Answered step by step

Verified Expert Solution

Question

1 Approved Answer

***PLEASE INCLUDE FORMULAS...IF THERE IS ANY OTHER NEEDED FROM ME, PLEASE LET ME KNOW. THANK YOU SO MUCH*** Argo Airlines, a privately held firm, is

***PLEASE INCLUDE FORMULAS...IF THERE IS ANY OTHER NEEDED FROM ME, PLEASE LET ME KNOW. THANK YOU SO MUCH***

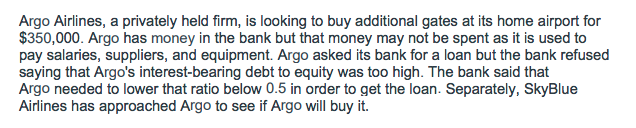

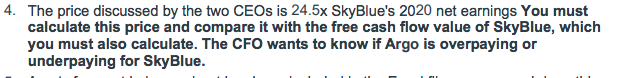

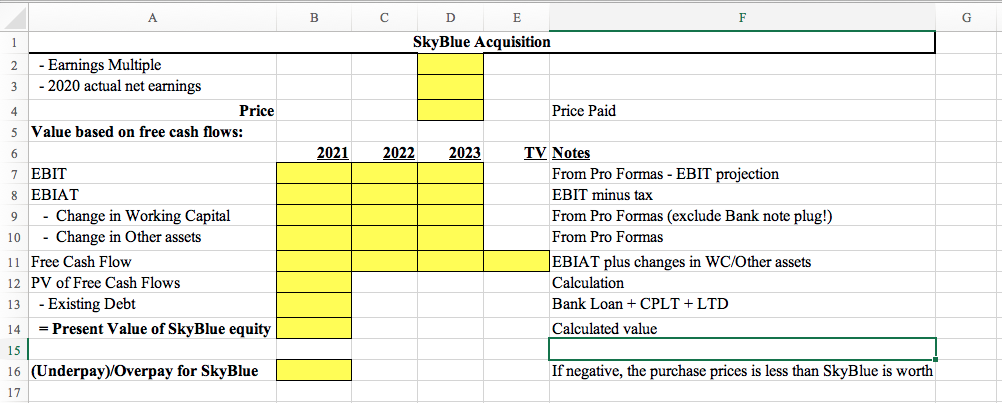

Argo Airlines, a privately held firm, is looking to buy additional gates at its home airport for $350,000. Argo has money in the bank but that money may not be spent as it is used to pay salaries, suppliers, and equipment. Argo asked its bank for a loan but the bank refused saying that Argo's interest-bearing debt to equity was too high. The bank said that Argo needed to lower that ratio below 0.5 in order to get the loan. Separately, SkyBlue Airlines has approached Argo to see if Argo will buy it. 4. The price discussed by the two CEOs is 24.5x SkyBlue's 2020 net earnings You must calculate this price and compare it with the free cash flow value of SkyBlue, which you must also calculate. The CFO wants to know if Argo is overpaying or underpaying for SkyBlue. B G DE SkyBlue Acquisition 4 Price Paid 2021 2022 2023 1 2 Earnings Multiple 3 -2020 actual net earnings Price 5 Value based on free cash flows: 6 7 EBIT 8 EBIAT 9 - Change in Working Capital 10 - Change in Other assets 11 Free Cash Flow 12 PV of Free Cash Flows 13 - Existing Debt 14 = Present Value of SkyBlue equity 15 16 (Underpay)/Overpay for SkyBlue 17 TV Notes From Pro Formas - EBIT projection EBIT minus tax From Pro Formas (exclude Bank note plug!) From Pro Formas EBIAT plus changes in WC/Other assets Calculation Bank Loan + CPLT + LTD Calculated value If negative, the purchase prices is less than SkyBlue is worth Argo Airlines, a privately held firm, is looking to buy additional gates at its home airport for $350,000. Argo has money in the bank but that money may not be spent as it is used to pay salaries, suppliers, and equipment. Argo asked its bank for a loan but the bank refused saying that Argo's interest-bearing debt to equity was too high. The bank said that Argo needed to lower that ratio below 0.5 in order to get the loan. Separately, SkyBlue Airlines has approached Argo to see if Argo will buy it. 4. The price discussed by the two CEOs is 24.5x SkyBlue's 2020 net earnings You must calculate this price and compare it with the free cash flow value of SkyBlue, which you must also calculate. The CFO wants to know if Argo is overpaying or underpaying for SkyBlue. B G DE SkyBlue Acquisition 4 Price Paid 2021 2022 2023 1 2 Earnings Multiple 3 -2020 actual net earnings Price 5 Value based on free cash flows: 6 7 EBIT 8 EBIAT 9 - Change in Working Capital 10 - Change in Other assets 11 Free Cash Flow 12 PV of Free Cash Flows 13 - Existing Debt 14 = Present Value of SkyBlue equity 15 16 (Underpay)/Overpay for SkyBlue 17 TV Notes From Pro Formas - EBIT projection EBIT minus tax From Pro Formas (exclude Bank note plug!) From Pro Formas EBIAT plus changes in WC/Other assets Calculation Bank Loan + CPLT + LTD Calculated value If negative, the purchase prices is less than SkyBlue is worthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started