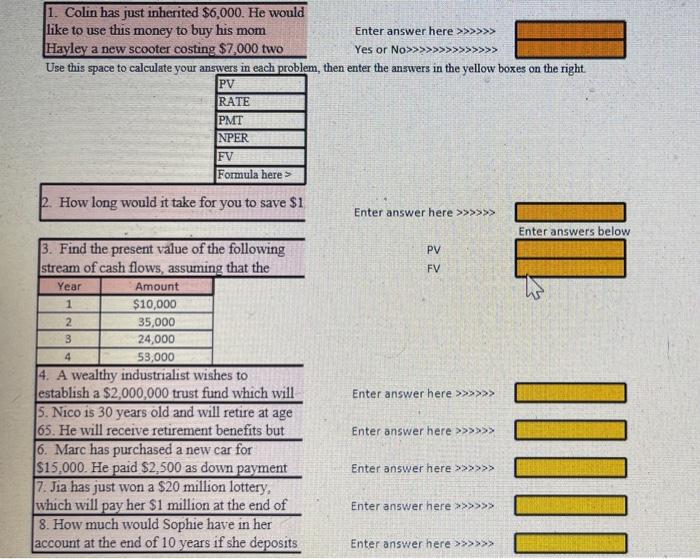

please include functions used to solve each problem.

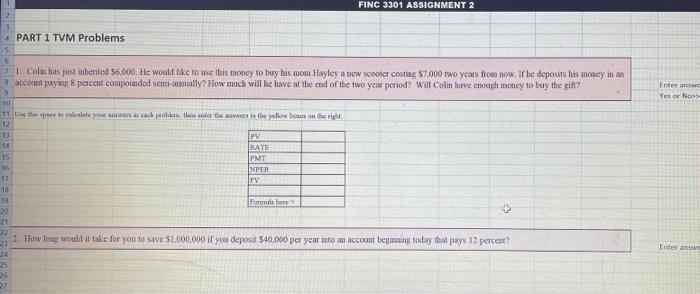

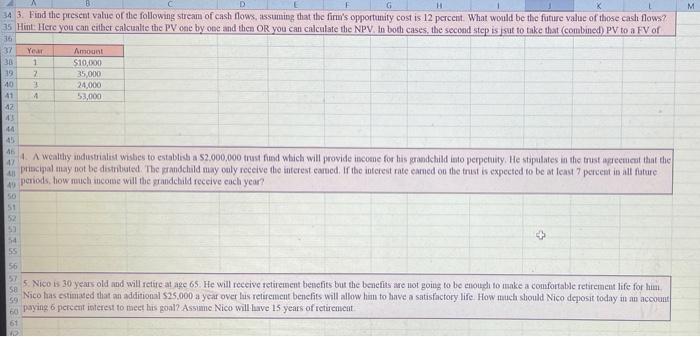

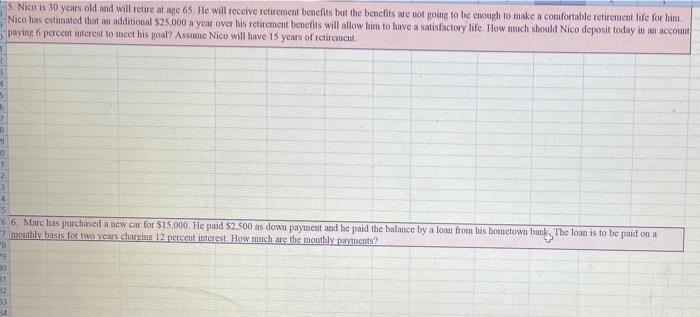

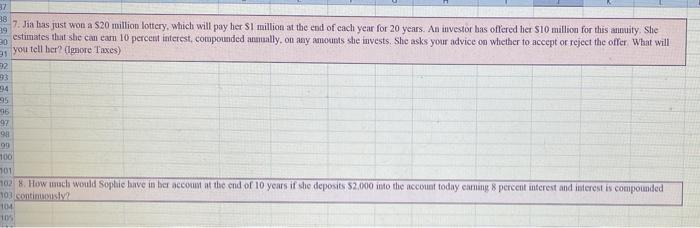

1. Colin has just inherited $6,000. He would like to use this money to buy his mom Enter answer here >>>>>> Hayley a new scooter costing $7,000 two Yes or No>>>>>> Use this space to calculate your answers in each problem, then enter the answers in the yellow boxes on the right PV RATE PMT NPER FV Formula here > 1. How long would it take for you to save $1 Enter answer here >>>>>> ter answers below PV FV 4 3. Find the present value of the following stream of cash flows, assuming that the Year Amount 1 $10,000 2 35,000 3 24,000 53,000 4. A wealthy industrialist wishes to establish a $2,000,000 trust fund which will 5. Nico is 30 years old and will retire at age 65. He will receive retirement benefits but 6. Marc has purchased a new car for $15,000. He paid $2,500 as down payment 7. Jia has just won a $20 million lottery, which will pay her $1 million at the end of 8. How much would Sophie have in her account at the end of 10 years if she deposits Enter answer here >>>>>> Enter answer here >>>>>> Enter answer here >>>>>> Enter answer here >>>>>> Enter answer here >>>>>> FINC 3301 ASSIGNMENT 2 PART 1 TVM Problems Eeterans Yet or NOS Y Cola has just inherited 56,000. He would like to use this money to buy his mom Hayley a new scooter costing 57.000 Two years from now. If he deposits his money in a & account paying 8 percent compounded semi-anually? How much will be have at the end of the two year period? Will Colin have enough money to buy the gift? 0 10 11 teto lee you in a problem that in the won the right 12 PV 14 RAYE 15 PMI 16 NPER 17 111 19 Former 30 + 21 72 2 How long would it take for you to save $1.000.000 if you deposit 540,000 per year to an account being today that pays 12 percent 24 25 26 Enteras M G H 34 3. Find the present value of the following stream of cash flows, assuming that the fina's opportunity cost is 12 percent. What would be the future value of those cash flows? 35 Hint. Here you can either calcunite the PV one by one and then OR you can calculate the NPV. In both cases, the second step issut to take that combined) PV to a FV of 36 37 Year Amount 30 1 $10,000 19 2 35,000 40 3 24,000 41 53,000 42 45 45 45 4. A wealthy industrialist wishes to establish a $2,000,000 trust fund which will provide income for his grandchild into perperity. He stipulates in the trust agreement that the 47 principal may not be distributed. The grandchild may only receive the interest earned. If the interest rate carned on the trust is expected to be at least 7 percent in all future 49 periods. how much income will the grandchild receive each year? 50 51 52 50 54 SS 56 57 5 Nico is 30 years old and will retire at age 65. He will receive retirement benefits but the benefits are not going to be enoud to make a comfortable retirement life for him. S8 Nico has estimated that an additional $25.000 a year over his retirement benefits will allow him to have a satisfactory life. How much should Nico deposit today in an account 59 bo paying 6 percent interest to meet his goal? Assim Nico will love 15 years of retirement 61 5 Nico is 30 years old and will retire at age 65. He will receive retirement benefits but the benefits are not going to be chough to make a comfortable retirement life for him Nico has estimated that an additional $25.000 a year over his retirement benefits will allow him to have a satisfactory life How much should Nico deposit today in an account paying 6 percent interest to meet his goal? Assume Nico will have 15 years of retirement 5 1 3 9 1 2 3 4 5 66. Marc has purchased a new car for $15,000. He paid $2.500 as down payment and he paid the balance by a loan from his bonitown bank, The loan is to be paid on a 7 monthly basis for two years chargine 12 percent interest. How much are the monthly payments? - 8 9 30 31 82 33 34 30 32 38 7. Jia has just won a $20 million lottery, which will pay her sl million at the end of each year for 20 years. An investor has offered her $10 million for this annuity Shie 99 estimates that she can cam 10 percent interest, compounded annually, on any amounts she invests. She asks your advice on whicther to accept or reject the offer What will 31 you tell her? (Ignore Taxes) 332 93 34 95 16 -97 9 100 701 102 8. How much would Sophie have in her account at the end of 10 years if she deposits 52.000 into the account today caming 8 percent interest and interest is compounded 103 continues 104 10