Please include the answers highlighted

Please include the answers highlighted

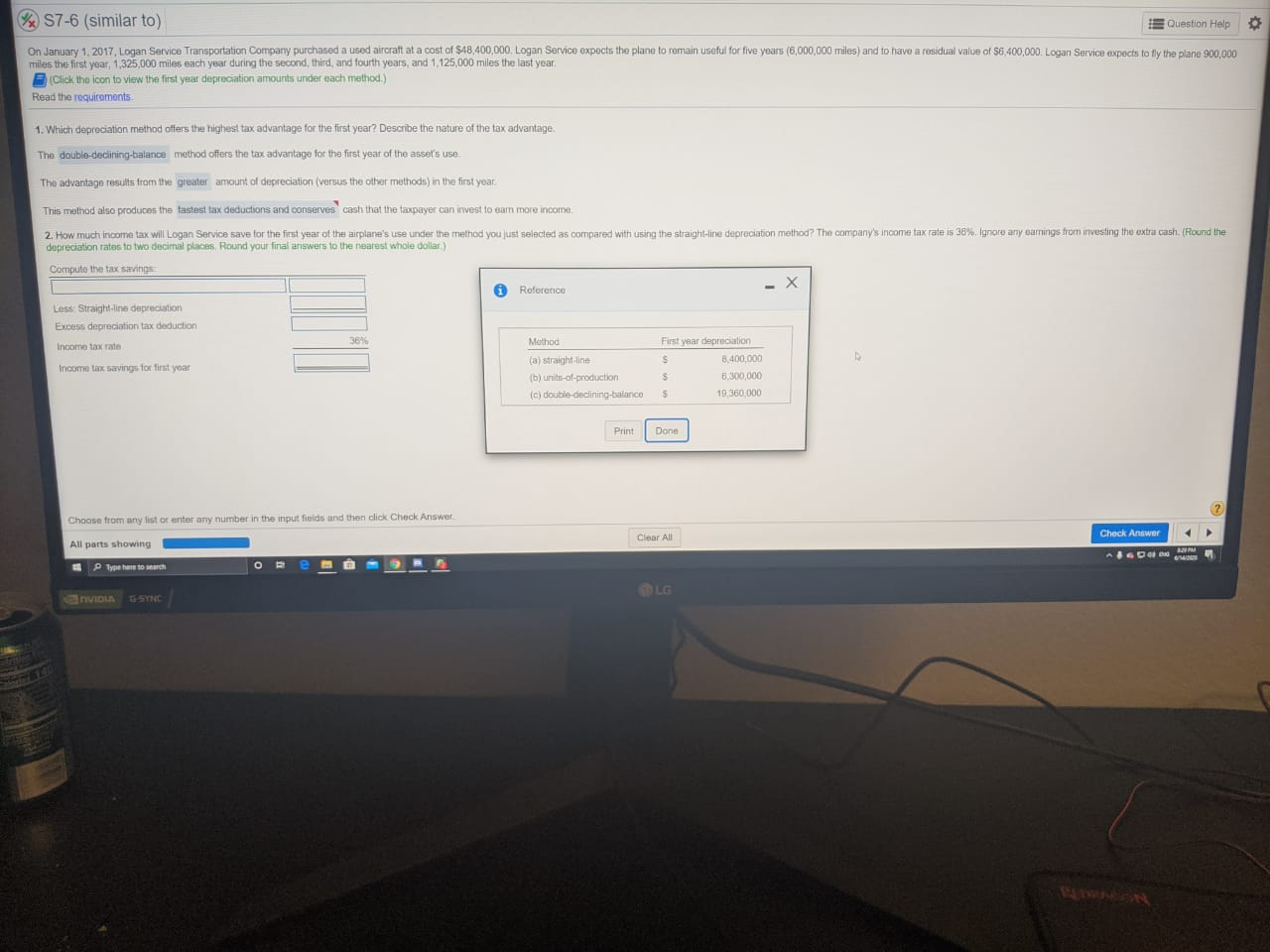

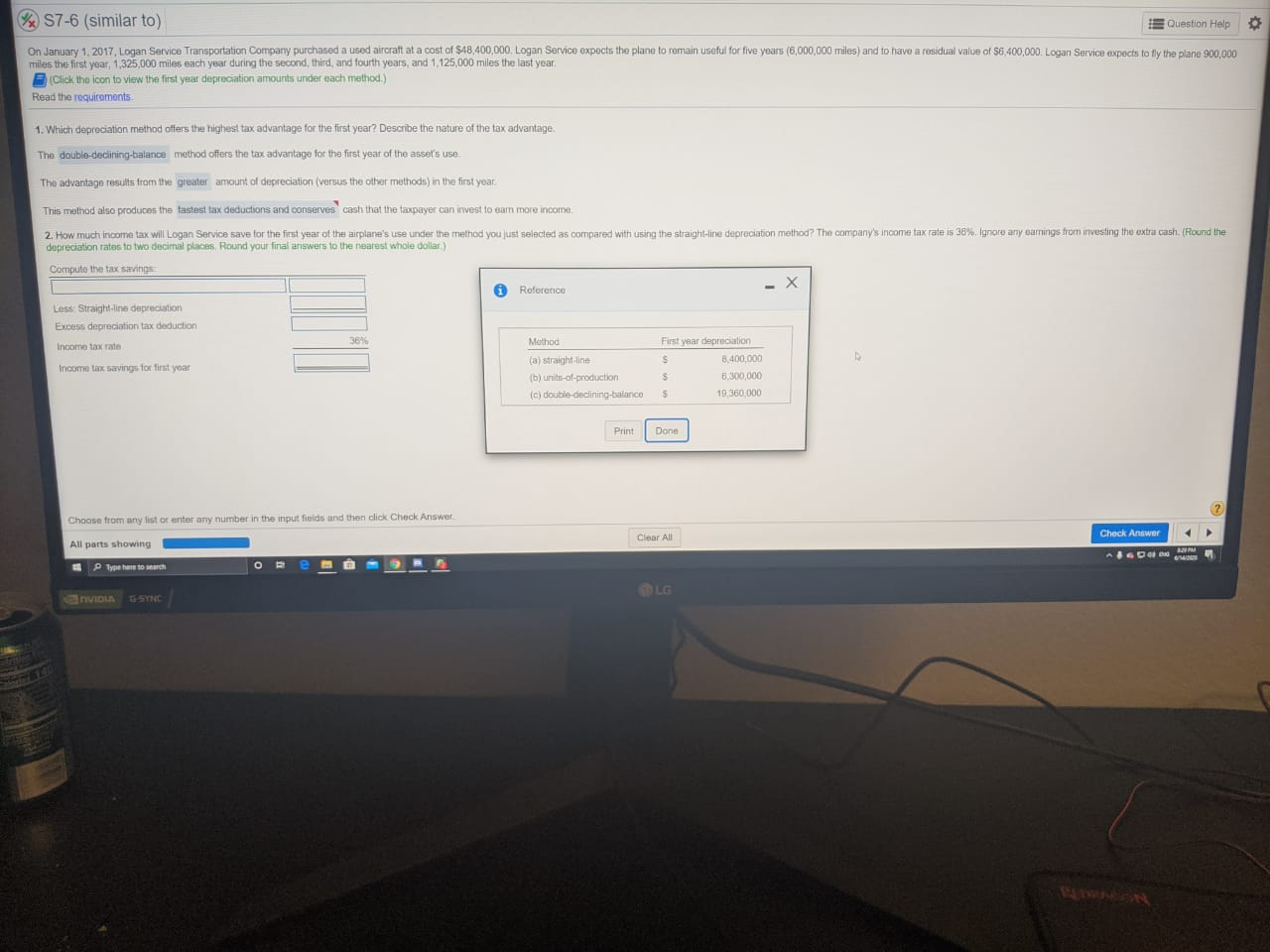

x 57-6 (similar to) Question Help On January 1, 2017, Logan Service Transportation Company purchased a used aircraft at a cost of $48,400,000, Logan Service expects the plane to remain useful for five years (6,000,000 miles) and to have a residual value of 55,400,000. Logan Service expects to fly the plane 900,000 miles the first year, 1,325,000 miles each year during the second third, and fourth years, and 1,125,000 miles the last year (Click the icon to view the first year depreciation amounts under each method.) Read the requirements 1. Which depreciation method offers the highest tax advantage for the first year? Describe the nature of the tax advantage The double-declining balance method offers the tax advantage for the first year of the asset's use: The advantage results from the greater amount of depreciation (versus the other methods) in the first year This method also produces the fastest tax deductions and conserves cash that the taxpayer can invest to earn more income 2. How much income tax will Logan Service save for the first year of the airplane's use under the method you just selected as compared with using the straight-line depreciation method? The company's income tax rate is 36%. Ignore any carrings from investing the extra cash. (Round the depreciation rates to two decimal places. Round your final answers to the nearest whole dollar) Compute the tax savings 6 Roforence - X Less Straight-line depreciation Excess depreciation tax deduction Income tax rate 36% Method First year depreciation Income tax savings for first year (a) straight-line $ 8.400,000 (b) units-of-production s 5.300.000 (c) double-declining-balance 19.360.000 ILULE Print Done 2 Choose from any list or enter any number in the input fields and then click Check Answer Check Answer Clear All All parts showing Dewa Type to O NVIDIA G-SYNC x 57-6 (similar to) Question Help On January 1, 2017, Logan Service Transportation Company purchased a used aircraft at a cost of $48,400,000, Logan Service expects the plane to remain useful for five years (6,000,000 miles) and to have a residual value of 55,400,000. Logan Service expects to fly the plane 900,000 miles the first year, 1,325,000 miles each year during the second third, and fourth years, and 1,125,000 miles the last year (Click the icon to view the first year depreciation amounts under each method.) Read the requirements 1. Which depreciation method offers the highest tax advantage for the first year? Describe the nature of the tax advantage The double-declining balance method offers the tax advantage for the first year of the asset's use: The advantage results from the greater amount of depreciation (versus the other methods) in the first year This method also produces the fastest tax deductions and conserves cash that the taxpayer can invest to earn more income 2. How much income tax will Logan Service save for the first year of the airplane's use under the method you just selected as compared with using the straight-line depreciation method? The company's income tax rate is 36%. Ignore any carrings from investing the extra cash. (Round the depreciation rates to two decimal places. Round your final answers to the nearest whole dollar) Compute the tax savings 6 Roforence - X Less Straight-line depreciation Excess depreciation tax deduction Income tax rate 36% Method First year depreciation Income tax savings for first year (a) straight-line $ 8.400,000 (b) units-of-production s 5.300.000 (c) double-declining-balance 19.360.000 ILULE Print Done 2 Choose from any list or enter any number in the input fields and then click Check Answer Check Answer Clear All All parts showing Dewa Type to O NVIDIA G-SYNC

Please include the answers highlighted

Please include the answers highlighted