Please include formulas thank you

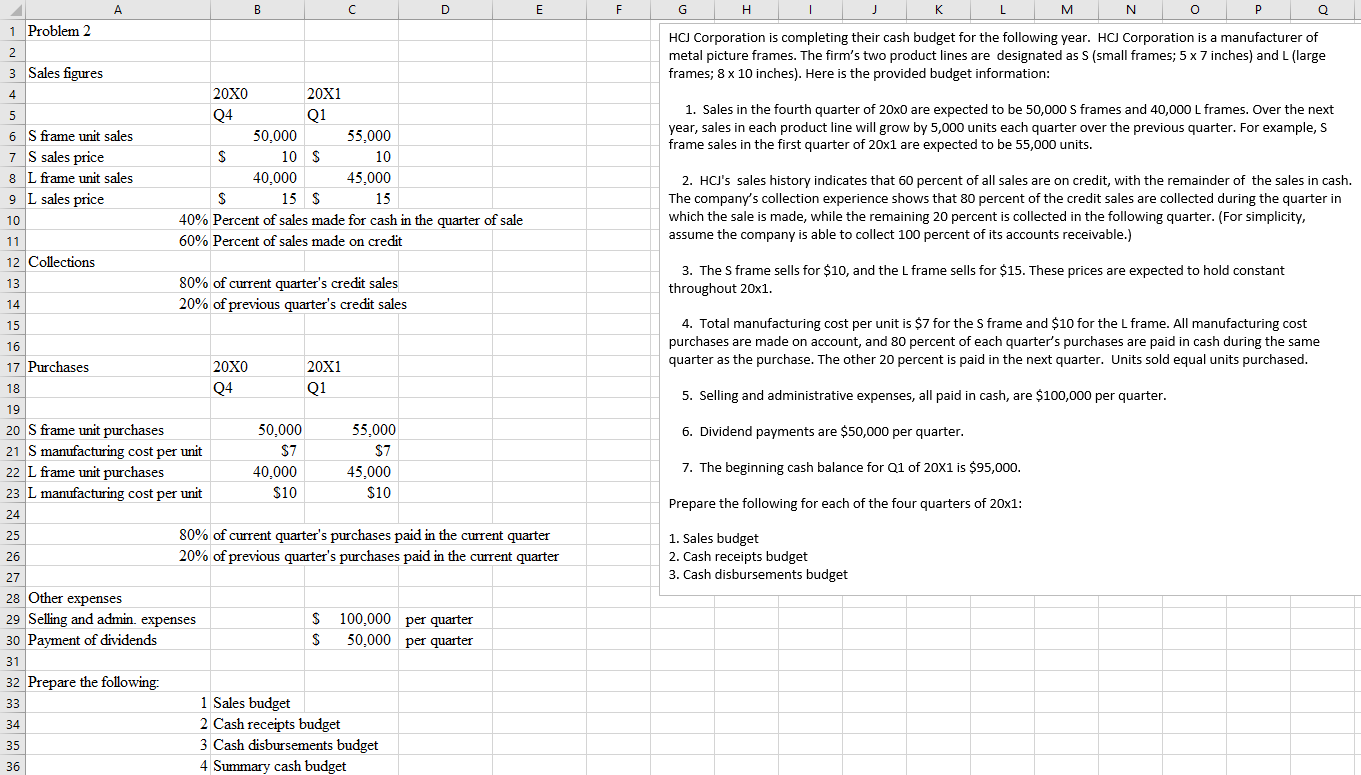

A B C D E F G H K M N O P Q Problem 2 IN HCJ Corporation is completing their cash budget for the following year. HCJ Corporation is a manufacturer of w metal picture frames. The firm's two product lines are designated as S (small frames; 5 x 7 inches) and L (large Sales figures frames; 8 x 10 inches). Here is the provided budget information: 20XO 20X1 Q4 Q1 1. Sales in the fourth quarter of 20x0 are expected to be 50,000 S frames and 40,000 L frames. Over the next 6 S frame unit sales 50,000 55,000 year, sales in each product line will grow by 5,000 units each quarter over the previous quarter. For example, S 7 S sales price S 10 S 10 frame sales in the first quarter of 20x1 are expected to be 55,000 units. 8 L frame unit sales 40.000 45.000 2. HCJ's sales history indicates that 60 percent of all sales are on credit, with the remainder of the sales in cash. 9 L sales price S 15 S 15 The company's collection experience shows that 80 percent of the credit sales are collected during the quarter in 10 40% Percent of sales made for cash in the quarter of sale which the sale is made, while the remaining 20 percent is collected in the following quarter. (For simplicity, 11 60% Percent of sales made on credit assume the company is able to collect 100 percent of its accounts receivable.) 12 Collections 13 80% of current quarter's credit sales 3. The S frame sells for $10, and the L frame sells for $15. These prices are expected to hold constant 14 20% of previous quarter's credit sales throughout 20x1. 15 4. Total manufacturing cost per unit is $7 for the S frame and $10 for the L frame. All manufacturing cost 16 purchases are made on account, and 80 percent of each quarter's purchases are paid in cash during the same 17 Purchases 20XO 20X1 quarter as the purchase. The other 20 percent is paid in the next quarter. Units sold equal units purchased 18 Q4 Q1 19 5. Selling and administrative expenses, all paid in cash, are $100,000 per quarter. 20 S frame unit purchases 50,000 55.000 6. Dividend payments are $50,000 per quarter. 21 S manufacturing cost per unit $7 $7 22 L frame unit purchases 40.000 45,000 7. The beginning cash balance for Q1 of 20X1 is $95,000. 23 L manufacturing cost per unit $10 $10 24 Prepare the following for each of the four quarters of 20x1: 25 80% of current quarter's purchases paid in the current quarter 1. Sales budget 26 20% of previous quarter's purchases paid in the current quarter 2. Cash receipts budget 27 3. Cash disbursements budget 28 Other expenses 29 Selling and admin. expenses 100,000 per quarter 30 Payment of dividends 50,000 per quarter 31 32 Prepare the following: 33 1 Sales budget 34 2 Cash receipts budget 35 3 Cash disbursements budget 36 4 Summary cash budget