular} & \begin{tabular}{l} Ending \\ Inventory \end{tabular} \\ \hline 31 & Beginning inventory & 3,000 & $6,00 & $18,000 & & $6.00 & & & $6.00 & \\ \hline 32 & Purchase of Aprll 10 & 1.200 & 56.30 & 7,560 & 2x & $6.30 & & 7 & $6,30 & \\ \hline 33 & Purchase of April 25 & 1,400 & $7.20 & 10,080 & E= & $7.20 & & & $7.20 & \\ \hline 34 & Total & 5,600 & & $35,640 & & & & & & r \\ \hline 35 & & & & 67 & & & & & & \\ \hline \end{tabular} 3. Determine the cost assigned to ending inventory and to cost of goods sold using the average cost method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started